What’s the difference between Direct Debits and standing orders?

Direct Debits and standing orders are two different payment methods that your customers may use to pay for your business’s products or services.

Although the payment methods share some similarities, understanding their uniquely distinct functions and benefits will help you to better organise your small business’s payment processes.

Conversely, misunderstanding the variations between these two payment methods could make it more difficult to maintain positive business relationships and to properly manage your cash flow.

In this article, we’ll explain the key features and differences between Direct Debits and standing orders, when to use each one and how to choose the right payment method for both your business and your customers.

Table of contents:

- What exactly are direct debits and standing orders?

- When to use direct debits vs. standing orders

- The benefits and disadvantages of using direct debits

- The benefits and disadvantages of using standing orders

- Wrapping up

What exactly are Direct Debits and standing orders?

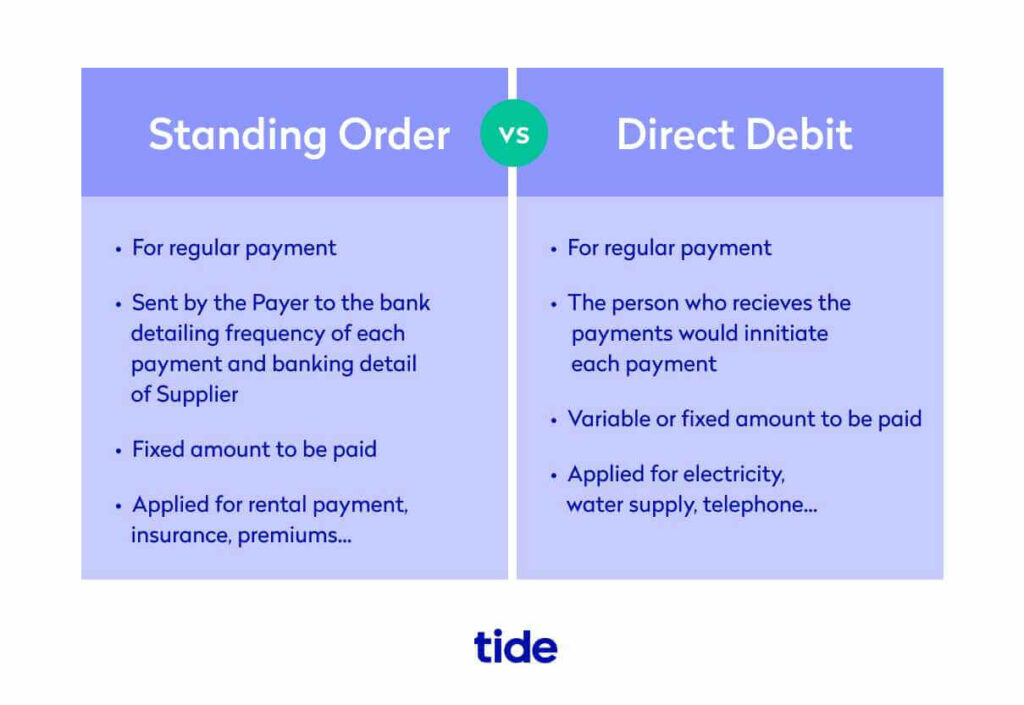

Direct Debits and standing orders are both automatic payment methods. The key differences between the two are that customers control standing orders while businesses control Direct Debits, and standing orders are fixed amounts whereas Direct Debits are variable amounts.

Here is a quick overview of the two payment methods and their differences.

Standing orders:

- Customers instruct their banks to pay a fixed amount regularly which could be weekly, monthly, quarterly, or yearly depending on your agreed payment terms.

- Customers select the payment amount and frequency without any input from the business.

Direct Debits:

- Conversely, businesses have complete control over the payments they take via Direct Debit.

- You choose the payment amount and frequency and are in complete control over amending these payment details.

Direct Debits and standing orders shouldn’t be confused with continuous payment authorities (CPAs), also known as recurring payments. These are payments that businesses can take directly from your debit or credit card to pay for subscriptions or other ongoing bills. If you subscribe to services like Netflix or Spotify you may be familiar with recurring payments.

Top Tip: Before diving into when it’s best to use Direct Debits and standing orders, it’s a good idea to have a solid grasp of small business accounting. Taking payments effectively is an essential part of running a smooth business operation. To learn more about the ins and outs of effective small business accounting including tracking your expenses, setting up an invoicing system, calculating your business tax and working with an accountant, read our complete guide to small business accounting.

When to use Direct Debits vs. standing orders

Given their different use cases, Direct Debits and standing orders are suited to different business sizes, customer profiles and payment types. Knowing when it’s best to use Direct Debits and standing orders will help you to streamline your business’s payments.

When to use standing orders

Standing orders are often used to make fixed payments on a regular basis for activities such as rent deposits, charity donations or moving money into a savings account.

Because of their nature, they are suited well for organisations like small members clubs that charge regular subscription fees.

There’s also no need for a provider which means if your business is in the early developmental phase, standing orders can offer a straightforward solution for taking payment.

It’s worth considering that you’ll need to track standing orders to ensure payment has been successfully made. Businesses with a handful of customers may find standing orders effective, however larger businesses with many customers may find tracking such payments a drain on resources.

Customers handle the admin side of standing orders which is why it’s important that you’re able to trust your customers to set up and maintain standing orders when requested. Always keep in mind that customers can change or cancel standing orders without letting you know, so it’s best practice to double-check that they are in fact paid into your business account each month to avoid any surprises.

When to use Direct Debits

Direct Debits are often a convenient and flexible payment method for businesses of all sizes. You may be using them already to pay your recurring monthly business bills like electricity, company credit cards, WiFi and council tax.

You can also use Direct Debits to collect recurring invoice payments of different amounts from your customers.

For example, if you run a florist’s shop and your regular customer base includes local shops and cafes, you may choose to invoice them monthly to save time spent on collecting payment daily. When the end of the month arrives, you would add up each customer’s purchases and send out individual invoices.

If some customers choose to pay in cash, and others opt to pay by card or bank transfer, this process could soon become a time-consuming operation of chasing customers for late payments as well as processing various payment methods.

In this situation, it could make more sense for a business to ask customers to pay by Direct Debit each month to streamline payment for both parties. Even if the amount is different each time, it would be easy for you to adjust the debit before payment. This is especially important in recent times as the Coronavirus has made cash payments much less convenient or safe.

Equally, if your business bases its prices off a multi-tiered subscription model or offers service upgrades, Direct Debits may be able to offer both parties the most flexibility since their frequency and amount are easy to modify as and when needed.

If Direct Debits are likely to change significantly each time, it’s good practice to send your customers an invoice so they can check quantities and payment amounts before the money is debited from their account.

Direct debits can also be useful for one-off payments. To eliminate time spent on following up on payments, some business owners and freelancers may find it easier to schedule a one-off Direct Debit when they send out the invoice. If your customer then decides to do repeat business, you can use the same mandate to set up another one-off Direct Debit later on.

Top Tip: Creating invoices is an essential part of everyday business operations. It’s important to know how to create an invoice, what to include on it, how to avoid common invoicing mistakes and ensure it’s paid on time. Understanding the basics of invoicing will help you keep your business’s finances on track. To learn more, read our guide to raising invoices and getting paid.

What are the benefits and disadvantages of using Direct Debits?

While Direct Debit payments are the most flexible payment method for many businesses, it’s important to have a clear idea of their key benefits and disadvantages.

Benefits of Direct Debits

- Direct Debits are widely available. Most people who have a current account or a prepaid card can pay using Direct Debits.

- Save time spent on business financial admin. Instead of spending hours sending out and chasing up on invoices, the agreed payment amount can be automatically collected by a Direct Debit on a set day.

- Find out quickly if a payment hasn’t been processed. There’s no need to keep going through your bank account to see if due payments have arrived. Once a Direct Debit is set up, you’ll receive instant notifications if a payment fails or if there’s a cancellation.

- Direct Debits offer greater customer protection. Customer payments are protected by the Direct Debit guarantee in the event of a payment mistake.

- There’s a lower risk of late payment. Since businesses manage Direct Debits, they can charge customers immediately when payment is due without waiting for customers to make payment.

- Notifications can be sent to customers. When payment is due, customers may receive an email alerting them to when payment will be collected.

- Customers save time too. To set up a Direct Debit, customers only need to enter their account details and agree to a Direct Debit mandate once. There’s no need for clients to spend time logging onto online banking, writing cheques or entering card details each time payment is due.

- Direct Debits give businesses full control. You’ll be able to easily modify the payment amount and frequency without customer involvement.

- Direct Debits offer businesses more flexibility. You can use them for variable amounts and modify the payment date without customer authorisation. Remember that if the amount is changing significantly it’s best to give your customers some advance notice to ensure they have the correct funds available.

- Costs are generally low. Depending on your provider, costs are usually a tiny percentage of the payment if not free.

Top Tip: Collecting payments for your invoices via Direct Debit can help you and your customers save time on admin. Helping streamline your payment processes, avoiding late payments and offering more payment flexibility are a few of the advantages Direct Debits can offer your business.

Disadvantages of Direct Debits

- Customers need to feel comfortable with the business. Some customers prefer to be in complete control of their payments and dislike businesses managing payment amounts and frequencies. Sometimes customers need to take some time to familiarise themselves with the business before feeling confident enough to authorise Direct Debits.

- Direct Debits rely on customers managing their accounts effectively. Customers must have sufficient funds in their account at the time of the Direct Debits otherwise their bank or building society may refuse to make the payment or put them in overdraft. A payment refusal ultimately means that you receive funds later than expected.

What about the benefits and disadvantages of using standing orders?

Although standing orders are often useful for fixed and regular payments, there are a few benefits and disadvantages to weigh up when deciding if they’re right for your business.

Benefits of standing orders:

- Customers handle the set up. Your customer sets the payment up for you and deals with all the associated admin, leaving you with more time to run your business. All your customer will need is your business account number and sort code.

- The charges are generally low. Standing orders are commonly free or incur a very small bank charge.

- Easy to use for fixed payments. Once a customer sets up a standing order, you can rely on receiving the set amount on the agreed dates.

Disadvantages of standing orders:

- Customers can modify standing order payments without any notice. You may not realise that a customer has changed or cancelled the payment until you check your business account.

- Payments are less flexible. If you need to modify the amount or frequency of the payment the standing order will need to be cancelled and a new one set up. You will need to rely on customers changing the standing order when they say they will.

- There’s a risk of late payment. Sometimes it may be hard to get customers to set up the standing order on time for the required amount.

- You may spend more time on admin. If you rely on standing orders for payments, you may need to check your account daily for incoming payments. There’s no notification system for failed payments.

Wrapping up

Understanding the key differences between Direct Debits and standing orders along with each of their key features and use cases will help you save a significant amount of time. Plus, it will allow you to streamline your payment methods and give your customers peace of mind, ultimately leading to better customer relationships and happier partnerships.

Photo by Andrea Piacquadio, published on Pexels