An 8 step guide to surviving your first year in business

You’ve come up with a great business idea, validated it, produced a killer go-to-market strategy and have launched your new venture.

Now, you’re entering into your first year of business and aspiring to run a successful operation.

But no matter how you slice it, your first twelve months as a small business owner will be a rollercoaster.

It will be filled with exciting milestones as well as moments of frustration as you try to navigate the day-to-day challenges and wins that come with running your own business.

In this guide, we’re going to share everything we know about surviving your first year of business and making it a success.

Top Tip: The average UK business spends £22,756 in their first year. Because cash flow is a major contributor to business success or failure, understanding how to budget and track your income and expenditure is key to survival. To learn more, read our guide to how much it costs to start a business in the UK💡

Contents

- What is the first year of business like?

- Prepare for a rainy day

- Get your accounting in order

- Get your legal logistics in order

- Build your network

- Don’t try to offer too many things at once

- Be patient and commit to the long-game

- Expert insights

- An FAQ for your first year in business

- Wrapping up

What is the first year of business like?

As amazing as it can be, running a business can also feel like fighting fire, especially at the start. Apart from all the great experiences you’ll have, things you’ll learn and successes to look forward to, you’re taking on a risky job, fixing problems and, quite frankly, you’ll probably never get enough credit.

But what matters most is how you walk through that fire and take the heat. If you face it with an open mind, you’ll come out the other side stronger because of it. That’s because with the right mindset, you’ll learn from the ups and downs and gain key experience that makes you a better leader and owner in the long run.

Top Tip: Just like athletes, you need to harness your mindset to make your business a success. Learn more about how to manage growth from day one in our quick guide to why you should have a game plan when starting a new business 🥊

Chris Weeks and Alastair Byrne designed Bounce, an instant access, automated mental health-focused chatbot. The pair was so committed to making it through their first year of business, that they had their own share of anxiety:

“It’s quite funny because we run a mental health business, but it’s very stressful!…It challenges your confidence and self-esteem. Some weeks you feel great – you feel like everything’s going well and you can take on the world. Other weeks you feel like you’ve got this massive boulder on top of you and everything you’re trying to do is really hard.” – Chris Weeks, co-founder Bounce

There are many things that could go wrong when starting a business. Sales might begin to slow or a team member might let you down. The truth is, there are countless challenges that could completely break your business. However, many can be prevented if you set things up correctly from the outset:

1. Have a business plan

Having a plan for your business can give you strategic focus, allow you to make cash flow forecasts and keep an eye on key priorities.

Use a business plan template

A business plan doesn’t need to be an overwhelming 30-page document. According to Growthink surveys, anywhere from 15-25 pages will work. But no matter how long or short yours ends up being, you should include the following nine sections:

- Executive summary

- Company description

- Market analysis

- Management and company structure

- Service or product information

- Marketing and sales strategy

- Funding information

- Financial projections

- Appendix

At the bare minimum, your business plan should clearly summarise your business model, value proposition, business objectives, target audience, financial plan, marketing plan and past and future milestones.

Top Tip: To dive deeper into the nine key components of a business plan and how to write your own, read our complete guide to writing your company roadmap and creating a business plan ⚙️

You can also find resources from GOV.UK’s business plan hub including templates and examples to get you started.

Get your accounting in order from day one

Planning ahead and getting your financials in order early on can save you financial headaches down the line.

If you haven’t yet, we recommend registering your business and setting up a business bank account (both through Tide!), getting an accountant and using cloud accounting software.

This way, you’ll be able to keep your cash organised and categorised from the get go, get the help you need with tax preparation and filing and keep a pulse on your day to day financial activity.

All of this matters because your first year of business is going to be extremely busy. You may not have time to effectively balance the books, focus on filing taxes correctly and on time, manage invoicing, and all of the other financial responsibilities that you have as a business owner.

But we also understand that you may not have the budget to hire lots of help, either. A powerful business current account with seamless accounting integrations will do a lot of the work for you. With all of this extra time on your hands, you can focus on growing your business and doing what you love.

2. Proactively take time out to rest

When you’re setting up a business, it can be easy to get swept away and work 80-hour weeks. Not only is this detrimental to your health according to a study by Occup Environ Med, it can also reduce your productivity (Stanford University and IZA). Here are some ways to mitigate this:

Try 10-minutes of meditation a day

Meditation is proven to reduce anxiety levels, particularly so in those who have the highest levels of stress. Using a meditation app like HeadSpace or Calm for as little as 10 minutes a day can help keep stress and anxiety at bay.

Aim to get 7-8 hours sleep

According to the National Sleep Foundation, changes associated with sleep loss include ‘decreased short-term memory, poor performance on newly learned or complex tasks, and difficulty maintaining attention’. Not ideal if you’re starting-up a business! Having a ‘screens-off’ rule from 9pm or making your bedroom a ‘no phone zone’ can help you wind-down in the evening and ease temptations to work late.

Block out holiday days you want to take for the year in a calendar

When running your own business it can be tempting to neglect taking time off. Hard work is important, but so are intentional breaks. Here’s some advice on holiday leave from entrepreneur Daniel Priestly from his book Entrepreneur Revolution:

“Take out a yearly planner (I like giant Sasco wall planners) and put in the holidays you want to take. Blank out the time you’ll be taking off in the coming year. Rule out the long weekends you plan on taking and the mid-week lazy days you want off” – Daniel Priestly, author Entrepreneur Revolution

Top Tip: Looking after your mental health and well being may be the best gift you can give yourself as a business owner. But that is much easier said than done. To learn more about some practical approaches to taking care of yourself, especially in your first year of business, read our guide to how to look after your mental health and combat loneliness as a startup founder ☀️

3. Prepare for a rainy day

We’ve all heard romanticised stories of people starting businesses in their garden sheds. These rags-to-riches stories are something many budding business owners aspire to create.

Most of the time, reality is a little messier than this. To get up-and-running, it’s likely you’ll need some capital to get started. Below are some recommendations on how to use your money to grow in the smartest way.

Top Tip: While you may in fact need business funding to get started, you don’t always need capital to hit the ground running. To learn more, read our guide that details 4 useful tips on starting your business with no money or capital 🙌

Have a runway fund

It’s useful to have a ‘rainy day’ pot of savings to last you at least 6 months without any income. It can take longer than you imagine to get your first customers! Ideally, you’d have this fund saved up before you quit your day job.

Saving for upcoming business expenses once you’re up and running can also help you avoid taking on debt, and you can earn interest with a business savings account.

Stay frugal

Cash flow can be tricky in year one. That’s why it’s important to think about ways you could save money when funds are low. Even the simplest things can help.

Could you work from home and cafes or choose a flexible co-working space instead of leasing an office? Could you use public transport for your business travel instead of taking Ubers? Bring in a packed lunch twice a week instead of eating out?

Of course, due to COVID-19, working remotely and from home is presently the norm, not the outlier. So, at the moment staying frugal and setting up a home office is easier than usual.

Use proven time management principles

Between meetings, planning, managing budgets and executing on your work, entrepreneurship takes a huge amount of dedication. Make these tasks easier to manage by setting up a calendar system.

Reduce distractions by batching common tasks at the same time each day. Check your email at the same times everyday, prioritise your most important tasks and create clear boundaries between your work and personal life.

Be honest with friends and family

Speaking of boundaries, it’s important to make these clear with those closest to you. Let them know that you’ll be making sacrifices to go all-in on your venture and achieve your goals. Reassure them you have contingency plans in place if you run into hurdles along the way.

For example, the day after Stephen launched Tress Clothing, his first child was born. He’s had to juggle being a father to a newborn daughter with being the father of a newly-founded business.

“Being an entrepreneur is brutal,” says Stephen. “I’d be lying if I said I was able to emotionally shut myself off, and then come home and be the most cheerful and jumpy partner and dad. I’d be lying, because that’s how much the brand means to me.” – Stephen Skeete, founder Tress Clothing

4. Get your accounting in order

Once you have your business plan in order, it’s time to focus on your numbers.

As a successful business owner, you should be able to answer questions such as:

- Will I need to buy stock/inventory?

- How much inventory should I keep?

- Will I have employees to pay?

- How long does it take to get payment from clients?

And as a new business owner, you should establish a system for organising your receipts and records on a regular basis. This will help you with taxes and in the case of potential audits.

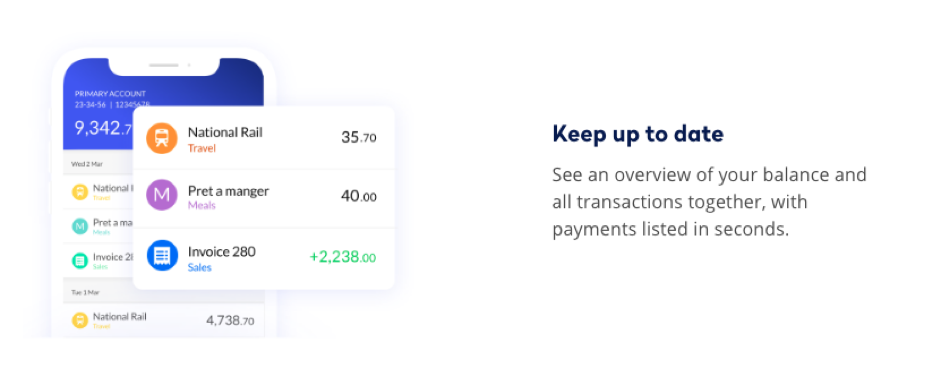

Tide allows you to add comments and photos to transactions (for example, a photo of a receipt) to help you keep track of your expenses. Moreover, Tide’s accounting integrations allow you to automatically upload transactions into your accounting software.

Make sure to keep track of your overall balance, your income and your expenses. This will allow you to minimise risks and know where you’re headed.

It will serve you well to back up your business vision with numbers, especially when it comes to your finances.

Top Tip: If you want to dive deeper, you can learn everything you need to know to organise your small business accounts in our complete guide to small business accounting 📌

Here is a quick accounting cheat sheet to get you up and running as quickly as possible:

1. Track your expenses

An expense is any amount spent or cost incurred in your efforts to generate revenue (and ultimately profitability). In other words, it’s your cost of doing business.

Business expenses (i.e money spent on the running costs of a business) can be subtracted from a company’s income before it’s subject to taxation. You should keep an eye on your subtractable business expenses in order to avoid overpaying on your taxes.

Top Tip: To learn more about the ins and outs of expenses, including which ones you can claim and how exactly to claim them, read our guide to what expenses are and how small businesses can manage them 📊

2. Set up an invoicing system

An invoice is a document sent by the provider of a service or product to the purchaser. The invoice works as a verification of the agreement between buyer and seller, establishing an obligation to pay on the part of the purchaser.

Top Tip: To learn more about what invoices are, what you need to include in them, how to create one and how to ensure it gets paid on time, read our guide to raising invoices and getting paid 💯

With Tide, you can send invoices directly from your app, anytime, anywhere. Simply create the invoice, choose your payment terms, personalise, review and send away. Then, turn on auto-matching so that when your invoices come through, they automatically get marked as paid.

3. Set up a bookkeeping or accounting system

Bookkeeping is the process of recording financial transactions whereas accounting is the process of interpreting, classifying, analysing and summarising this financial data. Bookkeeping is the first part and the foundation of accounting.

Top Tip: If you do decide you need a bit of financial help from a bookkeeper or an accountant, it’s important to find one that aligns with your business needs. To learn more, read our guides to the difference between an accountant and a bookkeeper and getting an online accountant for your small business ⚡️

5. Get your legal logistics in order

When starting a new business, things can go against the plan. Prevent any unnecessary setbacks and avoid legal headaches by getting your legal logistics in order upfront.

The following checklist will help you organise your legal responsibilities:

- Investigate the different types of business structures. Sole trader, partnership, LLP or limited company. If you’re unsure which one to go for, read our guide that outlines what the company formation types mean and the pros of cons of each in our complete guide on how to register a business in the UK.

- Investigate your rate of Corporation Tax. The rate of Corporation Tax you pay depends on how much profit your company makes. To learn more, read our guide to small business tax.

- Choose an available trading name. Check that your desired company name isn’t used by another company and that you’re allowed to take it. You can check its availability here, and for naming ideas and best practices, read our guide to finding the perfect name for your business.

- Contact HM Revenue & Customs to organise tax and National Insurance. And don’t forget PAYE if you plan to become an employer. If you meet the threshold, you also need to register for VAT.

- Organise insurance and check if you need any licenses. Especially if your business has to comply with health and safety regulations. Not too sure if you do? Find out which licenses you’ll need for your business via GOV.UK’s license finder.

When Abi Nolan first started her studio Supply Yoga, she had to adapt and learn fast:

“If it’s your business and a one-person operation, you have to motivate yourself…I had to learn everything from scratch, like accounting and legal stuff…The biggest challenge is figuring out the future. You build up to the launch of your business and then you get there and it’s like ‘okay, what happens next?’.” – Abi Nolan, founder Supply Yoga

Top Tip: Here are our top tips to avoid legal headaches in your first year in business ⚠️

6. Build your network

People do business with people they know, like and trust. The professional network that you build in your first year can open doors for you that otherwise couldn’t be opened. So go out there and start mingling!

Top Tip: Learn about what it takes to be successful at business networking efforts in our guide to 5 useful small business networking tips for entrepreneurs 🚀

Utilise LinkedIn

Use LinkedIn or other social media platforms to reach out to professionals in your industry or others who, just like you, have started their own business. The more people you connect with, the more opportunities you’ll create for yourself, and the more support you’ll have when you need it.

You can search for people by industry, location and title on LinkedIn:

Utilise offline communities

Be creative with your networking and step outside of your lane. If you’re a graphic designer and you join a graphic design meetup, you’re mostly going to be meeting other graphic designers.

While this is valuable for keeping up with industry trends, you probably wouldn’t generate new clients that way. A better business development method could be to get involved in communities where your ideal client can be found.

Meetup and Eventbrite are useful sources for finding these niche communities and events you could attend —both in person and online.

7. Don’t try to offer too many things at once

One mistake entrepreneurs make is trying to be everything to everyone.

It might seem contradictory, but you’re better off appealing to a small group of loyal customers than trying to attract everyone. Especially when you’re beginning to build your business. Nail down your offer and business processes to a core target audience.

Top Tip: To identify your target audience and competitors within your target market, you need to know where and what to look for. To learn more, read our guide to how to conduct market research for your business idea 💥

Start by setting realistic goals and milestones. Focus on achieving small incremental benchmarks rather than building a multimillion-pound empire from day one.

By trying to be everything to everybody, you’ll end up being nothing to nobody. In an attempt to please everyone, you’ll just end up watering down your business proposition, your brand and what your company stands for.

But that doesn’t mean you shouldn’t experiment and switch things up if something isn’t working.

Ismail Jeilani founded Scoodle, a platform that connects students and tutors. He discovered early on in his business journey that even small changes can make a big difference:

“We take a lean approach…Release quickly, get feedback very quickly, iterate and change. Startups aren’t just about how quickly you grow, per se, but about how quickly you learn. In our case, when we come up with something, we track it, measure it, and see if it works or not.” – Ismail Jeilani, founder of Scoodle

8. Be patient and commit to the long-game

Rapid growth can be attractive to many founders. But more often than not it results in problems down the line. By jumping to conclusions too soon, you risk overlooking important details and missing opportunities.

Impatience can also alienate the people you’re working with. And what’s an entrepreneur without a solid team behind them? Be ready to face challenges and keep your cool when things don’t go according to plan.

Deborah started her Brighton-based design and marketing consultancy, catchily named Tell Me Something Good. She has one but important advice for you to succeed:

“Your business plan will change in the first year, so don’t get too attached to it.” – Deborah Benson, founder of Tell Me Something Good

💡 Expert insights

Insights author: Suds Singh is the founder of Interesting Content, they are a specialist video production agency that only works with predominantly SME’s and B2B brands. Since being established they have worked with scores of companies including Tide! They are also one of our proud members.

What is a common mistake first-time business owners make in the first year?

Looking back at my first year of business, the most common mistake I made and have seen fellow entrepreneurs make has to be: not saying the word NO enough!

Most first time business owners will be in the learning and figuring things out mode. Everything will be shiny and new and it’s very easy to get sucked into playing the role of a “Wannapreneur”.

“The difference between successful people and really successful people is that really successful people say no to almost everything.” – Warren Buffet

There will be so many networking, speaking, marketing opportunities that you will encounter and it’s very tempting to say yes to everything but you must be careful not to spread yourself too thin and lose focus away from your main goal.

An FAQ for your first year in business

There won’t always be straightforward answers to your biggest business questions but we’ve tried to address frequently asked questions from new small business owners:

Should I take on any client that comes my way?

When starting out it can be tempting to onboard the first client that offers you money, even if they’re outside your ideal niche. However, the quicker you can do work for your ideal client type, the quicker you’ll be able to show off your results and therefore attract similar clients with similar goals.

Think early on what your ideal type of company is in terms of sector, size, and culture.

Ben and Rob founded Provius, a Leeds-based website and app design agency. You’d think that they’d be happy to onboard every client that comes their way to grow their business but the pair has decided otherwise.

“We choose companies that try to help others, not only those who pay the most…For example, we work with Calderdale Council, which is between Leeds and Manchester, helping with their work with mental health in young people. They’ve been spot-on as a client. We could have chased more lucrative clients, rather than gone down the altruistic road, but the approach has turned out well.” – Rob Gill, co-founder of Provius

How can I get a trademark?

Getting a trademark means you can take legal action against anyone who uses your brand without permission. It also means you can:

- Use the ® symbol next to your brand

- Sell and licence your brand.

The official fees for a UK registration are £200. The registration process takes around 4 months (assuming there are no objections) and trademarks last for 10 years. See more information here about applying to register a trademark.

Top Tip: To learn more about how you can secure your brand assets, read our guide to protecting your business idea and securing your intellectual property 🔐

Where can I get investment?

Your options aren’t as limited as you think. From seed funding and Angel investors, to crowdfunding and grants, make sure you’ve done your research and come up with a plan to suit your own needs. Borrow from friends and family with caution! As tempting as it may be, relationships can be strained if your business doesn’t succeed.

Top Tip: To learn more about seeking out capital investment, read our guide to 7 ways to raise capital for your startup 🧲

Wrapping up

As we’ve covered above, there are plenty of logistics and potential pitfalls to consider when starting a small business; from running out of runway cash to avoiding burnout. Being well prepared will put you in the strongest position during your first business year and beyond.

Photo by BBH Singapore, published on Unsplash