What exactly are Direct Debits and standing orders?

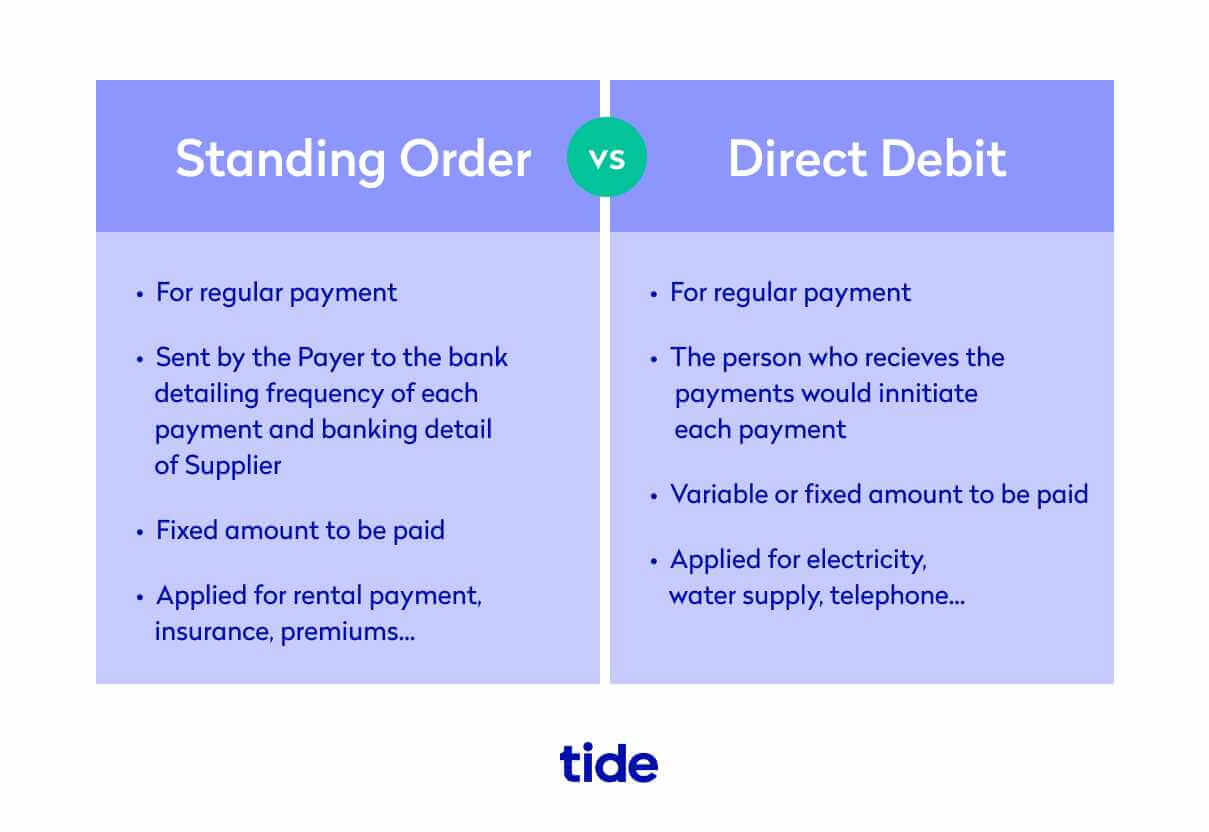

Direct Debits and standing orders are both automatic payment methods. The key differences between the two are that customers control standing orders while businesses control Direct Debits, and standing orders are fixed amounts whereas Direct Debits are variable amounts.

Here is a quick overview of the two payment methods and their differences.

Standing orders:

Customers instruct their banks to pay a fixed amount regularly which could be weekly, monthly, quarterly, or yearly depending on your agreed payment terms.

Customers select the payment amount and frequency without any input from the business.

Direct Debits:

Conversely, businesses have complete control over the payments they take via Direct Debit.

You choose the payment amount and frequency and are in complete control over amending these payment details.

Direct Debits and standing orders shouldn’t be confused with continuous payment authorities (CPAs), also known as recurring payments. These are payments that businesses can take directly from your debit or credit card to pay for subscriptions or other ongoing bills. If you subscribe to services like Netflix or Spotify you may be familiar with recurring payments.

Top Tip: Before diving into when it’s best to use Direct Debits and standing orders, it’s a good idea to have a solid grasp of small business accounting. Taking payments effectively is an essential part of running a smooth business operation. To learn more about the ins and outs of effective small business accounting including tracking your expenses, setting up an invoicing system, calculating your business tax and working with an accountant, read our complete guide to small business accounting.

When to use Direct Debits vs. standing orders

Given their different use cases, Direct Debits and standing orders are suited to different business sizes, customer profiles and payment types. Knowing when it’s best to use Direct Debits and standing orders will help you to streamline your business’s payments.

When to use standing orders

Standing orders are often used to make fixed payments on a regular basis for activities such as rent deposits, charity donations or moving money into a savings account.

Because of their nature, they are suited well for organisations like small members clubs that charge regular subscription fees.

There’s also no need for a provider which means if your business is in the early developmental phase, standing orders can offer a straightforward solution for taking payment.

It’s worth considering that you’ll need to track standing orders to ensure payment has been successfully made. Businesses with a handful of customers may find standing orders effective, however larger businesses with many customers may find tracking such payments a drain on resources.

Customers handle the admin side of standing orders which is why it’s important that you’re able to trust your customers to set up and maintain standing orders when requested. Always keep in mind that customers can change or cancel standing orders without letting you know, so it’s best practice to double-check that they are in fact paid into your business account each month to avoid any surprises.

When to use Direct Debits

Direct Debits are often a convenient and flexible payment method for businesses of all sizes. You may be using them already to pay your recurring monthly business bills like electricity, company credit cards, WiFi and council tax.

You can also use Direct Debits to collect recurring invoice payments of different amounts from your customers.

For example, if you run a florist’s shop and your regular customer base includes local shops and cafes, you may choose to invoice them monthly to save time spent on collecting payment daily. When the end of the month arrives, you would add up each customer’s purchases and send out individual invoices.

If some customers choose to pay in cash, and others opt to pay by card or bank transfer, this process could soon become a time-consuming operation of chasing customers for late payments as well as processing various payment methods.

In this situation, it could make more sense for a business to ask customers to pay by Direct Debit each month to streamline payment for both parties. Even if the amount is different each time, it would be easy for you to adjust the debit before payment. This is especially important in recent times as the Coronavirus has made cash payments much less convenient or safe.

Equally, if your business bases its prices off a multi-tiered subscription model or offers service upgrades, Direct Debits may be able to offer both parties the most flexibility since their frequency and amount are easy to modify as and when needed.

If Direct Debits are likely to change significantly each time, it’s good practice to send your customers an invoice so they can check quantities and payment amounts before the money is debited from their account.

Direct debits can also be useful for one-off payments. To eliminate time spent on following up on payments, some business owners and freelancers may find it easier to schedule a one-off Direct Debit when they send out the invoice. If your customer then decides to do repeat business, you can use the same mandate to set up another one-off Direct Debit later on.

Top Tip: Creating invoices is an essential part of everyday business operations. It’s important to know how to create an invoice, what to include on it, how to avoid common invoicing mistakes and ensure it’s paid on time. Understanding the basics of invoicing will help you keep your business’s finances on track. To learn more, read our guide to raising invoices and getting paid.