How to keep track of expenses

For small business owners, learning how to effectively manage your expenses is crucial to your business’s financial health.

More than half of small business owners have experienced cash flow problems, and expenses are one of the biggest factors in your cash flow equation. The good news is, it is easy to implement efficient expense tracking to minimise such issues.

Good money management helps you save money, cut down on unnecessary costs, and improve your business’s financial health in the long run.

In this article, you’ll learn about the different types of expenses and how to track them for your own business.

Top Tip: Expenses are costs experienced by your business for the purpose of generating revenue. Before diving into how to track expenses, it’s important to grasp what they are in general and how they affect your accounting processes. To learn more, read our guide to what expenses are and how small businesses can manage them 📣

Table of contents

- Types of business expenses

- The importance of tracking expenses

- How to keep track of your expenses

- Wrapping up

Types of business expenses

The expenses, or costs, that you incur when running your business may include employee salaries, office rent, utility bills, the cost of machinery used in operating your business, advertising and marketing initiatives, and more.

There are three main types of business expenses.

1. Operating expenses

Operating expenses, or OPEX, are short-term expenses that a business incurs on a day-to-day basis.

These are divided into two broad categories:

- Selling, General, and Administrative expenses (SG&A)

- Cost of Sales

SG&A expenses are the non-production costs incurred by a company. These costs usually fall under a company’s overheads.

Examples of SG&A expenses include:

- Advertising spend

- Utility bills

- Telephone bills

- Travelling expenses

- Healthcare insurance

Cost of sales, or cost of goods sold (COGS), are directly related to the production level of a business. The more items a company produces, the higher its cost of sales would be.

Examples of cost of sales include:

- Freight or shipping charges

- Storage costs

- Direct labour costs

- Direct material costs

Both types of operating expenses are usually paid off in the same accounting period in which they’re incurred.

Top Tip: To learn more about the accounting period and the important deadlines you need to be aware of, read our guide highlighting 3 top tips to keeping track of small business expenses ✅

2. Non-operating expenses

Non-operating expenses are costs that aren’t related to the core operations of your business but are still incurred on a per-need basis.

Examples of non-operating expenses include:

- Interest expenses

- Loss on disposal of assets

- Obsolete inventory charges

- Lawsuit settlement expenses

Non-operating expenses may or may not apply to your small business depending on your specific situation.

3. Capital expenses

Capital expenses, or CAPEX, are costs incurred by a business to acquire, maintain, or improve its fixed assets.

Examples of CAPEX include:

- Buildings

- Machinery

- Office equipment

- Land

- Vehicle

Capital expenses are largely incurred when a business undertakes a new project or invests in improving its processes and future output.

Top Tip: Understanding small business accounting is a crucial part of mastering how to track and organise your business expenses. Armed with this knowledge, you’ll be able to make more informed decisions on the type of accounting method that works best for your business, as well as how to set up a healthy bookkeeping, accounting and invoicing system. To learn more, read our complete guide to small business accounting 💡

The importance of tracking expenses

Knowing exactly how much money you’re spending every day and where you’re spending it helps you make better short and long-term financial decisions for your business.

Here are some key benefits of tracking your expenses.

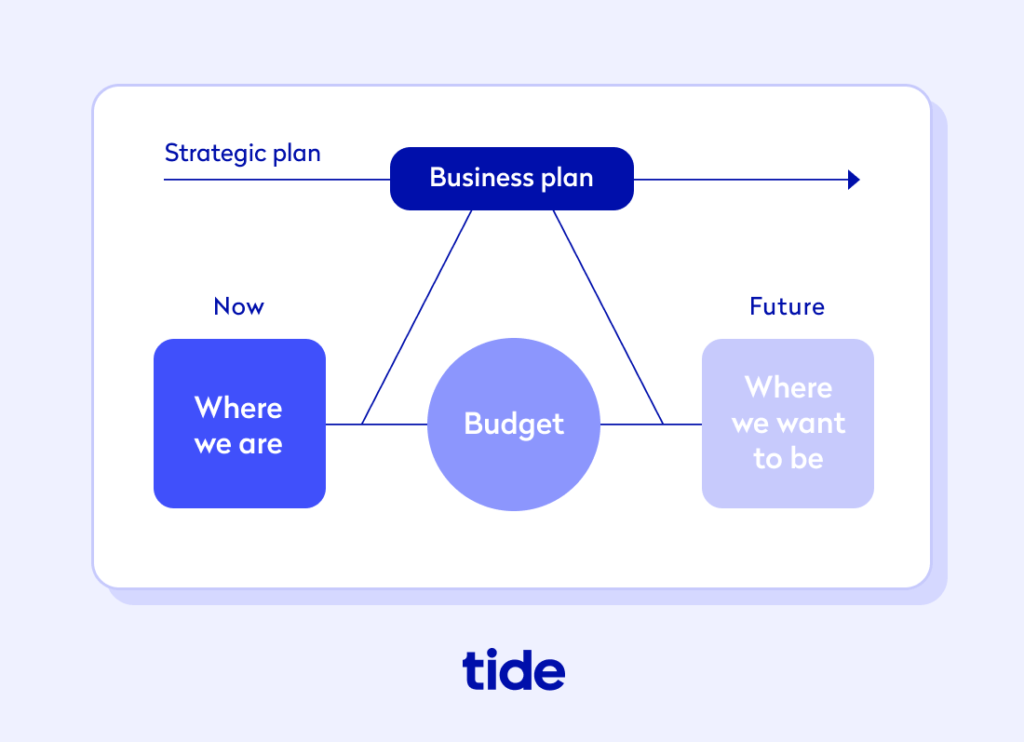

1. Stick to a budget

Keeping track of expenses helps you stay within a specified business budget. If you don’t know how much money you’re spending or where you’re spending it, you won’t be able to tell if you’re overspending, underspending, or spending it in the wrong place.

If you are overspending, a business budget also helps you to identify unnecessary or excessive costs and take appropriate measures to adjust those spending habits before it’s too late.

Further, you need a budget to ensure you have enough money stored in an emergency fund at all times in case you run into a cash flow issue.

Budgeting tools give you a pulse on exactly where and how you’re spending your money, which helps you to become more conscious and strategic about your spending.

Top Tip: Speaking of strategic spending, financial forecasting is a key part of tracking your expenses so that you can reach your financial goals. Essentially, it’s the practice of predicting how much money (sales, income and expenses) will move in and out of your business over a 12 month period. To learn more about why financial forecasting is so important, and how to create a cash flow forecast yourself, read our cash flow forecast guide📈

2. Create accurate financial statements

Accurate financial reporting, whether monthly, quarterly or yearly, is key to making better business decisions. It helps you answer questions like:

- Can you afford to buy another company vehicle?

- Is organising a company-wide retreat a good idea at this time?

- Do you need to switch suppliers?

Expenses are an important part of both the income and cash flow statements.

For example, you need to know the exact amount of expenses incurred to find out if your company made a profit or loss during a specified period of time.

Accurate financial reporting, whether monthly, quarterly or yearly, is key to making better business decisions. It helps you answer questions like:

- Can you afford to buy another company vehicle?

- Is organizing a company-wide retreat a good idea at this time?

- Do you need to switch suppliers?

Plus, the more accurate your financial statements are, the more likely you’ll be to pay the right amount of tax. This leads us to the next point.

Top Tip: There are three main financial statements: the balance sheet, income statement and cash flow statement. The more familiar you are with what each one means, how they work and how they relate to one another, the better accounting decisions you’ll be able to make. Of course, a dedicated bookkeeper or accountant can help you to create and analyse these statements as your business grows. To learn more, read our complete guide to accounting for startups 🔥

3. Pay the right amount of tax

Some expenses incurred by your business are tax deductible and can be claimed. These claims can effectively reduce the tax your company has to pay to HMRC.

Here are some examples of expenses that are tax deductible:

- Marketing and advertising, such as website domain registration and hosting fees

- Staff costs, such as salaries, bonuses, and commissions

- Office costs, such as rent, utilities, and phone bills

- Clothing expenses, such as uniform and safety gear required to do business

It’s important to note that there are different sets of rules for how you can claim your expenses depending on the type of business that you run.

For example, limited companies are able to claim allowable expenses that ultimately reduce their Corporation Tax bill. Sole traders and partnerships, on the other hand, can claim reimbursable expenses that reduce their business profit tax.

Top Tip: To learn more about what you can claim as a limited company, read our detailed guide to what allowable expenses limited companies can claim. And to dive into what you can claim as a sole trader or if you work in a partnership, read our guide to reimbursable expenses and how you can claim them 🌟

How to keep track of your expenses

Having a good system in place to track your business expenses helps you avoid confusion and hassle at the end of each accounting period.

There are several different ways to track your expenses, from manually writing entries in a ledger to using desktop and mobile apps and software that automatically record transactions.

Here are five ways to keep track of your business expenses.

1. Open a dedicated business bank account

Even if you’re a sole proprietor or running a very small business, it’s a good idea to open a separate bank account for your company.

A business bank account makes it easier to keep track of all of the money going in and out of your company. It also lets you separate your business expenses from personal expenses, which can be helpful during tax time. And it makes it easier to check your business vs. personal account balances, guaranteeing you don’t run into a problem where you have more or less money in your business or personal accounts than you thought.

This also works to guarantee that you don’t run into a problem where you have more or less money in your business or personal accounts than you thought—another contributor to keeping a pulse on your business cash flow.

Ideally, all of your business transactions should be conducted through your business account and be kept away from your personal finance. This will also help you effectively reconcile your bank statements with your books.

2. Decide how to record transactions

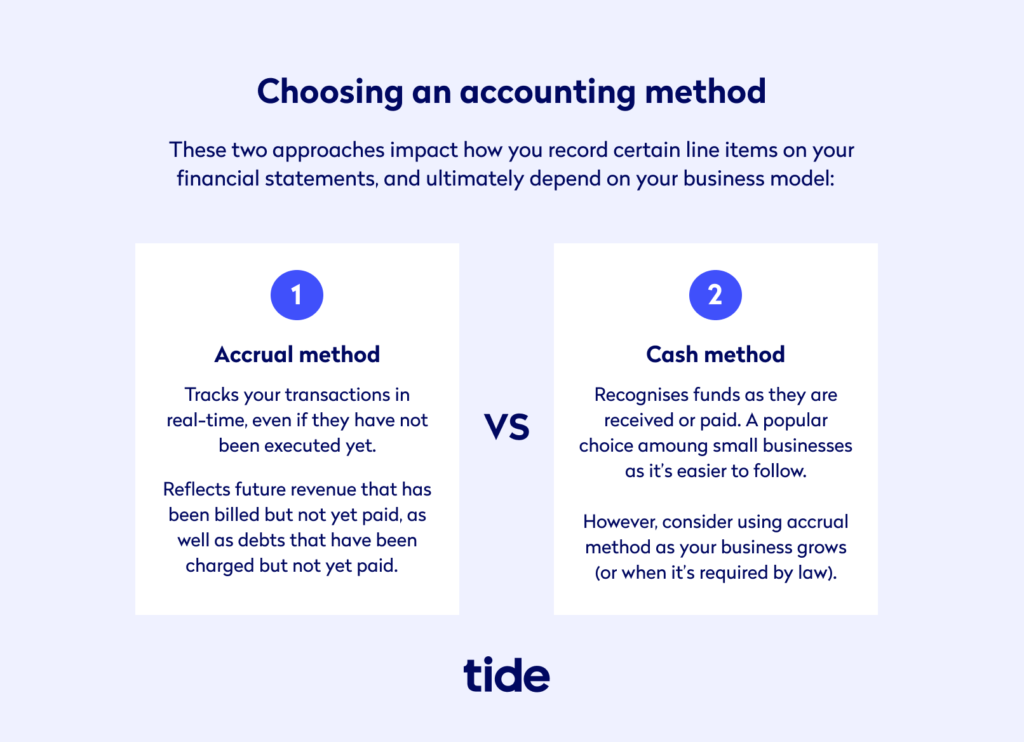

When setting up an accounting system for your business, you’ll need to decide how you want to record transactions.

There are two methods of recording business transactions:

- Cash accounting

- Accrual accounting

In the cash accounting method, you record revenue when cash is received and when expenses are paid. So, for example, if a client has yet to pay for the services you provided, you won’t record this transaction until they actually pay you.

This is a straightforward way to record transactions and can be done without any help from an accountant or a bookkeeper, as there are no account payables and receivables.

In the accrual accounting method, both revenue and expenses are recorded when they’re earned, not when they’re actually received or paid.

For example, if you’ve provided services to a client who has yet to pay you, you’ll still record the transaction in your books.

This method of recording transactions is a bit more complex and may require you to hire a professional. However, it provides a more accurate picture of your business’s financial health than cash accounting.

For freelancers and new businesses, cash accounting might make more sense. But if your business is growing and you frequently provide services to clients on credit, the accrual accounting method might be a better way to record transactions.

Top Tip: To learn more about the five steps to setting up your small business accounting, so that you can properly identify, record, measure and interpret financial information, read our complete guide to small business accounting 💯

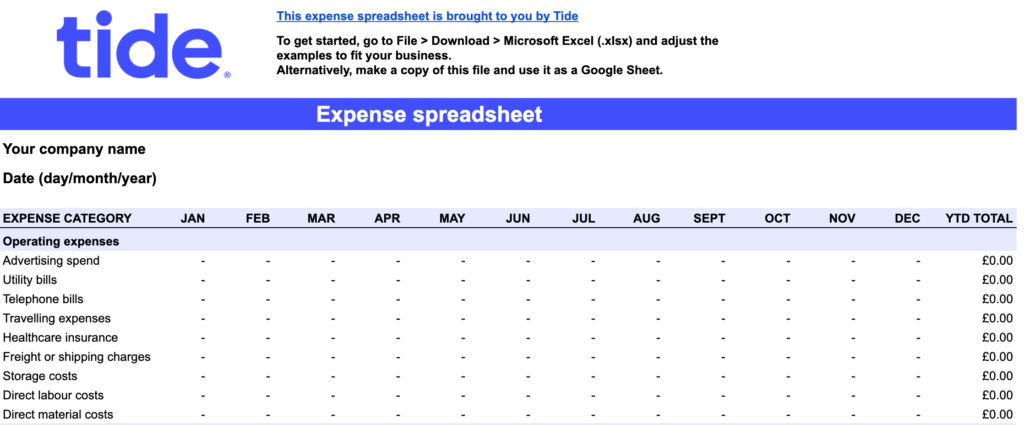

3. Create an expense spreadsheet

Once you’ve decided on a method, it’s time to start recording your transactions.

To keep things organised, you may want to create a spreadsheet as an expense tracker. You can record expenses by hand, but using a digital spreadsheet will save you plenty of time.

Plus, using an online spreadsheet allows more than one person to record expenses at the same time, which boosts productivity. And if it’s in the cloud, it automatically saves your work, which can be a lifesaver in the event of an emergency or if you lose your document.

If you’re not familiar with how to use Microsoft Excel or Google Sheets to create a template from scratch, you’re in luck—we’ve done it for you. Here’s our free online expense spreadsheet template to get you started.

Templates like the one we’ve created for you have usually have pre-designed expense categories and formulas in place—all you need to do is type in your expenses as you incur them in the right columns.

Ready to take cashflow forecasting to the next level?

Stay on top of your numbers with Tide’s easy to read real-time insights, with our new FREE Cashflow Insights tool. Understand your cashflow, plan for the future and keep track of your business credit score. Plus, you’ll be offered flexible and affordable finance options which are tailored to your business, with Tide Credit Options. Register now for early access 🔮

4. Maintain a backup of your expenses

Regardless of how reliable you think your system is, there’s always a risk of something going wrong. You may face issues like missing entries, corrupt files and system errors. Someone may even accidentally delete important records.

To overcome any such potential issues, you should always keep a backup of your expense records. This could be a physical backup of receipts and contracts or a digital backup that includes photos of your receipts and other expense documents.

We recommend storing your backup data in a cloud-based folder, such as Google Drive, Dropbox, or OneDrive.

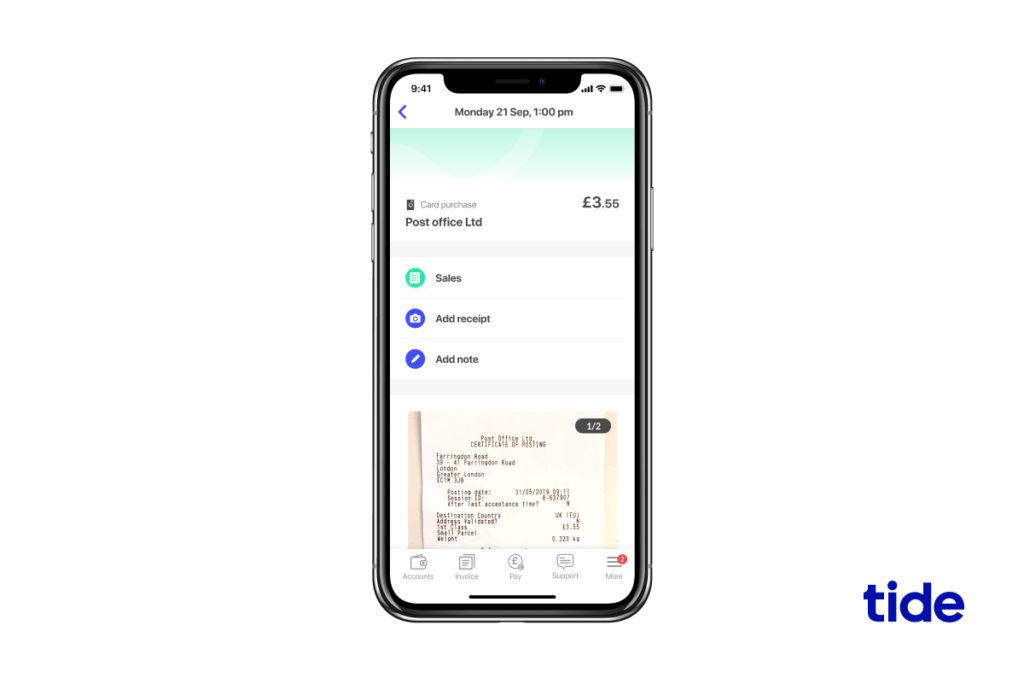

With the Tide app, you can also take pictures of your receipts and match them to expenses—making it easier than ever to track what you or your employees are spending money on.

Top Tip: When you do employ staff and allow them to make expenses on behalf of your business, that requires a whole other level of tracking and managing. Your team needs to know what they are allowed to spend cash on, the limits for each type of transaction and how to get reimbursed (if need be). To learn more, read our guides on how to create a company expense policy and how to manage employee expenses 📌

5. Invest in an accounting software

Manually recording each and every expense can be time-consuming, even if you’re using an online spreadsheet.

A faster and money-saving alternative is to use a business finance platform that seamlessly integrates with your accounting software, like Tide, that automates the entire process of recording transactions as they occur in real-time.

Tide is a mobile banking app that helps you conduct and record transactions on the go. Simply integrate it with your favourite accounting software, and keep track of your expenses as you incur them.

Using software to track expenses eliminates human error and saves you valuable time. Tide also auto-categorises your expenses so you can stay organised and up-to-date with your company’s transactions at all times.

While recording expenses in your Tide account, you can add notes and attachments with each transaction. This means you don’t need to keep an offline backup as all your data is automatically stored in one place.

Wrapping up

Keeping track of expenses can help you boost your company’s financial health. Not only does it help you save money, cut costs, pay the right amount of tax, and prepare accurate financial statements, it drives you to make better decisions for the future of your business.

You can choose to track your expenses manually or invest in reliable accounting software to automate the entire process. Learn more about how Tide’s features can help you record transactions and keep track of expenses on the go so you can save time and get back to doing what you love.

Photo by Marcus Aurelius, published on Pexels