What is bookkeeping? A beginner’s guide

Bookkeeping is a critical part of running your small business. It helps you keep tabs on your day to day financial data, monitor your cash flow and evaluate your success.

In this guide, we’ll share everything you need to know about bookkeeping in order to effectively manage your accounts and grow your business.

We’ll also share some expert tips to help you stay on top of your business finances and remain profitable.

Top Tip: Before diving into the complexities of bookkeeping, it’s a good idea to have a solid grasp of identifying, recording, measuring and interpreting all of the financial information related to your business. Learn about tracking your expenses, working with an accountant and calculating your business tax in our complete guide to small business accounting 📌

Table of contents

- What is bookkeeping?

- The basics (and benefits) of bookkeeping

- Three bookkeeping terms you must know

- How to create a bookkeeping system

- Frequently asked bookkeeping questions

- Wrapping up

What is bookkeeping?

Bookkeeping is the act of recording money that flows in and out of your business.

More specifically, this includes:

- Recording financial transactions (including receipts and any payment that goes out or comes into your business)

- Producing, sending and managing invoices as well as recording payments when they are made

- Paying suppliers and recording payments

- Managing payroll (if you have employees, freelancers, or contractors that work for you)

- Keeping track of accounts receivable (this goes beyond invoice management and accounts for all bills, including lines of credit that have been given out to customers)

- Maintaining and balancing a general ledger, which is the primary financial record-keeping system for your business (this is what an accountant will then use to prepare financial statements)

If you’re looking to go beyond the basics of bookkeeping and take a deep dive into accounting, we’ve linked several resources at the end of the article that you can use to brush up on your knowledge.

The basics (and benefits) of bookkeeping

It’s critical that you always have a pulse on where your business stands financially at any given time. That’s why a bookkeeper should update your books at the end of every single business day.

This way, you can stay ahead of any potential problems that may arise. And, be ready to make smart business decisions at the drop of a hat based on data rather than guesswork.

Here are a few of the common reasons why it’s important to keep accurate books:

Improve cash flow management

If you lose track of the money that flows in and out of your business, you could run into serious cash flow problems that damage your ability to survive. In fact, only 42.5% of SMEs survive longer than five years in business.

This is due, in large part, to late payments.

24% of UK businesses report late payments as a threat to their survival. Further, 37% of small business owners note problems with late payments as a reason why they’ve considered closing their business prematurely.

The best way to prevent this outcome is to keep proper records so that you are always aware of how much money you have in your pot. Additionally, it’s a good idea to maintain an effective business budget to remain accountable to your business spending. And, keep an emergency fund aside to dip into in the case of unpredictable circumstances.

Get invoices paid on time

Because late payments are so problematic, good bookkeeping empowers you with the data you need to chase an overdue invoice the right way.

Great bookkeeping also makes use of tools like automatic invoice chasing, which frees up your time and helps to ensure your invoices are paid promptly.

Once invoices do get paid, a bookkeeper (or invoice software) will record that payment and swiftly update your records to ensure you’re up to date.

Increase your chances of receiving financing

Accurate record keeping is absolutely essential if you’re planning to seek funding or raise capital.

That’s because, whether you’re seeking debt or equity finance, you are asking somebody to trust your business. They need to know that your company will be successful so that they can trust in your ability to repay the debt or provide a return on their investment.

And the best way to prove that you will be responsible with external financing is to prove that you have been responsible with your money thus far.

This is where excellent bookkeeping shines. Detailed reports and statements that show past, present and future projected financial statements help to curb doubt and shed light on your potential success rate (with the new financing).

Along this same vein, maintaining an accurate business plan even after you’ve launched is a great way to stay prepared for attracting funding, loans, talent or partnerships if and when the time comes.

Provides the fundamentals for good financial planning

For most entrepreneurs, it’s wise to hire a bookkeeper from the very beginning. They’ll ensure that all of your financial records are in order so that you never have to worry about untangling a web down the line.

A great jumping-off point is to choose an accounting software to manage your books and financial data. You can either manage this yourself or hire an accountant to do it for you.

Top Tip: Wondering how to find an accountant for your small business? Learn how to find the right one for your needs in our guide to getting an online accountant for your small business ✅

Either way, accounting software helps you to stay on top of your cash flow and many come with helpful features such as invoicing, time tracking, expense tracking, project management tools, the ability to generate accounting reports, and more.

Another great option is to open a free business bank account with Tide and take advantage of the ability to manage all of your business finance admin in one place:

- Auto-categorisation, which automatically tags your income and spending and even lets you create custom labels that align with your business processes.

- Easy expenses, allowing you to upload receipts and auto-match them to transactions.

- Invoicing, which lets you create, send, pay and track invoices from anywhere, anytime.

- Tide Accounting, our easy-to-use accounting software that takes the hassle out of your bookkeeping, invoicing and tax returns.

Whether or not you choose to use accounting software yourself or you hire a bookkeeper to help you out, it’s important to have a key understanding of the basics of managing your books so that you’re always in the know.

Three bookkeeping terms you must know

Let’s take a closer look at assets, liabilities, and equity so you have a complete understanding of each key term.

Assets

Assets are everything that your business currently owns. They are divided into two categories: current assets and fixed assets.

Current assets include prepaid expenses, cash at hand, accounts receivable, inventory, and notes receivable.

Fixed assets, or long-lived assets, are tangible and less easily converted into cash. These could include company-owned vehicles and property.

Liabilities

Liabilities are your company’s debts. There are two categories of liability, current and long-term liabilities.

Current liabilities are debts that are due to be paid within 12 months. These could be wages payable, sales tax, and balances on business credit cards.

Long term liabilities include debts that won’t be due in under a year. They may include mortgage payments, bank loans, and notes payable. The two together equal the total liabilities.

Equity

Equity, also known as capital or net worth, shows how much capital belongs to your business.

If you’re a small business owner, you may hold the only investment in the firm. But in larger businesses, third parties may have investments too which you’ll need to take into consideration when calculating equity.

How to create a bookkeeping system

If you want to stay on top of your small business finances, it’s best to set up a solid bookkeeping system as early as possible. Let’s take a look at how you can easily improve your bookkeeping methods.

Audit your current financial systems

Before you jump into creating a bookkeeping system, take a thorough look at your current financial processes.

Review earnings and expenses

Review how frequently you’re tracking the money coming in and flowing out of your business. Is this something you do daily, weekly, or monthly?

If you had to give a presentation right now about the state of your business financials, would you feel confident in your data?

Consider if you feel confident in your existing system, and if not, what specifically you would like to improve.

Back up your business records

Think about your current business records storage method.

Do you store paper copies of records that could be more easily damaged or lost? Do you store digital copies that are backed up?

Review the overall security of your business records and uncover areas for improvement.

Ensure your business records are accessible

If you need to track down a specific piece of information, could you do so within a few minutes, or would it take hours to locate?

Analyse the overall organization of your business records to figure out how accessible they are.

Audit your invoices and expenses processes

Think about how frequently you invoice your customers and how often you track what you’ve spent out of your own pocket on business expenses.

Work out if you’re efficiently tracking key details or if you’re missing information.

Follow strategic and secure processes

Following a few key steps will help you keep your business finances organised and on track.

Build a reliable and comprehensive tracking system

It’s vital that you store all your bookkeeping details in one place and record each minor detail correctly.

Once you’ve entered a piece of information, it should be safely stored in your system.

Even better, if you use a platform like Tide, you don’t have to manually track this information at all.

You can automatically track and categorise your income and spending, upload receipts and match them to expenses and even create and send invoices on the go. And if you have accounting software, you can link your account to it and never worry about a manual upload again.

Keep security top of mind

Security should be your number one priority when setting up a bookkeeping system. This is why online systems that automatically backup your details are the best choice for businesses of all sizes.

Ensure it’s accessible

Your bookkeeping system should be easy to use and access from anywhere, anytime. It also doesn’t need to eat up valuable time in your day. User-friendly bookkeeping systems make it easy to stay on top of your finances while also leaving you time to effectively run your business.

Assemble accountant friendly systems

When you set up your bookkeeping system it should make sense to both you and your bookkeeper/accountant alike.

Professionals will thank you for a straightforward system that presents all the relevant information clearly. If you tick this box, your accountant can spend more time giving you helpful advice and insights instead of having to spend time putting your numbers straight.

Turn bookkeeping into a habit

Now that you have a solid idea of your current bookkeeping system and how best to manage your business financial records, it’s time to turn effective bookkeeping into a habit.

Build checklists

Checklists ensure that you know what needs to be done, and when, to keep your bookkeeping system effective and on track.

Here are some ideas for what may need to be included:

- Monitor your cash flow

- Review your bank statements

- Pay supplier bills

- Send out customer invoices

- Review the profitability of your projects

Keeping these items top of mind as you perform regular bookkeeping tasks means you won’t miss out on any key details.

Create a daily or weekly habit

You could choose to block out an hour a week to do bookkeeping related tasks. But, it can be easier and more effective to set aside a few minutes every day to check in with your business finances.

At the same time as you’re checking emails or doing other business admin tasks, you could perform any relevant tasks on your bookkeeping checklist.

While you may not need to perform every bookkeeping task every day, it’s good practice to check in on your business finances daily.

You could consider dividing bookkeeping tasks by those you need to do every day, such as cash flow monitoring, and those you can do weekly or monthly, like paying supplier bills.

Setting and sticking to good bookkeeping habits will help you feel in control of your business finances and save you time in the long run.

Frequently asked bookkeeping questions

Let’s break down the most common bookkeeping questions that small business owners often ask.

What’s the difference between a bookkeeper and an accountant?

A bookkeeper records and classifies the financial transactions of the business.

An accountant on the other hand analyses, reviews, and reports on the bookkeeper’s work, offering advice to help you make informed business decisions.

Both bookkeepers and accountants are essential for the financial health of all businesses, regardless of their size. If you run a small business, you may prefer to hire one person who performs both tasks.

Top Tip: As a business owner, it’s vital to have a solid understanding of the differences between accounting and bookkeeping, the key functions of an accountant and bookkeeper and how each plays a part in effectively managing your business’s financial health. Learn more in our guide to the difference between an accountant and a bookkeeper ⚖️

How do I balance my books?

To balance your books, you need to carefully track all of your business’s income and expenditure.

Balancing your books boils down to correctly recording and storing all transactions that deal with your business assets, liabilities, and equity.

There is an accounting equation you should use to ensure your books always balance:

Assets = Liabilities + Equity

This equation simply means that everything a business owns (assets) is balanced against all claims against the business (liabilities and equity).

If your assets are greater than your liabilities, your business is financially solvent.

Should I use single or double-entry bookkeeping?

Single-entry bookkeeping is the simplest method of bookkeeping and best suited to small businesses with a low volume of transactions. It follows a cash-based bookkeeping system which means that transactions are recorded as you pay bills and make deposits into your company account.

Double-entry bookkeeping is better for larger businesses with more complex structures. For every business transaction, two entries are made: a debit entry to one account and a credit entry to another account. In double-entry bookkeeping, the entries recorded as debits must equal those recorded as credits.

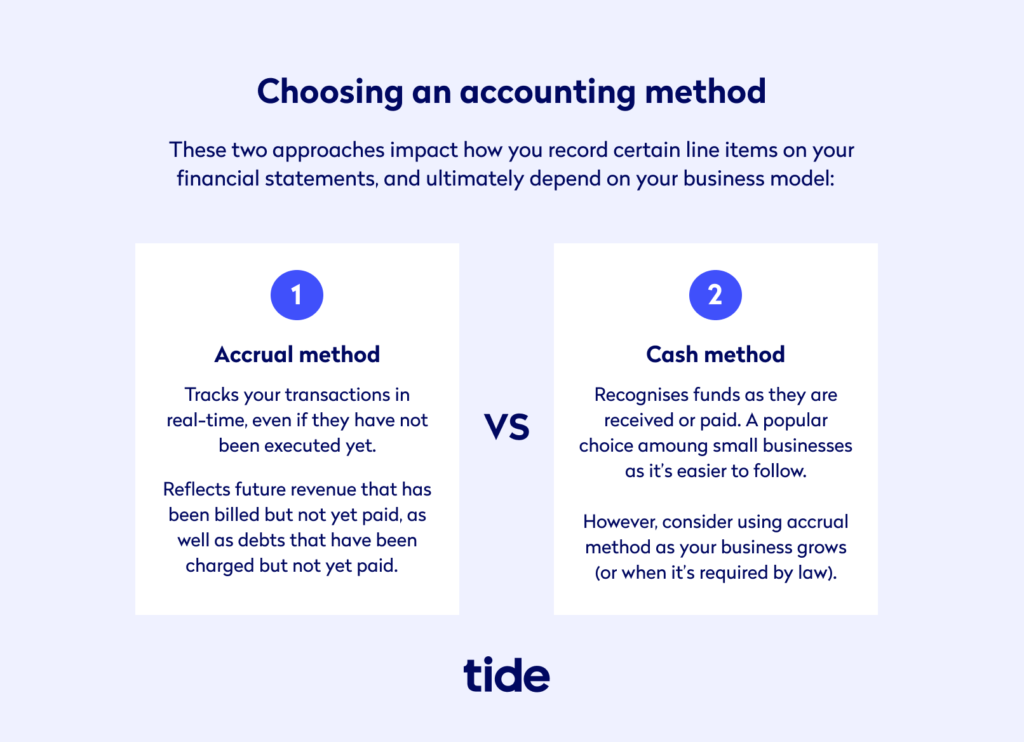

What about cash or accrual accounting methods?

The key difference between accrual (also known as traditional accounting) and cash basis accounting is the timing of when both revenue and expenses are recorded.

- Cash accounting is an instant recognition of expenses and revenue

- Accrual accounting concentrates on expected revenue and expenses

It’s common for businesses to start by using cash accounting and then switch to accrual accounting as their business grows. That’s because the cash method is easier to follow, but as you grow, accrual accounting makes forecasting future revenue much easier.

The government also stipulates when you can use each method. At time of writing, if you run a small self-employed business and have a turnover of £150,000 or less a year, you can use cash basis accounting.

If you run a limited company or a limited liability partnership, and/or have a turnover of £300,000 per year, you must use the accrual method.

If you offer your customers credit or you need to request credit from your suppliers, you will also need to use an accrual accounting system.

Wrapping up

Bookkeeping is essential for businesses of all sizes. As your business grows, so will its transactions and accompanying paperwork. Without a proper bookkeeping system in place, it could become difficult to manage your cash flow and monitor your overall business success.

An effective bookkeeping system will help you analyse your progress, manage admin tasks, set targets and save time during tax season.

Tide’s powerful business admin features are designed to streamline your business finances and save you time and money. Stay up to date with your transactions, categorise your income and expenses and easily create and pay invoices. To get started, sign up for a free business bank account today.

To go beyond the basics of bookkeeping and learn more about accounting principles and practices, here are some comprehensive articles to get you started:

Financial calculations, statements and health

- Accounting for startups – The complete guide

- Net profit margin: What it is and how to calculate it

- How to calculate cost of sales (with examples provided)

- Cost of sales: what you need to know for your business

- What is accounts receivable (and how to manage it)

- What is a cash flow forecast? (And how to create one)

- What are expenses? A guide for businesses

- How to create an expense log step-by-step

- Reconciliation – how to maintain financial health for accounting

- 8 steps to create an effective business budget

Business tax & VAT

- Small business tax: A simple guide

- 8 tax breaks small businesses can take

- What allowable expenses can limited companies claim?

- Everything you need to know about VAT

- A guide to VAT rules and rates on exports

- Guide to VAT codes: The full list

Payroll

- Payroll for small businesses: A complete guide

- How to process payroll and pay employees on time

- How to switch payroll providers for your small business

Invoicing

- What is an invoice? Raising them & getting paid

- The 11 best invoicing software solutions for your small business

- How to streamline your invoice process

- What’s the difference between an invoice and a receipt?

- Purchase order vs invoices: What’s the difference?

- What information you must include on your VAT invoice

Photo by Karolina Grabowska, published on Pexels