What is a company expense policy?

A company expense policy guides employees on how to spend company money for business purposes. The policy should set out clear rules and expectations for how much company money can be spent, the tool in which to spend it (i.e. via personal finances, a company card, or petty cash) and under what circumstances it can be spent in.

This clearly-defined guidance reduces the need for back and forth between your staff and finance department, as well as general confusion or misunderstandings about what is or is not considered allowable spending.

According to the Global Payroll Association, 10% of employees in the UK admit to submitting erroneous expense claims ‘all the time’ while 20% do so ‘some of the time’. While some of these fraudulent claims may be intentional, many others are accidental and could be rectified with an original, easy to understand, frequently communicated expense policy.

Creating a detailed expense policy at the outset of launching your business will also save you time down the road when you begin to hire employees, as they will surely have expense policy and process questions. Instead of improvising rules and regulations on the spot, it’s best to premeditate guidance before anyone on your team considers spending company money.

How to create an effective expense policy

In larger companies, typically HR, operations and finance teams write the expense policy together. If your company is smaller and you haven’t yet hired these key positions, you may need to create the policy yourself.

Either way, it’s important to know what makes a strong policy so that you can effectively maintain and manage it as you grow your business.

Following a few simple steps will help to ensure your business’s expense policy covers all the basics and acts as a helpful resource for your employees.

Step 1: Create clear rules across your business

The best chance of creating a policy that will be followed to the letter is to clearly define your rules and budgets in a way that is easily understood.

Use simple language

An expense policy is only effective if your employees actually read it. Make the rules easy to understand by using simple language throughout your expense document. It should not read like a contract full of legal jargon that elicits skimming.

After reading the rules, your employees should have a clear idea of how they’re able to use company money. Avoid making the rules too complex as this can sometimes result in confusion and misuse of the expenses policy.

Top Tip: Create an open-door policy for any expense related questions. If your employees know that they can ask you anything, anytime, they’ll be more likely to understand and effectively follow your guidance.

Set budgets

Divide expenses by category and budget so that employees have a clear understanding of how much they’re allowed to spend for each type of potential expense.

For example, depending on your business’s needs your expense policy may include several budgets for different activities, such as company lunches, technology (i.e. software packages or a new hardware tool), stationery, travel (i.e. flights, hotel rooms, taxi fares) and use of a company car.

You’ll need to weigh your budget so that it’s fair to your employees and also makes sense for what your business can realistically afford.

For example, if you set the budget for booking a hotel room at £50, it will be incredibly difficult for your employees to find a decent hotel room to stay in. But if you set the hotel room budget at £300, your employees may have too much room to play with and end up costing you a fortune on unnecessary splendour.

Do your market research to strike an equitable balance while always making sure that your employees have enough money to cover their work-related costs.

Here are a few travel expense examples:

We will reimburse your transportation fares so long as they make use of public transport when possible and are the most cost-effective option. Economy class is preferred for both train and air travel unless there’s a specific reason for travelling higher than standard class.

Overnight accommodation costs are reimbursable, however, to avoid unnecessary costs we will need to approve accommodation before it is paid for and we may work with agencies to agree on the best price.

Evening meals are partially reimbursable. A daily budget will be provided for meals during business trips. Please note meals do not include alcoholic beverages.

Here are a few non-reimbursable travel expense examples:

Unapproved service upgrades (hotel rooms or economy to first class).

Costs incurred by non-employees who accompany team members on their business travels (spouses, relatives, friends).

Personal purchases (souvenirs, gifts).

As your business’s needs will likely change as it grows, you should aim to update each expense budget and category regularly as needed.

Top Tip: Sticking to a predetermined budget means you need to effectively track your business’s expenses. Opening a dedicated business bank account and creating detailed expense spreadsheets are great places to start. Read more in our article on how to keep track of expenses and then download our free online expense spreadsheet template to get you started.

Step 2: Consider whether a detail-oriented or broad policy would suit your business

Established businesses often prefer to create highly detailed expense policies so that no potential question goes unanswered.

This approach is well-intentioned but may have the adverse effect of going unread in full. If you do choose this approach, follow it up with mandatory presentations and/or meetings to ensure each point is covered in a group setting.

For smaller businesses, there’s a valid argument for creating a set of broad guidelines and giving employees the power to make their own expense related decisions.

With this approach, you may not go into extreme detail but will still cover the main principles of what’s appropriate and in the best interest of the company. Providing real-life examples of what’s considered acceptable will help employees understand what they can spend company money on without breaching the policy.

It may make sense to create broad principles at first and then update your expense policy to include more details as you grow your business. This will save you the time and effort of needing to constantly update a long and detailed policy as you’re actively forming it.

Step 3: Get buy-in from your employees

Sometimes expense policies are written by people in top management positions without consulting those team members who have to work with the policy daily. Your employees provide the best perspective for what, and how much, they need to spend company money on.

Lower-level managers often know their team’s needs best and can offer valuable insight when it comes to setting realistic expense budgets. Involving team members will prevent you from setting budgets that are too low or high and help ensure staff feel satisfied with the end result.

Step 4: Pay attention to the law

Expense laws vary from country to country, so make sure that your expense policy is compliant with local regulations. If your business is based in the UK, you will need to ensure that all expenses adhere to HMRC’s criteria.

In general, the laws state that an expense only counts if your employee uses company money for business purposes. For a full list of what qualifies as an expense or benefit that you can provide to employees, see GOV.UK’s Expenses and benefits: A to Z.

Your business doesn’t need to deduct or pay tax or national insurance on business expenses that qualify. In some cases, business expenses are covered by exemptions which means you don’t need to include them in your end of year reports.

Expense laws will help you understand what can and can’t be claimed and ensure you create an expense policy and reports that follow the law accordingly.

Step 5: Include details on expense payment and reimbursements

48% of employees use their own money to cover business costs and then fail to file an expense report for reimbursement. This could be an indicator of a lacklustre expense policy and practice that does not clearly inform employees on how the reimbursement process works.

As your employees must be reimbursed for business expenses by law, it’s crucial that your expense reimbursement process is expressly communicated.

Within the reimbursement policy, you should explain specifically how your employees are expected to make payments and how your business plans to reimburse them, including who they should submit their report to and if there’s a time limit.

Consider the several different payment methods your employees could use when making a business expense:

Expense advances. Businesses sometimes prefer to give employees an advance on their paycheck to cover imminent costs. This generally comes into play when the expense amount is too high to ask an employee to cover it with their own funds. Since this is less common than other payment methods, it’s important that your policy clearly explains how it works and in what circumstance it would apply to.

Payment with company card: Writing a clear procedure for using a shared company card will ensure expense payments remain reasonable and controllable. Think about who’s in charge of the company card and how employees should track payments. Sometimes shared company cards can become unmanageable and even liable to fraud if too many team members are using them without close monitoring. Easy to understand policies with designated oversight should help to prevent this.

Payment out of pocket: Sometimes employees may need to pay for work expenses with their own money. This is more common in exceptional circumstances, such as an employee having to pay for a taxi following train delays to a conference, or needing to book a new flight if one got cancelled due to bad weather. Your expense policy should specify when employees may need to pay out of pocket and exactly how they’ll be reimbursed.

Petty cash: This is often used for smaller expenses such as stationary or office supplies. As digital options have come on the scene, petty cash is becoming a thing of the past for many industries. That said, it’s still popular in small retail businesses that often deal with cash at the point of sale. If you do use petty cash, make sure you have a policy on who is allowed to access the cash box, the protocol for taking out and returning money to it, and keep it locked up to reduce the chances of it getting stolen.

No matter which payment method you ask your employees to use, ensuring the reimbursement and expense process is well documented and simple to carry out will save your team members’ valuable time and lead to timely repayments (if applicable).

Step 6: Leave room for exceptions

It’s nearly impossible to write a policy that covers every single potential situation and use case. Knowing this, it’s important to leave room for exceptions by noting these unique circumstances in your guidelines themselves.

You should tell your employees that there may come a time where they need to use their best judgment and common sense when making an expense related decision. Write this directly into your company policies so that it is more than a word of mouth assertion.

For example, as alluded to above a flight may get cancelled due to bad weather or another unforeseen reason. If your employee paid for their original flight on a company credit card back in the office, but don’t have the card with them on the trip, they’ll need to know how to act in this situation. They might not have enough company spending money to cover a new flight, and If they can’t reach you and are told to use their best judgment, they should have complete faith that they’ll get reimbursed if they use their own money to book a new flight home.

Communicating that you stand by your employees in unexpected scenarios will help to build trust and confidence in your leadership and ethics.

Step 7: Build in approval protocol

While you definitely don’t want to create a policy that requires a line manager’s sign off for every pound spent, larger expense payments such as travel to a foreign country will likely need the green light from a more senior member of staff.

If the approval protocol isn’t written down and formalised, it can be a headache for employees to both grant and receive permission for larger expense payments. Why? Because without a formal process, your employees won’t know how long you expect the approval process to take. Leaving the decision up to them could cause unnecessary delays if they are prioritising other projects that do have hard deadlines, for example.

Writing a protocol for your expenses approval system into your expense policy will help to streamline this process and reduce extended back and forth communications and delays. Specifically, it should include how far in advance large expense requests must be made and in what timeframe they should be approved. It should also detail what request types need further approval, for example requests with an amount higher than £X must be kicked up to the CFO. This will set your team up for success and help to avoid any undue frustration.

How to avoid problems with your expense policy

Whether you’re writing an expense policy for the first time or are simply looking to upgrade your company’s current policy, take note of these common errors so that you can avoid making them yourself.

Not accounting for every pound

If you run a brick and mortar business, it can be tempting to just give employees cash in hand to pop out to a local shop for stationery or other office supplies.

Since it’s a small amount you may think it doesn’t matter and you may even have a petty cash box that employees can access.

However, when running an efficient business, every pound must be accounted for. If not, it becomes too easy for team members to take advantage of readily available cash and spend it with the knowledge that the cash isn’t properly tracked.

If you do run a business where petty cash makes the most sense, make sure that you store your petty cash box in a safe and secure location that is monitored by a team member at all times.

Top Tip: It’s easy to lose track of cash and almost always better to use a company card to manage employee expenses. If you use Tide’s expense management feature, you can order Expense Cards for your team and monitor your expenses in real-time.

Using paper expense reports

Although most businesses are reducing their use of paper, it’s not uncommon for companies to still insist that team members file expense reports using paper and diligently keep hold of paper receipts.

Tracking paper expense reports and receipts can become a time consuming and ineffective operation, as employees often make mistakes on paper reports and/or lose paper receipts. What’s more, companies often manually enter this data into a spreadsheet, leaving them open to human error and the need to double and triple-check entries for accuracy.

A digitised automated expense management solution can rectify these pain points. Automating expense management eliminates the need for holding onto paper receipts or writing out paper expense reports. Instead, all expense related information can be easily found within the dashboard, saving your team time and reducing the risk of human error.

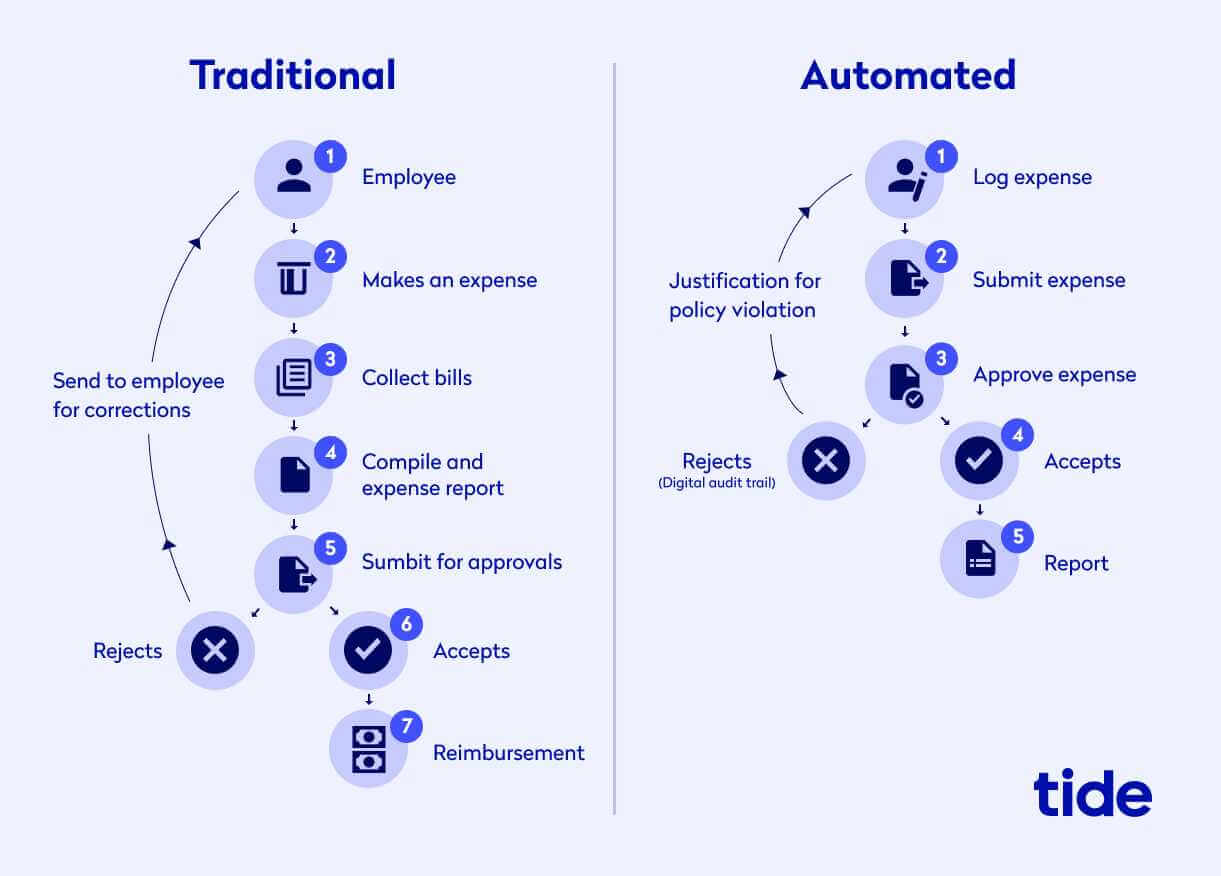

Here’s a visual explanation of how automated expense tracking works compared to traditional methods:

Wrapping up

An effective expense policy should provide clear guidance on how employees are expected to manage company money. Ultimately, an expense policy needs to be fair, coherent and clearly written to ensure all team members know what is and isn’t an appropriate use of company funds.

Tide’s expense management feature can help you to automate and track expenses across your business. Our powerful tools make uploading receipts, viewing paid VAT, monitoring your transaction history, categorising your expenses and automatically sending reports to your accountant a breeze. To get started, open a free business bank account and experience the power of organised, automated expense management that saves you time and money.