Reconciliation – how to maintain financial health for accounting

Reconciliation is the process of checking your financial statements for accuracy and consistency.

Reconciliation also helps to determine and explain any discrepancies that may arise when comparing these statements with daily, monthly, quarterly, or annual statements.

It’s best to reconcile your accounts on a regular basis. Not only is it important for keeping track of the money flowing in and out of your business, but it also helps to maintain the financial health of your company in the long term.

In this article, we’ll explain what reconciliation is and why it’s so important.

Table of contents

- What is bank reconciliation and why is it important?

- Are there standard methods of reconciliation?

- The reconciliation process

- Common reconciliation mistakes that business owners make

- Wrapping up

What is bank reconciliation and why is it important?

The methodological system of bank reconciliation ensures that the money recorded as expenses in your account matches the actual amount of money you spent. It is the process of comparing two sets of accounting records and making sure that they match.

An example is comparing your internally recorded bank transactions with your bank statement, which is a common bookkeeping task that most business owners (or bookkeepers) must complete on a monthly basis.

Reconciling accounts helps business owners maintain veracity and exercise better control over their company’s financial situation.

It can also help prevent errors in financial statements, track any fraudulent activities, and avoid hefty penalties from auditors.

Here are four ways bank reconciliation can help your business:

1. Minimise financial statement errors

Reconciling your accounts on a monthly basis helps ensure that your internal account statements are identical to what is recorded at your bank or financial institution.

This makes it easier to detect any bookkeeping errors on either side and make corrective adjustments in time.

Reconciling on a regular basis not only helps you eliminate these errors but also keeps them from happening again.

2. Catch fraudulent activity

One of the biggest advantages of reconciling your accounts regularly is that you get to catch fraudulent activity before it’s too late.

Keep an eye out for duplicate cheques, or cheques issued without authorisation.

Also, scan your bank statement for any missing deposits, unauthorised cash withdrawals or suspicious transfers.

Even if these amounts are small, they can add up and cause serious losses to your company.

3. Track and manage your transactions

Let’s assume that you’ve paid a cheque to a vendor for a service they’ve provided.

But months have gone by, and they still haven’t cashed the cheque yet.

Because your business handles from dozens to thousands of cash outflows throughout a few months, it’s probable that you’ll have forgotten about that specific cheque.

This is where account reconciliation can help you.

When you reconcile on a regular basis, you can keep track of all transactions—even the ones that have been delayed.

Keeping track of all bank transactions also helps you manage your bills and payments, as well as other bookkeeping tasks.

For example, if you’re using services that deduct money from your account automatically once payment is due, you can identify if you’ve overpaid or missed a payment.

4. Save money

As a business, you should always be on the lookout for ways to cut down on unnecessary expenses.

Bank reconciliation can boost the profitability of your business by helping you identify runaway expenses, bank fees, and other hidden amounts that you might not even know you are paying.

Once you have complete knowledge of the charges that you’re facing, you can talk to your bank to see if there’s any way to lower the costs or upgrade to a better deal.

Are there standard methods of reconciliation?

While there’s no one true standard, according to Generally Accepted Accounting Principles (GAAP), there are two main ways to reconcile your accounts:

- Double-entry reconciliation

- Account conversion

Double-entry reconciliation

This method is more foolproof, which is why it’s the most widely used method in general. In double-entry accounting, every financial transaction has an equal effect on at least two different accounts—credits must always be equal to debits, and the net difference should always be zero.

Double-entry reconciliation most often affects both the income statement and the balance sheet.

Consider a business that incurs an invoice for lawn mowing services.

Initially, the business will credit the amount of the invoice in its accounts payable column on the balance sheet, and debit the account devoted to expenses on the income statement for the same amount.

When the business gets paid, it will then debit accounts payable on the income statement and credit cash with the same amount on the balance sheet, balancing it all out at zero.

This is a double-entry system, where one credit entry offsets another debit entry.

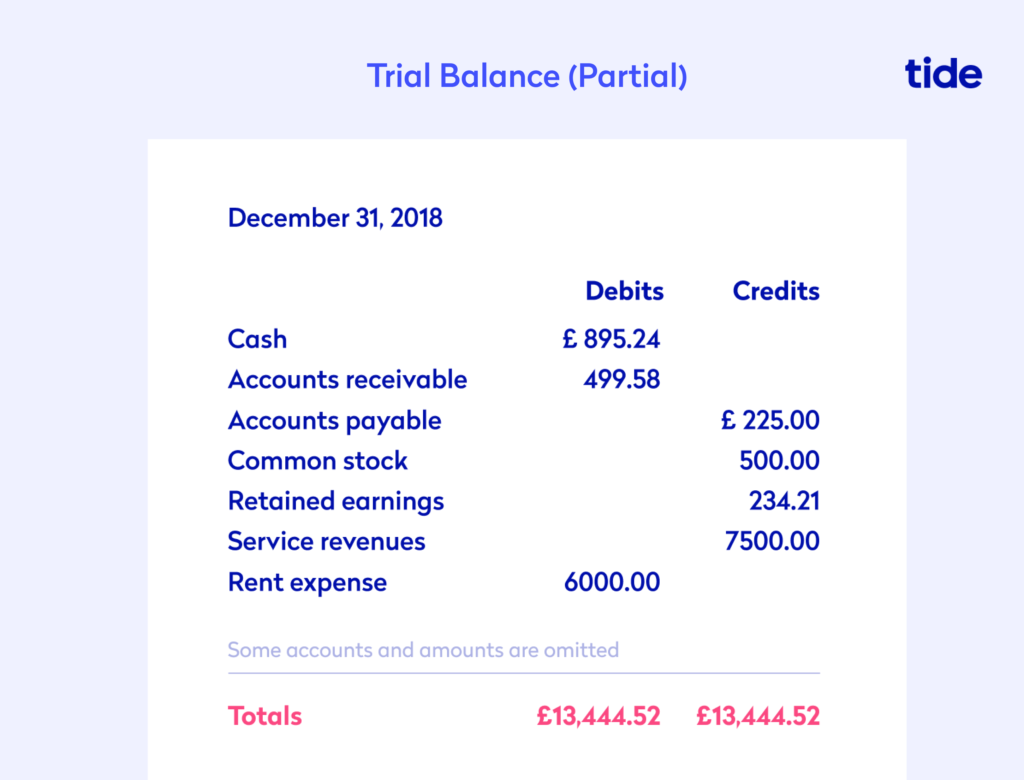

When creating a trial balance report, which is the account generated at the end of a reporting period once the bank reconciliation process has been completed, debits are recorded on the left and credits on the right.

The two columns should match perfectly, confirming that the net difference is zero.

Using double-entry accounting makes it easier to prepare accurate financial statements and detect errors on either side.

Account conversion

In this bank reconciliation method, records of transactions, such as cheques, invoices, and receipts, are simply matched with corresponding entries in a ledger. It’s more akin to keeping track of personal accounts and is a more casual way to reconcile.

While it may seem unwise, it is useful for new businesses who are either not yet self-trained in how to perform double-entry reconciliation or have yet to hire an accountant. This simple method is a great starting point, but as cash flow increases, the double-entry method is often adopted by businesses.

The bank reconciliation process

Bank reconciliation is generally carried out after the close of a financial period and is best done at the account level.

The entire process ensures that all transactions are valid, and properly coded and valued. In case of a discrepancy, corrective measures or adjustments are made.

Below are the steps involved in the account reconciliation process:

1. Verify internally recorded transactions

The first step of bank reconciliation is to make sure that all of your internal accounts are error-free, and the listed bank balance in your general ledger is correct and your closing balance accurate.

Remember, debits must always be equal to credits.

Here’s a list of internal accounts that you should look out for:

- Cash

- Accounts receivable

- Accounts payable

- Inventory

- Prepaid expenses

- Payroll liabilities

- Loans and other debt

At this stage, your aim should be to identify the differences in credits and debits in your own records. In case of a discrepancy, you can move on to correct it.

You should also look at the balance of each internal account in the trial balance report to ensure that it is reasonable and accurate.

Here’s a handy list of accounts to help you remember what classifications get labelled as debit vs. credit (source: Accounting Coach):

| Account Classification | Normal Balance |

| Assets | Debit |

| Contra asset | Credit |

| Liability | Credit |

| Contra liability | Debit |

| Owner’s equity | Credit |

| Stockholders’ equity | Credit |

| Owner’s drawing or dividends account | Debit |

| Revenues (or income) | Credit |

| Expenses | Debit |

| Gains | Credit |

| Losses | Debit |

If you notice that an account that should have a debit balance has a credit balance, or vice versa, evaluate each relevant transaction to find the error and make corrective entries.

2. Compare with external data sources

Once you’ve verified all your internal accounts, the next step is to compare them with other independent sources of data, such as a bank or credit card statement.

In this stage, each internal account is compared with its external data counterpart.

Here’s a list of external accounts that can be used to compare with your internal accounts:

- Bank statements

- Merchant processing reports

- Inventory counts

- Supplier invoices

- Credit card statements

- Payroll reports

- Loan statements

3. Identify differences and take corrective action

In case you come across a discrepancy, you should find the root cause of the issue and take appropriate action.

For example, if you find an error with your bank account balance, first double-check your work for human error, and then report the error to your bank.

This isn’t a common occurrence, but it is advisable to be prepared for anything and practice corrective measures.

If you do find a mistake in your general ledger, you can go back and make a corrective entry. In accounting, you can’t ever simply erase a mistake and fill in the right number. You must make a new entry and fill in the correct information there. Then, explain in detail what the corrective entry fixes in case it needs to be explained in a future audit.

4. Keep a record of all information

The bank reconciliation process must be completed before a company can certify the integrity of its financial information and issue financial statements.

These bank reconciliations confirm that what the company is reporting in the trial balance sheet does, in fact, match the record’s that the banks have on file. They are essentially another reconciliation through a financial institution to compare bank statements to the company’s accounts.

To avoid getting into any trouble, it is imperative that you store the information found, the analysis performed, and corrective actions taken for audit purposes. This information can be stored in the bank reconciliation statement, a useful tool for tracking the reconciliation process that makes the process of auditing simpler and less time-consuming.

After you’ve gone through all four steps, your bank statement balance should now be equal to the balance in your records.

If the number of items that have been revised is high, you should try to identify the root cause of the imbalance and fix any issues that may be present in your current system.

Common bank reconciliation mistakes that business owners make

Reconciling accounts is a smart decision for all small businesses.

But it’s common to see business owners, and even professional accountants, make mistakes during bank reconciliation every once in a while.

Here are a few common mistakes you should be aware of:

1. Incorrect cheque entries

There are generally two reasons for an incorrect cheque entry:

- Outstanding cheques may remain outstanding for too long

- Wrong cheques may be included in the reconciliation

To avoid this mistake from occurring, you must always review the cheques by the number in addition to the amount.

Even the most obvious activities should not go overlooked. For example, you could have accidentally cleared cheque #105 for £500 when you should have cleared cheque #106 for £500. While this is rare, sometimes the simplest duties can slip through the cracks.

Double-checking everything beforehand will save you tons of trouble ahead of time.

2. Cash inflow and outflow problems

It’s common to ignore some small amounts of cash inflows and outflows in a company’s internal records.

Whether it’s bank fees, ATM transactions, or any other small charges, you must subtract these items from your internal records.

They might seem small on their own, but collectively they can add up to a large amount and considerably affect your ending balance.

Keep an eye out for these charges on your bank statement at the end of the month and adjust them in your internal records.

Here are some charges that you should look out for:

- ATM service charges

- Internally recorded auto-payments

- Uncleared cheques

- Cheque-printing fees

- Bank charges, such as overdrafts and insufficient funds (NSF)

Similarly, you must also keep a check on all cash inflows that you might have overlooked.

Start by searching for deposits in your internal records that haven’t yet been recorded by the bank and add these to the statement balance.

Do the same exercise with your bank account—see if the bank shows money deposits that are not yet reflected in your internal books, and make corrective entries.

Quick-tip: In case you’re reconciling an interest-bearing account after a few weeks, you might need to add interest as well.

3. Transposition errors

A transposition error is simple—entering a transaction as £34.56 when it was actually £34.65.

You’ll be surprised at how many times you encounter this mistake.

This mistake can be identified at the end of the bank reconciliation process where you’ll notice that your balance is off by a certain number.

Since business owners are usually juggling multiple tasks, they may try and skim through the numbers and not pay attention to what’s actually written, because the numbers look so similar.

Surveying your financial statements will help to detect these types of errors.

Wrapping up

Reconciling your accounts on a regular basis is crucial for maintaining the financial health of your business in the long-term.

It helps you catch errors before it’s too late, ensures your balances match across internal and external records, and prevent you from landing in hot water because of inaccurate reporting.

More importantly, it helps you exercise more control over your company’s cash and finances.

Working with an accountant, using respective software or looking into a business account provider such as Tide to help keep on top of your finances will help with the process.

Make accounting easy with our simple software

Tide Accounting is our easy-to-use accounting software that brings all your biggest bookkeeping and accounting tasks into the same account you use for your banking.

Designed specially for busy small business owners, Tide Accounting software makes it quick and easy to:

- Get paid faster by creating and sending personalised invoices

- Manage your bills better to boost your cash flow

- Track your business performance with brilliant bookkeeping

- Get your Self Assessment and VAT returns right first time

Find out how you can take the stress out of accounting with Tide Accounting.

Photo by Kaboompics, published on Pexels