How to create a business plan: A complete guide to writing your company roadmap

A business plan is a roadmap that outlines what your business does, how it’s going to work and how you’re going to achieve your goals.

According to Bplans, who worked with the University of Oregon to analyse academic research around planning, entrepreneurs who take the time to create a plan for their business idea are 152% more likely to start that business.

Further, 129% are more likely to push forward with it beyond the start-up phase. And companies that strategically plan grow 30% faster than those that don’t.

In this guide, we’re going to walk you through how to write a business plan that helps your company start, build and achieve success.

Table of contents

- What is a business plan and why do you need one?

- The nine key components of a business plan and how to write them

- Five top tips for writing a compelling business plan

- 📹 Masterclass video: How to write the perfect business plan

- Wrapping up

What is a business plan and why do you need one?

A business plan is a document that guides you through the various stages of building, launching and running your business. Essentially, it helps you put the building blocks in place to make your company a success.

If you’re bringing a new small business to market, a business plan will be crucial in:

- Securing funding or loans

- Achieving investment or raising venture capital

- Attracting talent or business partners

- Guiding your go-to-market strategy

All banks and most investors and venture capitalists will only invest in a business if they can see that they’ll get their money back. They want to know that you have the business idea, team, scalability and planned sales growth to succeed. A business plan gives financiers the details they need to make informed decisions.

Similarly, for talent or prospective partners, a business plan is your assurance to them that your business matches their short and long-term career ambitions.

A business plan also keeps you focused on what you need to do to accomplish your goals. If you’re not meeting your targets, you can turn to your business plan to help guide you on changes that need to be made. It’s the drawing board you can always go back to.

Because of this, having a business plan is as important for existing businesses as it is for start-ups.

Top Tip: Business plans also apply to side hustles. Even if you have a full-time job or already run a small business, a side hustle can be a great way to pull in extra income or capitalise on a hobby. But just because it doesn’t take up all of your time doesn’t mean it should lack structure. To learn more about how to effectively run a side business, read our guide to 5 side businesses you can start quickly and affordably💡

How long should a business plan be?

According to Growthink surveys, 15 to 25 pages is the optimum business plan length. But the number of pages isn’t the ideal way to measure length.

As Bplans points out: “A 20-page business plan with dense text and no graphics is much longer than a 35-page plan broken up into readable bullet points, useful illustrations of locations or products, and business charts to illustrate important projections.”

Instead, Bplans says that your business plan should:

- Take no longer than 15 minutes to skim read. Make sure that key information in each section is easy for readers to find.

- Mirror the length of its audience. The length is directly tied to the intent. If the purpose is for outsiders who know nothing about your business to gain a deeper understanding, it must include detailed executive summaries and team descriptions. If the intent is to procure investment, it must be built to withstand legal scrutiny and include any information a bank would look for in a business loan application. Know your audience, and work backwards to create the ideal business plan to match that scenario (we’ll dive into exactly how to do this in a later section).

How to present your business plan?

Your business plan is designed to evolve as your business grows. It’s a living document that should be consistently tweaked to match the health and goals of your company. Because of this, it’s best to keep your plan as a digital document that can be easily updated and sent to third parties as a PDF.

That said, there may be times when your plan needs to be presented to investors or bank managers in person, so it should always be print-ready with a front cover that includes your:

- Company name

- Company logo and colour scheme

- Business name and date

- Contact information

It should also have a contents page, with numbered pages and sections so that readers can easily find what they’re looking for.

When you are ready – register your business with Tide for only £14.99!

Registering your business with Tide is incredibly fast, easy and only £14.99. You not only get to officially start your company, but you get a free business bank account at the same time, which is the best way to ensure you’re keeping your finances in order from day one. Be your own boss and register your company with Tide!

The nine key components of a business plan and how to write them

A business plan features nine main sections related to your business operations, structure and finances:

- Executive summary

- Company description

- Market analysis

- Management and company structure

- Service or product information

- Marketing and sales strategy

- Funding information

- Financial projections

- Appendix

Let’s take a closer look at each.

1. Executive summary

The executive summary is a top-level look at your business that summarises the detailed information found in the rest of the sections.

It’s also your elevator pitch—a chance for you to immediately captivate the reader by portraying your mission, vision, goals, product, leadership, finance information and growth plans.

Picture yourself in a lift for 45 seconds with a potential investor. How would you sell your business? Think about that when writing this section. Be concise and compelling with your words.

Because it is a summary, it’s often easier to write this section last after you’ve fleshed out the finer details of your business plan.

Writing your executive summary

Start with the basic information:

- Your company name

- Company address

- Names of all owners and partners

Then, get into the business information.

- Value proposition. Describe in one sentence what your company does and why it’s great. This is your value proposition. For example, Uber’s value proposition is “The smartest way to get around”. For email marketing platform MailChimp it’s “Send Better Email”. For Dollar Shave Club it’s “A great shave for a few bucks a month”.

- Problem and solution. In a paragraph, briefly explain the problem customers are facing and how your product or service solves it.

- Target customers. Who is your ideal customer? Be extremely specific. For example, if you’re selling men’s suits, your audience won’t simply be every man because every man wears suits. That doesn’t hold true. It’s more likely to be targeted towards ‘fashion-conscious men’ or ‘businessmen’.

- Competitors. List other companies that are solving the same problems you are and how they’re solving them.

- Team. A sentence or two on why your team is the best team to bring your product or service to market.

- Finances. Focus on the key aspects of your financial plan–your planned costs and how you will make money.

- Funding. Details of your start-up costs and how much you need to raise to get your business off the ground.

- Milestones. Briefly mention what you’ve achieved so far and what goals you plan to achieve. This lets potential investors, talent or partners know how serious you are in building a successful business.

As mentioned above, before you can write this section you have to flesh out all of your company details, including who you are, who you’re selling to, how you’re going to sell your product or service, what your financial goals are, how you will reach those financial goals, and so on.

The rest of this article will inform you on how to do just that.

2. Company description

The company description is your story. It digs deeper into your value proposition, looking at how you came to be and what you intend to achieve.

Break your description down into three sections:

- Mission statement

- Company profile

- Business objectives

Mission statement

Your mission statement is a sentence or short paragraph that describes why your business exists.

To create your mission statement, answer the following questions:

- What does my business do?

- How do we do it?

- Who do we do it for?

- What value are we bringing to customers?

For example, Patagonia’s mission statement is “Build the best product, cause no unnecessary harm, use business to inspire and implement solutions to the environmental crisis.”

In a single sentence, they get across their aims and ambitions, their value to the market (safe, quality products) and their value to people and the world (helping the environment).

Use this as inspiration to come up with a statement that captures the heart and soul of your business.

Top Tip: Your company description will also help to inform your business culture. You will carry these core values throughout all of your business behaviours and they will also influence how you make future business decisions. Because of this, it’s crucial to devote the necessary time and energy to get this right. To learn exactly how to do that, read our guide on why business culture matters & how to get it right from the start ☀️

Company profile

In a paragraph or two, your company profile should detail your:

- Founding date

- Company location

- Products or services

- Number of employees

- Details of company leaders and their roles

- Company milestones

The information is the most important thing here, so approach it like a business profile and stick to the facts and figures.

Business objectives

In a paragraph or two explain what you want to achieve as a business. This needs to be a realistic aim that investors can get behind and your team members can work towards.

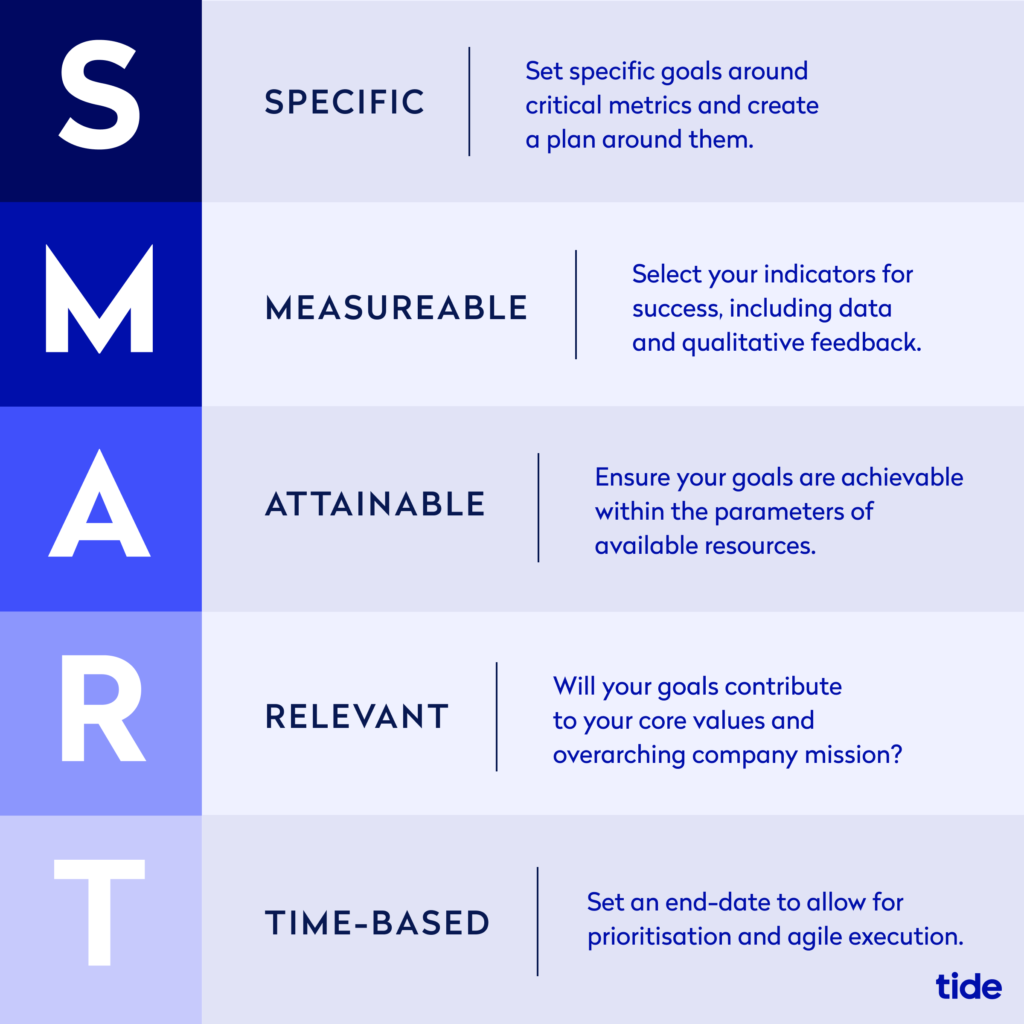

The SMART goals method can help you to ensure your goals are practical.

SMART stands for: Specific, Measurable, Attainable, Relevant, and Timely.

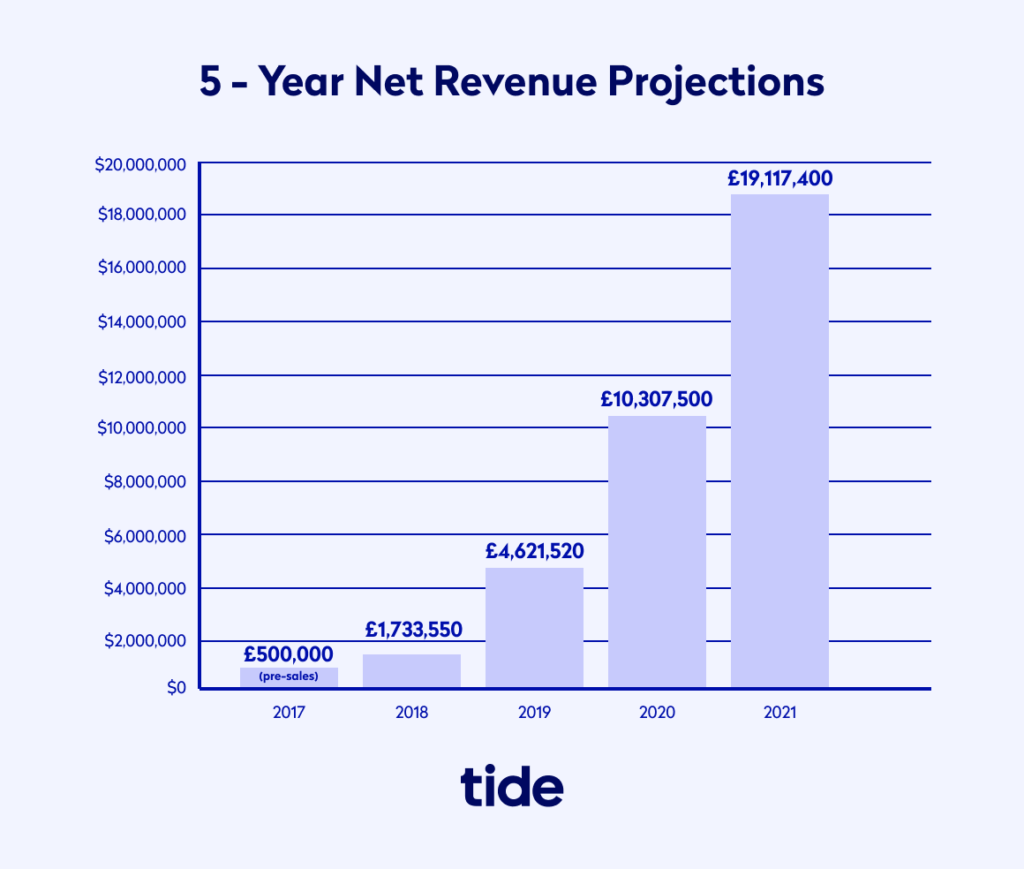

Use graphs to add weight to your objectives. For example, if you aim to increase revenue from £100,000 in year one to £500,000 by year five, create a chart that plots your growth. The visual aspect helps to grab attention whilst providing readers with key information they may miss if skim reading.

This chart from an example business plan does just that:

You’re immediately drawn to the planned-growth projections and want to learn about how they’ll reach such high goals. We will get into the specifics of how to create accurate sales and revenue forecasts in a later section.

Top Tip: To learn more about how to establish practical SMART goals that will inform your business strategy and help you effectively market your brand, read our beginners guide to digital marketing strategy.

3. Market analysis

Marketing analysis focuses on three areas:

- Your target market (the industry your selling in)

- Your customers (who you’re selling to)

- Your competitors (who you’re selling against)

By detailing information about the themes and trends within your industry, you’ll be able to show that the appetite for your product or service exists. Outlining information about your ideal customer helps you to identify the marketing and sales tactics you can use to attract them. And highlighting your competitor’s strengths and weaknesses gives you a chance to showcase what you do better than the rest.

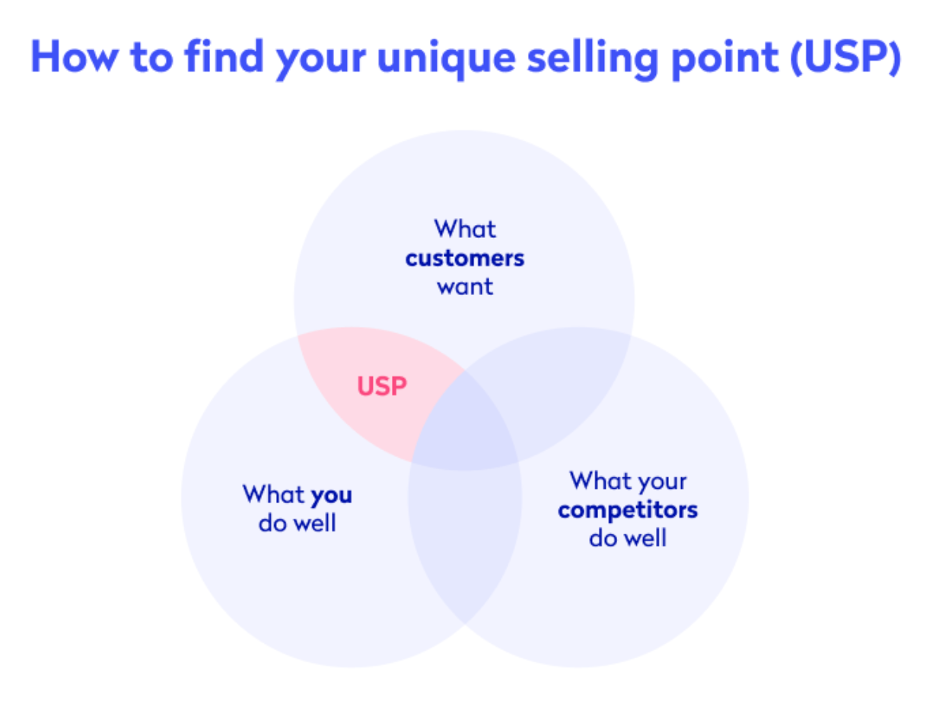

Market analysis

Market analysis should identify the market as a whole, as well as your addressable market and your share of the market. From this information, you can begin to get an idea of your target market, which informs your messaging, positioning and unique selling point (USP).

Start by researching the current state of your industry and where the market is heading in terms of size, trends and projected growth.

Your approach here will depend on your business. For example, if you’re opening a small local shop, you should assess the market around your shop. If you’re starting an ecommerce business and selling UK-wide, you’ll need to analyse the market at a national level.

When estimating market size, look at:

- Volume. The number of potential customers

- Value. The value of the market

You can find this information by searching for publicly available data or by commissioning a market research report. If you’re searching on a national level, you may find figures published online. On a local level, data might not be as easy to come by, which is where you’ll need to carry out your own research.

Top Tip: Conducting market research takes time, but it’s important that you get a full picture of your audience to ensure your message and USP resonates. To learn more, read our detailed guide on how to conduct market research for your business idea ⚡️

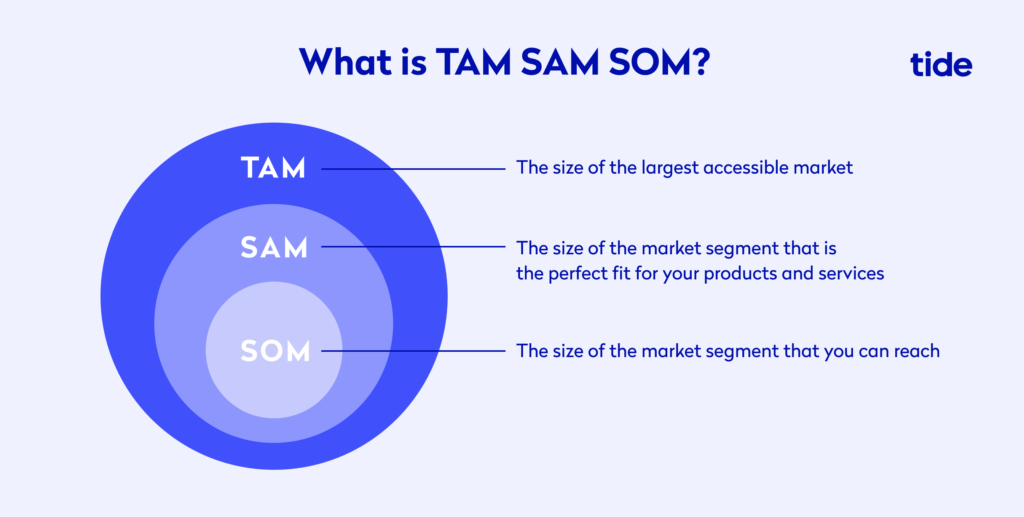

Once you have the information, you can use TAM SAM SOM to work out your business’ relationship to the market size.

- TAM stands for Total Addressable Market

- SAM stands for Serviceable Addressable Market

- SOM stands for Serviceable Obtainable Market

- To calculate your TAM, work out how many people have a need for your business. For example, let’s say you’re opening a shop selling custom-designed women’s clothes in a town of 100,000 people. Market research shows that 50% (50,000) of residents are women. Your total addressable market would be 50,000 people.

- To calculate your SAM, take your TAM and discount all the people that fall outside of your target market. Let’s say your target market is women between 18 and 35, with disposable income. This discounts 30,000 people, which means your serviceable addressable market is 40% (20,000) of your total addressable market.

- To calculate your SOM, work out how many of your SAM you can realistically serve. Your shop offers a measuring service and design consultation but only to people in a five-mile radius, which means you can serve 200 people a month. That would mean serving 2,400 people a year, which makes your SOM around 12% of your SAM.

Ideal customer

Your ideal customer is the person your product or service is aimed at. In the above example of the women’s clothes shop, the ideal customer is between 18 and 35, with disposable income.

Customer analysis digs deeper than this, looking at your target customers’ education, income, job, relationship, buying concerns, interests and more.

You’ll find methods to help you discover your ideal customer and create customer personas in our guide on how to create a go-to-market strategy.

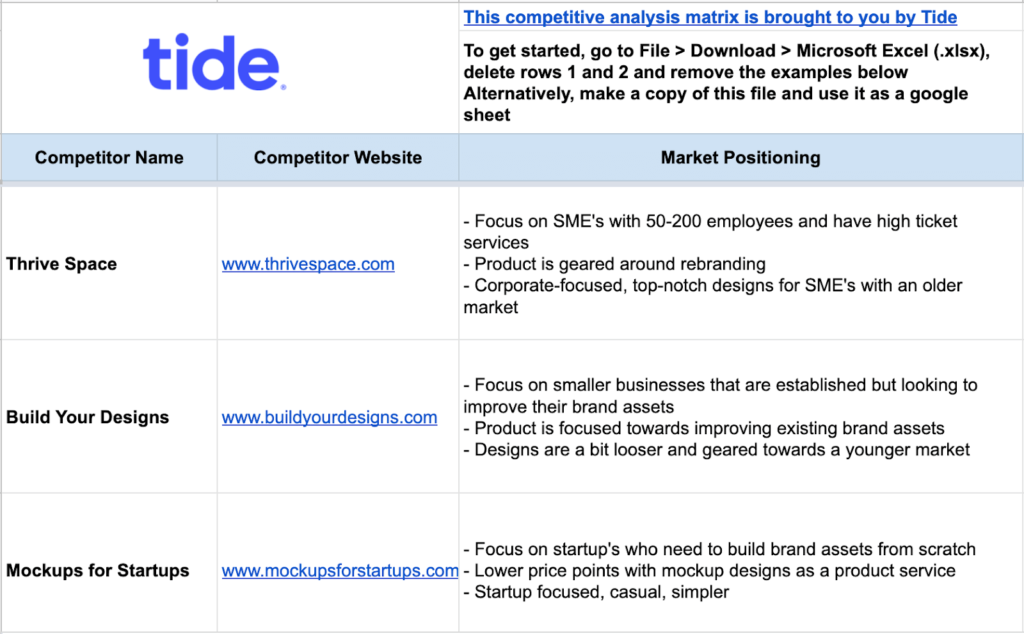

Competitors

Competitive analysis is the process of identifying gaps in the market that your product or service can fill. It’s about finding out what the competition does so you gain a competitive advantage.

In our guide on how to run a competitive analysis, we walk you through the process of analysing the finer details of your rivals in five steps:

Step 1: Identify & segment your competitors

Step 2: Analyse their market positioning

Step 3: Review their content & social media

Step 4: Check out what their customers are saying

Step 5: Walk through their customer journey

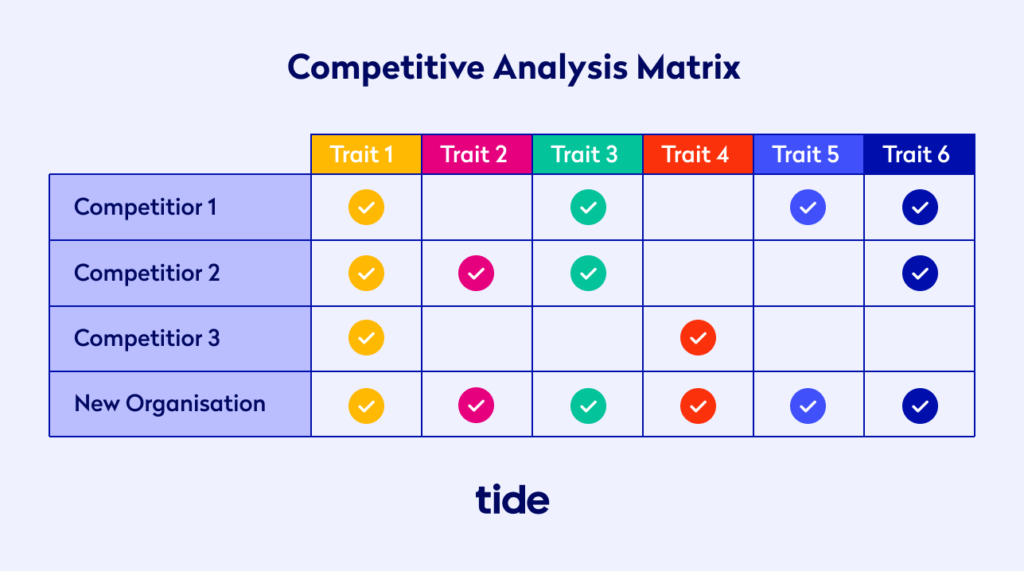

Use this information to show potential investors and talent that your business is going places. Our competitive analysis matrix template is a great starting point.

Once complete, take it a step further and create a simple visual that clearly shows where your company outperforms the competition. Here is a basic example of how to build out this visual.

It’s hard to ignore a chart that checks all of the boxes.

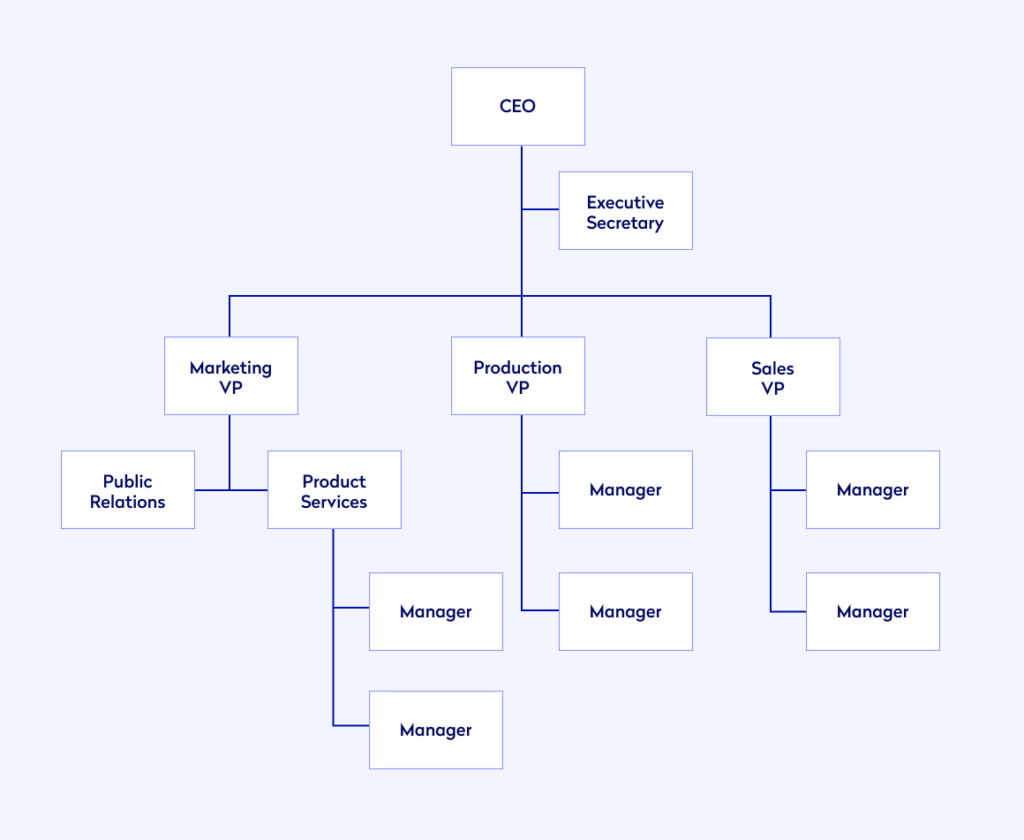

4. Management and company structure

This section goes into detail on how your company is structured and who is running it.

The structure here means two different things:

- Team structure

- Company structure

Team structure

First, you need to show your management structure: what each leader’s role is within the company.

The simplest way to show your company hierarchy is with an organisational chart like this example:

For each member of your team, give details on their background and credentials with a bio that includes their:

- Education

- Professional background

- Achievements

- Awards

Including this information gives readers assurances that the team you have in place is well-positioned to take the company forward.

If there are any roles yet to be filled, give details on those positions.

Company structure

Company structure is your legal structure. For example, limited company or sole trader.

Top Tip: If you’re yet to decide on a business structure, you can weigh up the pros and cons for setting up as a sole trader or limited company in our sole trader vs limited company guide.

If you plan on changing the structure of your company in the future, include details on this as well. For example, you may start as a private limited company (Ltd), but grow to become a public limited company with shares offered to members of the public.

5. Service or product information

Here is where you get to wax lyrical about your offer and why it’s better than anything currently on the market.

This section should include:

- A description of your product or service. Details on what it is and what it does.

- How your product or service will be priced. Do you offer tiered pricing or a subscription model, for example.

Top Tip: Choosing the right pricing strategy is another key part of your go-to-market strategy. Will you price higher, lower, or similar to your competitors? What does the market demand? How does your pricing strategy reflect the value of your products and services? To learn more about how to answer these questions, read our 6-step guide on how to price a product and achieve profitable markups 💷

- How your products compare to competitors. List several competitor products along with their pros and cons.

- The production process. Details on how your products are created, how your source materials, quality control management, supply chain, inventory and bookkeeping.

- Product lifecycle. Details on upsells and cross-sells, research and development plans and time between purchases.

- Orders. Details on how you process and fulfil orders.

- Legal aspects. Details on any intellectual property or trademarks you own.

- Future products or services. If you plan on expanding your offer, give details on the offer and any research and development plans.

While there are formal and practical details to get across, the main point of this section is to get the reader excited about your product. To do this:

- Focus on the benefits. Describe how features give value to the customer. Here are some examples of features turned into benefits:

| Product | Feature | Advantage | Benefit |

| Coffee subscription | Monthly coffee delivery | Convenience and personalization | Higher quality coffee based on your taste, delivered |

| HR software | End-to-end people management | No need for multiple tools | Manage your people ops from one place |

| City bicycle | Made from lighter steel | Easier to carry and manoeuvre | The perfect bike for city commuting |

- Highlight your features. Get across what features your product or service has that the competition doesn’t. For example, your product might be the cheapest on the market or your turnaround time might be quicker or your expertise might allow you to offer a better level of service.

- Get across why you’re needed. Shine the light on why your product or service is important to the market. This will be especially crucial if your startup is bringing a new invention to the market, or you’re creating an entirely new market.

6. Marketing and sales strategy

If your business is going to be a success, you need a marketing strategy and sales plan that takes customers on a journey from awareness to purchase.

This section of your business plan should include:

- Your target market. Reiterating the information from the market analysis section.

- Which marketing channels you’ll use and which you’ll prioritise. For example, social media, word of mouth, Google Ads, print or radio advertising, exhibition stands or fairs, or referrals.

- Your plan to attract customers at launch. For example, you might run an opening discount offer to people who share your post on social media. Or give a voucher to every customer who refers a friend.

- Your plan to retain customers. For example, you may offer reward programs that allow customers to collect points for every purchase that can be redeemed for free or discounted products.

- Your expected results. What you hope to achieve from your marketing and how it will help you grow your business in terms of sales and visibility. If you’ve already started marketing your business, give details on what you’ve done and how it’s benefited the business.

7. Funding information

Funding information is all about how much money you need to start your business, why you need it and how you’ll use any capital.

The most critical part of this is your startup costs, which detail:

- The cost of producing your product or service

- Your fixed outgoings

- The cost of equipment, premises, supplies, insurance and other necessities required to run your business

Top Tip: If you’re yet to work out how much capital you need, check out our guide on how much it costs to start a business in the UK 📌

If you have the figures in place, you can set out presenting them.

This section should be broken down into three parts:

- Current and future funding requirements

- How funds will be used

- Current and future financial plans

Current and future funding requirements

Include how much money you need to get your business off the ground, along with any funding you’ll need in the foreseeable future (up to five years). Be clear about why you’re requesting a loan or investment and outline what your needs are based on in your financial forecasts (we’ll get onto those soon).

If you’re offering equity in exchange for investment, provide details on how an investor will be paid, as well as how and when they can cash out. For most small businesses, investors are paid in dividends (a share of company profits).

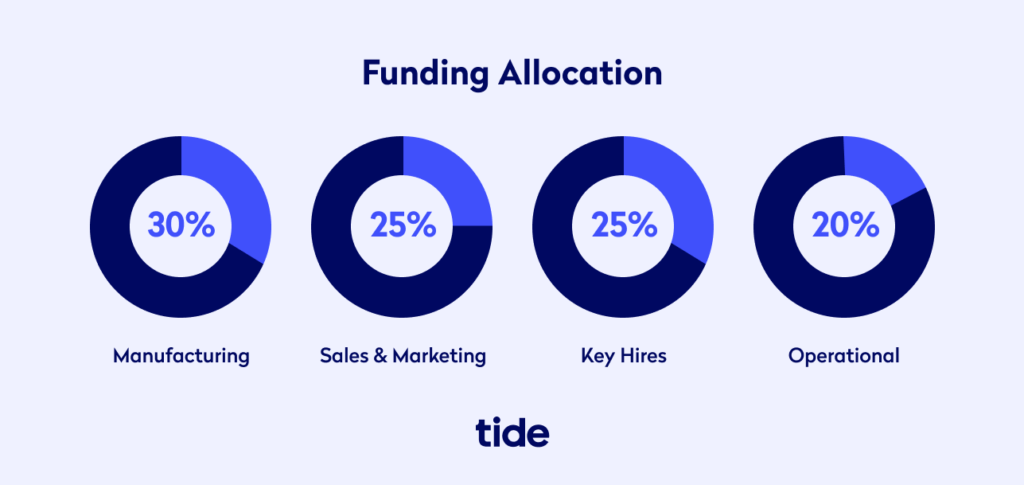

How funds will be used

This part should explain how you plan to use the funds so that investors can determine if your business is a worthwhile investment. If you plan on using capital for several things, list and provide costs for each.

Again, putting these numbers into a visual format will help to more clearly outline your vision.

Current and future financial plans

Finally, if applicable, provide information on any current investments and/or outstanding loan repayment plans.

If you’re seeking investment or a loan for the first time, most lenders will have their own repayment schedules. However, you should detail any factors that may affect lenders, such as any plans to relocate or sell the business.

Unlike other sections, funding information will need to be tailored to each financier. Investors will be interested in return on investment (ROI), whereas lenders will be interested in loan repayments. Create separate reports so that information is relevant to the reader.

Top Tip: Investors and banks will also be interested in your business credit report (if you have one). To learn more about why your business credit score is important and how it’s determined, read our guide to everything you need to know about your business credit score (and how to improve it) 🙌

8. Financial projections

Financial projections supplement your funding information by showing potential lenders and investors that your business has a positive financial outlook.

This section should include the following key information:

- Sales forecast. The amount of money you expect to raise from sales.

- Cash flow statement. Your cash flow balance and monthly cash flow patterns–how much is coming in and going out of your business every month.

- Balance sheet. An overview of the financial health of your business.

- Profit and loss statement. Your profit level and how much you expect to make based on projected sales, minus the cost of overheads and providing goods or services.

Top Tip: Unless you’re an accountant, this part of the business plan can be overwhelming. To learn more about the fundamentals of accounting and how to create each of the aforementioned statements, read our complete guide to accounting for startups 📣

If your business is already established, you’ll need to include financial figures from the last three years (or however long you’ve been trading if it’s less than three years) for all of the above, other than your sales forecast.

If you’re a new business, your financial figures need to be predicted.

We’ve built several spreadsheet templates to help you generate the below financial reports:

- Three main financial statements (balance sheet, profit and loss statement, cash flow statement)

- Cash flow forecast

- Estimated sales

Forecasting your finances

Sales forecast

Use your market analysis and knowledge of industry trends to estimate your future sales. For the first year, break these figures down into monthly sales, detailing what you’re selling, price points and how much you expect to sell. Moving into the second and third year of business, reduce forecasting to quarterly sales.

Cash flow statement

As a startup, your cash flow statement becomes a cash flow forecast based on your sales forecast, minus your expenses. Your expenses are the:

- Fixed costs. Expenses that are the same or close the same every month (e.g. rent, insurance and utilities).

- Variable costs. Expenses that vary every month depending on demand (e.g.costs for raw materials, production costs, shipping and advertising).

Provide monthly cash flow patterns for the first 36 months. Keep in mind that, depending on your business, you may need to account for a lag in revenue. For example, if you provide a service to a client, their payment terms might dictate the invoice is paid 60 days after being sent.

Top Tip: To learn more about the various types of expenses and how to manage them, read our guide to small business expense management 🙌

Balance sheet

Create a balance sheet by calculating company assets, minus company liabilities.

Company assets include:

- Property you own

- Equipment you own

- Unsold inventory

- Company vehicles you own

- Outstanding invoices

Company liabilities include:

- The amount you owe on a business loan

- The amount you owe unpaid invoices

Your balance is the difference between your assets total and your liabilities total.

Profit and loss statement

Use the figures from your sales forecast, expenses and cash flow statement to forecast how much you expect in profit and losses for your first three years in business.

Your statement needs profit and loss projections for each year, as well as a total figure for the three years and should include a breakdown of:

- Sales. Based on figures from your sales forecast.

- Cost of goods sold (COGS). The total cost of selling your product or service. If you need help with this, check out our guide on everything you need to know about cost of sales.

- Gross margin. Your sales minus your COGS. This is usually listed as a percentage, which you can calculate as:

Gross margin (total revenue – COGS / total revenue x 100

For example, £500,000 total revenue, minus £300,000 leaves a gross margin of £200,000.

£200,000 / £500,000 x 100 = 40%

- Operating expenses. A list of all your expenses, minus COGS (which you’ve already included), tax, amortisation and depreciation. List each expense individually and include a total sum.

- Operating income statement. Your total operating expenses minus your COGS, before interest, tax, amortisation and depreciation.

- Total expenses. Your expenses including interest, tax, amortisation and depreciation.

- Net profit. Your monthly and yearly bottom line.

List financial figures using bullet points and include graphs to show how you predict your business will grow over your first three years of trading.

9. Appendix

The appendix is the place to include any supporting documents. If a lender or investor hasn’t requested additional documentation, you can choose to leave this section out. But it’s a good place to strengthen your business plan, by including:

- Reference letters

- Patents

- Credit reports

- Permits and licences

- Client contracts or customer purchase orders

- Legal documents

- Associations and memberships

Format the appendix with a clear table of contents and sections that correspond to the business plan section.

5 top tips for writing a compelling business plan

- Keep it concise. Say what you need to say using simple language (no jargon) in as few words as possible. Your business plan only needs to get the key information across. The intricacies can come later.

- Make it easy on the eye. Most lenders and investors will skim read your business plan, picking out relevant information as they go. Use headings to define sections and make key data stand out on each page by using bullet points for lists, bolding important sentences and using graphs and charts to add weight to financial figures.

- Think about your audience. Consider who your business plan is aimed at and write with them in mind. If it’s an internal plan, think about what your team would want to gain from reading the document. If it’s for a lender or investor, think about the questions they might ask and which information is of particular interest to them.

- Get the figures right. If you’re forecasting costs, sales and expenses, numbers will never be 100% accurate and it’s better to overestimate than underestimate. However, figures must be realistic and they must add up. Expect lenders and investors to scrutinise your calculations. Always double and triple check the numbers.

- Proofread and proofread again. Don’t let your hard work be undone by something as simple as a typo or grammar mistake. Proofread your document from start to finish and then finish to start. Have someone you trust look over it too.

📹 Masterclass video: How to write the perfect business plan

You now know what goes into a strong business plan, but you might be wondering what tools and frameworks you can use to bring it to life.

In this Tide Masterclass, our Events Manager Cuan Hawker is joined by Tom Horbye, Head of Campaigns Development at Seedrs.

Seedrs connects investors and businesses. They help startups raise capital and grow a supportive community. As they put it, it’s “equity crowdfunding done properly”. It’s unlikely anyone has seen and improved more business plans than Tom!

Tom will explain:

- Why you need a business plan 📘

- How to structure your plan 📃

Two tried-and-tested structures that work. - What to include in your plan 📋

And what to leave out. - Tools, help and next steps 🛠

This Masterclass is useful for anyone thinking about starting their own business in the UK.

Wrapping up

A business plan is the cornerstone of your company. By clearly detailing your business objectives, strategies, marketing and sales plans, and financial forecasts you’ll be able to set out your business goals and keep track of your progress.

Use this guide to complete the key components and put together a plan that a) brings clarity to your team, and b) provides assurances to lenders and investors that your business is a safe bet.

Photo by William Ivan, published on Unsplash