Can you charge VAT when you’re not registered? What happens if you aren’t?

Knowing exactly which VAT fees to charge your customers, and when you can begin charging them, is a crucial part of running your business.

Failing to apply the correct amount of taxes to your invoices, or charging VAT before you officially register, could negatively affect your cash flow and land you in trouble with HM Revenue and Customs (HMRC).

In this article, we’ll introduce you to the issues that might arise for anyone charging VAT before officially registering with GOV.UK. We’ll also explain who needs to register for VAT, the opportunity to voluntarily register, exactly how to register and the consequences of late registration.

Top Tip: Understanding the fundamentals of VAT is critical to deciphering the complexities of this guide. To learn how VAT works in general, how much it costs, how to charge it and the various VAT schemes available to small businesses, read our detailed guide to everything you need to know about VAT.

Table of contents:

- What happens if I start charging VAT when not registered?

- Who needs to register for VAT?

- How to register for VAT

- What are the benefits of VAT registration?

- Can small businesses become VAT registered?

- Consequences of late VAT registration

- HMRC surcharges and penalties for VAT infringements

- Wrapping Up

What happens if I start charging VAT when not registered?

Before eligible sole traders, partnerships, and limited companies can begin charging VAT, they need to register with the UK government for a VAT number. However, value-added tax does not apply to all business transactions. VAT registration is only required for eligible businesses earning more than £85,000 per year. That said, businesses earning less than this minimum threshold can also voluntarily register for VAT if they so desire.

HMRC expects businesses to be aware of the VAT registration limit and how close they are to it at all times. If you are approaching the VAT threshold (known as the forward look), or have recently passed it (known as the backward look), you must immediately apply for your VAT registration number.

Your Effective Date of Registration (EDR) will be determined based on whether you applied to register directly before or after you surpassed the threshold (we’ll explain this process in more detail below). Fail to apply at the right time, and you risk penalties for late registration.

While applying for the UK VAT scheme too late is a serious problem, charging VAT too early is an issue too. Legally, you’re not permitted to charge VAT to customers before you’ve registered for VAT. Paragraph 2 from Schedule 41 of the Finance Act in 2008 states that the penalty for charging VAT when not registered can be up to 100% of the VAT on the invoice.

There’s also a minimum penalty of 10% for charging VAT ahead of schedule. This penalty applies even if you inform HMRC that you’ve committed a mistake.

While charging VAT before you have a VAT number opens you up to penalties from HMRC, if you’re waiting for a VAT number to arrive, you may inform your clients that you will be sending a VAT invoice the moment you receive your VAT number. In this case, you can send a pro forma invoice as a projection of future VAT fees.

Who needs to register for VAT?

You need to register for VAT when your amount of taxable income exceeds the registration threshold. The current annual registration VAT threshold is £85,000 and will remain the same until 2022. Sole traders, partnerships, and companies must begin to charge for and pay VAT from the date they are required to register for VAT.

As mentioned above, to determine whether you need to get a VAT registration, you can conduct a historic turnover test.

The historic turnover test, or backward look, looks at your taxable turnover in the last 12-month period up until the point of the month under review. If you passed the threshold in that time period, you must notify HMRC of your need to register within 30 days of the end of that month.

In a future turnover test, or forward look, you determine whether you are likely to exceed the VAT threshold in the next 12-month period. This means calculating your average taxable income from the current month under review for the next 12 months. Once again, you will need to notify HMRC within 30 days of knowing that you will surpass the threshold of your need to register for VAT.

Top Tip: Calculating whether you’re eligible to charge VAT can be complicated because it depends entirely on the specific items and services that you sell. The £85,000 you earn must be taxable sales. Exempt sales and out of scope sales do not count in this calculation because they are not considered taxable. However, reduced rates and zero-rate transactions are considered taxable and thus will count. To learn more about whether your sales are fully taxable, fully exempt or partially exempt, see our guide to VAT exemption.

If you have been charging VAT when not registered with HMRC, you will need to put matters right. To do this, you can issue credit notes or refunds to the customers wrongly charged and explain they may need to correct their VAT account based on your error.

You will also need to contact HMRC about making an unprompted disclosure, revealing your mistake. Outline the VAT payments you have received and explain that you are happy to correct the situation.

How to register for VAT

If you determine that you are eligible for VAT registration after examining the UK VAT scheme, you will have 30 days to register for your VAT number. You can do this online using the HMRC website. As part of Making Tax Digital, applying for VAT is much easier today, thanks to the online process. Once you register, HMRC will provide you with your VAT registration number.

You will not be able to charge VAT on taxable supplies and products until you have your number. The VAT due from your customers is known as output tax, and you will need to review HMRC’s VAT rates guidelines to determine which rate of VAT to charge to your customers.

The VAT rate that you charge depends entirely on your VAT scheme, the types of goods or services that you are selling, and whether they fall into the standard category of 20%, the reduced category of 5%, the zero-rated category of 0%, or if they are exempt.

The VAT that you owe to your suppliers is called input tax and the rate that you pay will be determined by them. Ultimately, the onus falls on the seller to determine what VAT rates to charge. If any mistake is made, the seller must rectify it or pay a penalty.

Registering for VAT also means that you can reclaim VAT on your input tax, or the VAT that your business incurs on taxable costs and expenses. When exactly you can reclaim your input tax VAT depends on your chosen VAT scheme. Regardless, you must keep detailed records of all of your VAT invoices, both incoming and outgoing, and make correct calculations when filing your VAT return.

Top tip: VAT is full of complexities, so it’s no surprise that 51% of people admit to making errors on their VAT return. The best way to avoid making mistakes is to know where they most often occur. To learn about the most common VAT mistakes, how to avoid them and how to correct VAT errors should they arise, read our guide to how to avoid common VAT mistakes.

What are the benefits of VAT registration?

If you’re about to hit the VAT threshold, you have to register to abide by the law. However, there are some advantages that convince some people to volunteer for early registration (more on this in the next section).

For instance, getting a VAT number adds credibility to your business. Why? Because it demonstrates to clients and customers that you’re an established company that is making at least £85,000 a year.

VAT registration also means:

- You can claim VAT refunds: After you complete registration, you will be able to claim VAT on the taxable resources your company buys. If you buy a lot of equipment, you may be able to claim a decent amount in VAT refunds. The perk of reclaiming input tax is only available to VAT registered businesses, even though all businesses must pay it if they are buying from a VAT registered entity.

- You can reclaim VAT from the past: In some cases, you’ll also be able to reclaim VAT on previous purchases. However, you will need access to the VAT invoices and records of the period you’re claiming for.

- You open new business avenues: There are some companies out there who refuse to work with other businesses that aren’t VAT registered, mainly due to a perceived lack of credibility If you can’t provide a proper VAT invoice, this could prevent you from seeking out certain sales avenues.

- You don’t have to worry: There’s no risk of you accidentally going over the VAT threshold and getting into trouble. You’ll already be registered, so you won’t have any issues with HMRC.

Can small businesses become VAT registered?

Newly formed sole traders, limited companies and partnerships can become VAT registered, and you can register earlier than you’d think. As mentioned above, you don’t have to wait until you’re earning £85,000 per year to register for VAT.

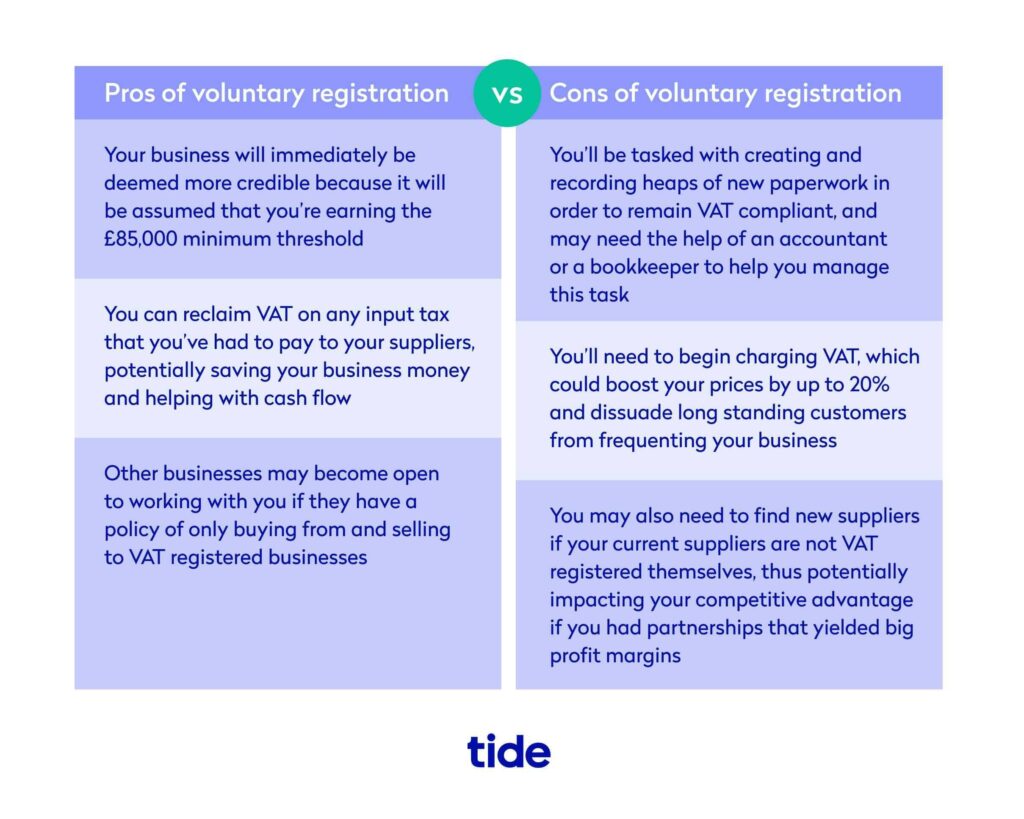

If you’d like, you can register voluntarily for VAT even if you haven’t breached the annual registration threshold. The biggest advantages of voluntarily registering are:

- The ability to reclaim input tax on business expenses;

- The new business opportunities that will arise from VAT registered businesses that will be open to working with you, and;

- A boost in credibility as businesses may assume you are making the £85,000 minimum sales required of VAT registered businesses.

That said, voluntary VAT registration means that you’ll have more to think about when invoicing clients. You’ll need to ensure that you’re following the compliance guidelines correctly, which requires more time, energy, organisation and management. Registering for VAT will also bring additional paperwork that you may need to hire a professional accountant or bookkeeper to help you with.

An obvious disadvantage of VAT registration is that you can also suffer from reduced competitiveness, as your competitors might be able to charge less than you. That’s because If your suppliers are non-VAT registered they won’t be required to add a VAT fee to their products or services.

In this same vein, you will need to add a VAT fee that will effectively raise your prices. This means that your suppliers will need to pay a higher fee and your customers who buy your finished products or services will also need to pay VAT at the point of sale. If you’ve had long standing customers who are used to your prices, this sudden increase of 20% (at the standard rate) could dissuade them from continuing to frequent your business.

As long as you’re below the VAT threshold of £85,000, it’s up to you to determine when VAT registration is a good idea. One situation where voluntary registration should always be a consideration is when the taxable supplies you sell are zero-rated. This means that you can charge a 0% rate of output tax, but you’ll still be able to claim all of your input VAT back as long as you are paying a standard rate for your items.

Consequences of late VAT registration

It’s important not to start charging VAT on taxable supplies before you’re registered to do so. Charging customers VAT before your VAT registration date is bad for business, and it could lead to various penalties from HMRC, as mentioned above.

However, you will need to ensure that you’re charging VAT when the time is right, which you will determine through a forward or backward look.

The penalty for contacting HMRC outside of the scope of the forward or backward look is a percentage of the unpaid VAT, which may be:

- 5% if you register less than 9 months late

- 10% if you register less than 18 months late

- 15% if you register more than 18 months late

Each of these penalties is available to be mitigated at the discretion of HMRC.

HMRC surcharges and penalties for VAT infringements

Charging VAT when not registered is risky. Not paying your VAT bills is risky as well.

If you register for VAT, you are also responsible for sending your VAT return on time. A default will occur when HMRC does not receive a return on all VAT due by a specific date. HMRC may extend this date in certain circumstances, such as in the case of the COVID-19 pandemic in which eligible businesses can defer VAT payments.

Now that all VAT returns are online, the due date for your VAT return is 7 days following the end of the month on the month after the VAT period ends. For example, for the VAT quarter up to 31 March, the due date would be on the 7 May.

If you default on your VAT, you will receive a warning following your first offence. Pay attention to this notice. If you do not pay the rate of VAT given to you by the due date, then the surcharge will be another 2% of your outstanding tax. This surcharge will increase to 5% for your next mistake, and then another 5% for any following issues. Surcharge assessments won’t be issued for an amount of less than £400.

Each time you default, your surcharge liability period extends. Only late payment will incur a surcharge. You will return to the start of a surcharge cycle when you pay a whole year of returns on time since the last default.

Top Tip: Partially exempt businesses have the most complicated VAT structures and thus get audited more often. If you’re worried about how to calculate your VAT and pay your VAT return correctly as a partially exempt business, it’s essential to get informed. To learn more, read our guide to VAT partial exemption.

Wrapping Up

Charging VAT when not registered is a sure-fire way to open yourself up to extra penalties and charges from HMRC. However, not charging VAT in accordance with your VAT scheme, or the VAT program you choose for your business is problematic too. Understanding the VAT threshold and how you can get registered will help you avoid penalties and reclaim money on purchases.

A trained accountant can also educate you on all of the VAT regulations, rules and options – check out our guide to getting an online accountant for your small business to get started. Alternatively, if you want to take care of VAT yourself, user-friendly accounting software can make it quick and easy even for a beginner.

Photo by Sigmund, published on Unsplash