The 11 best invoicing software solutions for your small business

Invoices are the method in which you ask for payment of goods and services from your clients. They provide legal protection for both parties as they act as an official agreement between the seller and buyer and establish an obligation to pay.

But manually creating, managing and tracking multiple invoices at once can be a tedious task that eats up valuable time. We surveyed 1,000 CEOs, founders, directors and senior management staff at SMEs and found that the average UK SME is chasing five outstanding invoices at any one time which takes up 1.5 hours per day.

Moreover, 50,000 small businesses in the UK are put out of business annually due to late payments causing cash flow problems.

Luckily, invoicing software can automate these tasks for you and significantly simplify the invoicing process. Invoicing software lets you set up recurring invoices, track payments, send out automated payment reminders and turn quotes into invoices, all with the aim of saving you time and helping you get paid promptly. And it’s all cloud-based, meaning you can keep on top of your invoicing duties from anywhere, at any time.

Most importantly, invoicing software helps to eliminate errors and prevent late and missed payments that can negatively impact cash flow and cause financial headaches.

To help you take advantage of what invoicing software has to offer, we’ve gathered the 11 best solutions for small businesses. For each one, we’ve listed the pros and cons of their pricing plans and features so that you can easily compare options. At the end of the article, we’ve included some questions to ask yourself to help you make an informed decision on which software is right for you.

Quick Tip: Before diving in, it’s important that you understand the basics of what an invoice is, what’s included and legally required to be in an invoice and how to avoid common invoicing mistakes. To learn more, read our in-depth guide to how to raise an invoice and getting paid on time 💸

Table of contents

- The key features of a good invoicing software solution

- The 11 best invoicing software solutions

- How to choose the right invoicing software for your business

- Wrapping up

The key features of a good invoicing software solution

As is the case with many business software solutions, there is no one-size-fits-all product and what’s right for one person’s business may not be what’s best for yours.

There are, however, general features that your invoicing software should include regardless of your specific needs or industry.

- Customisable efficiency: A range of customisable invoice templates that can be edited to suit your brand’s look and feel and payment terms. Invoice number, date, address, descriptions, prices, shipping and handling, VAT and methods of payment should all be quick and easy to change and numbers should automatically be calculated. For example, by changing an item cost, the total amount payable should calculate in line.

- Data integration: Software should seamlessly connect with your other business technology solutions such as your CRM, banking services and accounting software.

- Automated payment reminders: Triggered email reminders for payments that are due or overdue can help to minimise late payments.

- Multiple revenue types: If you provide products or services to an international market, being able to switch currencies with the click of a button will help save time when creating multiple invoices.

- Recurring billing: If you run a subscription service or cater to regular customers, recurring billing allows you to send timely invoices every month or at specific milestones.

- Invoice consolidation: The ability to create consolidated invoices ensures customers who place multiple or sporadic purchases receive a single invoice on-demand or at certain intervals, rather than multiple invoices. This prevents customers from being inundated with invoices and reduces the risk of them being paid late or not paid at all.

- Reporting: A dashboard or control panel with details of which invoices have been sent, paid and due to be paid will help you keep on top of your financial records, allowing you to make more accurate business decisions.

- Activity Tracking: Being able to set up alerts for when invoices are opened, viewed and paid will ensure you’re always aware of an invoice’s status.

- Payment options: If your business accepts multiple payment options (e.g. bank transfer, credit card, PayPal or Stripe), invoice software that offers the required payment gateways makes it easier for clients or customers to pay.

- Mobile app: As a small business owner juggling many things at once, a lot of business is done out of pocket. Being able to create and keep track of invoices when you’re away from your desk can help save time and keep your business running smoothly.

The 11 best invoicing software solutions

Let’s examine our top 11 picks in detail.

1. Tide

Tide’s modern financial platform for small businesses is full of features alongside a smart business bank account. Included with your Tide account, you’ll get free tools such as accounting software integration, auto-categories to simplify tracking income and expenditures, manage VAT and invoicing.

The all-in-one system makes it easy for you to manage your business finance admin through either a desktop or an app on your mobile phone. When it comes to invoicing, it’s incredibly simple to create and pay invoices from anywhere, anytime. Save customer details, add multiple line items, references, due date, and even tie the invoice to a specific category to keep your accounts organised.

Pros:

- Easy to use

- Customise invoices with your logo

- Preview invoice and edit email message

- Categorise your spending and payments

- Integrates with accounting software

- Available on web, iOS and Android

Cons:

- Limited choice of invoice templates

- Need a Tide business current account to use it

Cost:

- Free for Tide members on all membership plans

- Tide membership plan prices:

- If you’re setting up a new business, you can register your limited company with Companies House for £14.99 instead of £50, when you apply with Tide. Simply head over to Tide Company Formation.

2. Xero

With over two million users, Xero is one of the most popular small business accounting software solutions around. It’s invoicing software comes as part of its overall accounting package, so you’re not paying for solely invoicing capabilities. Rather, you get an all-in-all product that lets you create and send personalised invoices, track payments and monitor the overall financial state of your business from a single dashboard.

That could be a positive or negative depending on what you’re looking for. But if you need accounting features to run alongside your invoicing needs, the customisation, automation, integration and multiple payment options, along with the ability to access invoices on the move via a dedicated app, makes Xero a solid choice.

Xero is a well-established and award-winning product and with that comes excellent security and reliability. The company’s 24/7 support is also well-reviewed by users.

Pros:

- Fully customisable invoice templates

- User-friendly dashboard

- Two-step authentication to protect invoices from unauthorised changes

- Good accounting features

- Bulk invoicing

- 24/7 customer support

- iOS and Android mobile apps

Cons:

- Comes bundled with Xero’s accounting package

- No free plan

- No standalone invoice software option

- No customer support by phone

Cost:

- Starter: £10/mo

- Standard: £24/mo

- Premium: £30/mo

- Xero offers a 30-day free trial, no credit card required.

Pro Tip: Our integration with Xero makes it easy for you to feed transactions from your Tide account to Xero every two hours. It takes less than two minutes to set up, and the automatic transaction syncing means you’ll never have to worry about reconciling transactions again.

3. Intuit QuickBooks

Intuit QuickBooks is one of the best known invoicing and accounting apps on the market and is trusted by over 4.5 million small businesses. The product is designed for small business owners and self-employed contractors and keeps everything from creating to tracking invoices simple. The software works seamlessly on desktop and mobile, syncing data across your devices and all the features we covered earlier are accessible from a well-developed user-interface.

QuickBooks is another of the full accounting packages, but it offers a good selection of pricing plans that are contract-free and can be cancelled at any time. For basic invoicing for one user, the ‘Simple Start’ plan is an affordable option. If you want to add multiple currencies, the ‘Essentials’ plan offers that, plus additional users and bills and payment management. Or if you’re looking for a full accounting package with features such as stock management and budgeting alongside invoicing, the ‘Plus’ plan covers all of your needs.

Pros:

- Designed for freelancers, contractors and small business owners

- Single dashboard for managing invoices

- Online and phone support

- Great templates with full customisation

- Auto-adjustments for exchange rate fluctuations

- iOS and Android apps

Cons:

- No free plan

- No standalone invoice software option

- User limitations on plans

Cost:

- Simple Start: £6/mo

- Essentials: £10/mo

- Plus: £15/mo

- QuickBooks offers a free 30-day trial, no credit card required

Note: These prices are for the first six months only. After six months, monthly payments increase by 50%.

Pro Tip: Our integration with QuickBooks allows you to sync transactions on demand, from up to two years ago, allowing you to get an easy-to-digest and up to date view of your finances, anytime. We built this integration via Open Banking technology, which is the fastest, most secure way to put you in control of your financial data.

4. FreeAgent

FreeAgent was crowned Small Business Accounting Software of the Year by Accounting Excellence in 2018 and is popular with freelancers and new business owners for its user experience and customer support. With FreeAgent’s invoicing software, you get a wide range of HMRC compliant templates that can be edited and sent in minutes, then tracked from a simple Invoice Timeline that uses colour-coding to indicate which invoices have been opened, paid or are overdue. Invoices can also be converted from quotes to save time when a price has previously been agreed.

As with the above software, invoicing comes as part of an overall accounting package, which may mean paying for things you don’t need. And price plans can be expensive. But if you’re looking for a single home for managing finances and sending invoices—via your phone or desktop—FreeAgent ticks all of the boxes.

Pros:

- UK-based

- Easy to use templates

- Good customisation including CSS editing

- Reporting and tracking features

- Online and phone support

- UK-based business

- iOS and Android apps

Cons:

- No free plan

- Price plans can be expensive

- No standalone invoice software option

Cost:

- Sole Trader: £9.50/mo + VAT

- Partnership: £12/mo + VAT

- Limited Company: £14.50/mo + VAT

- FreeAgent offers a 30-day free trial, no credit card required

Note: FreeAgent’s listed prices are for the first six months only. After six months, monthly payments increase by 50%.

Pro Tip: Our integration with FreeAgent allows you to set up an Open Banking feed that automatically syncs your transactions from Tide to FreeAgent. Once set up, new transactions from Tide will appear in your FreeAgent dashboard every day.

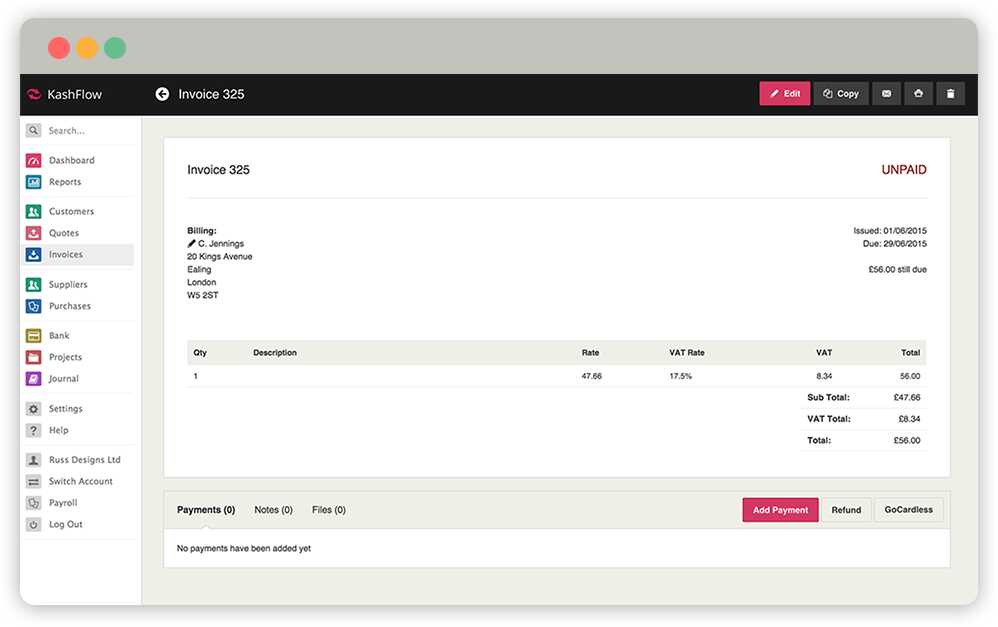

5. Kashflow

Kashflow is a multi-award winning, UK-based online accounting solution for small businesses. While its invoicing software is only one part of a wider suite of bookkeeping products, it offers everything needed to easily customise and edit invoices, set up automatic invoicing and reminders and follow up payments. All of this can be done from a single user-friendly dashboard that also includes reports, customer details and quotes that can be turned into invoices with one click.

Depending on your needs, Kashflow offers good pricing plans that can be cancelled at any time, starting with its ‘Starter’ plan aimed at sole traders, contractors and small businesses, and moving up to a ‘Business’ plan for growing businesses and limited companies, with the option to add payroll services. These plans allow the software to grow with your business.

Pros:

- Easy to use

- Good pricing plans

- Simple customisation

- Good accounting features

- Online and phone support

- iOS and Android apps

Cons:

- No free plan

- Limited invoice templates

- Fewer customisation options than some competitors

- Fewer integrations than some competitors

Cost:

- Starter: £8/mo + VAT

- Business: £16.50/mo + VAT

- Business + Payroll: £22.50/mo + VAT

- Kashflow offers a 14-day free trial, no credit card required

Pro Tip: Our integration with KashFlow takes advantage of Open Banking Feeds so that you can automatically sync transactions from Tide with KashFlow. Transactions will be pulled in daily so you are always up-to-date with your income and expenditures.

6. Crunch

Crunch is an online accounting service that supports freelancers, contractors, and practically anyone who’s self-employed. They combine bespoke online accounting software with award-winning client support and expert accountants.

Crunch offers free bookkeeping software – known, appropriately, as Crunch Free – that you can use to securely send invoices and record expenses, and it can even be securely linked to your bank account (such as Tide!). They also offer a suite of paid packages that include all your tax filings and unlimited support from a team of client managers and expert accountants.

Pros

- Simple, secure online accounting software

- Award-winning team of Chartered Certified Accountants and client managers

- Real-time view of company profits and taxes owed

- HMRC and Companies House taken care of for you

- Self Assessment submission support

- Expert IR35 advice, tools and solutions

- Open Banking feeds to easily import bank transactions

- Secure and easy-to-use on any device

Cons

- No free plan has customer support by phone

- No standalone invoice software option

Pricing

Crunch Free: Completely free!

Crunch Pro (Sole trader): From £24.50+VAT per month

Crunch Pro (Limited company): £71.50+VAT per month

Crunch Premium: £109.50+VAT per month

Pro Tip: It is super fast and easy to use Tide’s accounting integration with Crunch. Using Open Banking technology, all transactions made in your Tide app can be automatically and securely imported into your Crunch software, ready for you or your Crunch team to view and manage.

7. FreshBooks

FreshBooks is marketed towards freelancers and small business owners for its seamless user experience (UX) that makes it incredibly easy to send invoices which helps you get paid faster so you have more time to focus on running your business. While FreshBooks also provides time-tracking and expense-tracking features, invoicing is at the heart of what the company does. A few notable features are their customisable templates and a good range of automation options for reminders, recurring payments, credit card charging and more.

Over 24 million people have had over $60 billion in invoices paid through FreshBooks, saving 192 hours a year, according to the company’s data. It scores highly with its customers for its value for money, features, ease of use and customer support and 97% of users say they would recommend it to a friend or colleague.

Pros:

- Developed for small business owners

- Good range of price plans

- Beginner-friendly

- Phone and email support

- Real-time invoice status updates

- Additional tools for measuring project deliverables and taking care of project management

- iOS and Android apps

Cons:

- No free plan

- Fewer customisation options than some competitors

Cost:

- Lite: £11.00/mo

- Plus: £19.00/mo

- Premium: £38.00/mo

- FreshBooks offers a 30-day free trial, no credit card required

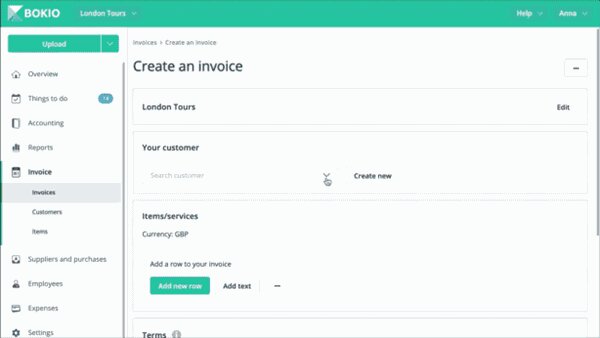

8. Bokio

Founded in 2015, Swedish company Bokio is a relatively new kid on the block. But while it’s perhaps not as well known as QuickBooks or FreshBooks, it’s a more than worthy competitor.

Like Wave, Bokio’s biggest benefit is the fact that it’s free. But free doesn’t mean you have to miss out on any much-needed features. Customisable templates, invoice tracking, automated reminders and multiple currencies are all there. And usability is simple—the app and online platform are minimalistic and very user friendly—true to popular Swedish design principles.

You also get to benefit from machine learning, with an automated invoice system that can capture transactions, automatically recognise dates and amounts and detect whether important information has been missed.

How is all of this free? Bokio makes money by charging for additional accounting partner services that include account management and access to a personal adviser.

Pros:

- Free invoicing software

- Aimed at freelancers, sole traders and small business owners

- User-friendly app and online platform

- Automated ‘smart templates’ save time and prevent mistakes

- Simple invoice management and tracking

- Integrated bookkeeping software

- iOS and Android apps

Cons:

- Premium help comes at a cost (accounting partnerships start at £25/mo)

- No phone support

Cost:

- Free

9. Zoho Invoice

Zoho offers a range of online productivity tools for small businesses of which invoicing software is one. Unlike other products in this list that include invoicing as part of an overall package, Zoho offers Zoho Invoice as a standalone solution.

Zoho Invoice lets you quickly create and send professional invoices, automate recurring invoices and accept online payments. You can also generate estimates and convert them to invoices and track time to bill clients for unpaid hours.

Although limited, Zoho provides integration options for payment gateways, CRMs, documents and G-Suite. And like other apps in the suite, the software offers a free price plan (limited to five customers).

Zoho Invoice was crowned Expert’s Choice and awarded Great User Experience in 2019 by FinancesOnline. It’s also been rated as Editors’ Choice by PCMag.

Pros:

- Reliable software from a respected company

- Good pricing options, including a free plan

- Fully customisable templates

- Email and phone support

- Client portal for communicating with clients outside of email

- Accept online payments

- iOS and Android apps

Cons:

- No reporting feature

- Mobile version has fewer features than the desktop version

- Not as many integrations as some competitors

Cost:

- Free (for up to five customers)

- Basic: € 9/mo

- Standard: € 19/mo

- Professional: € 29/mo

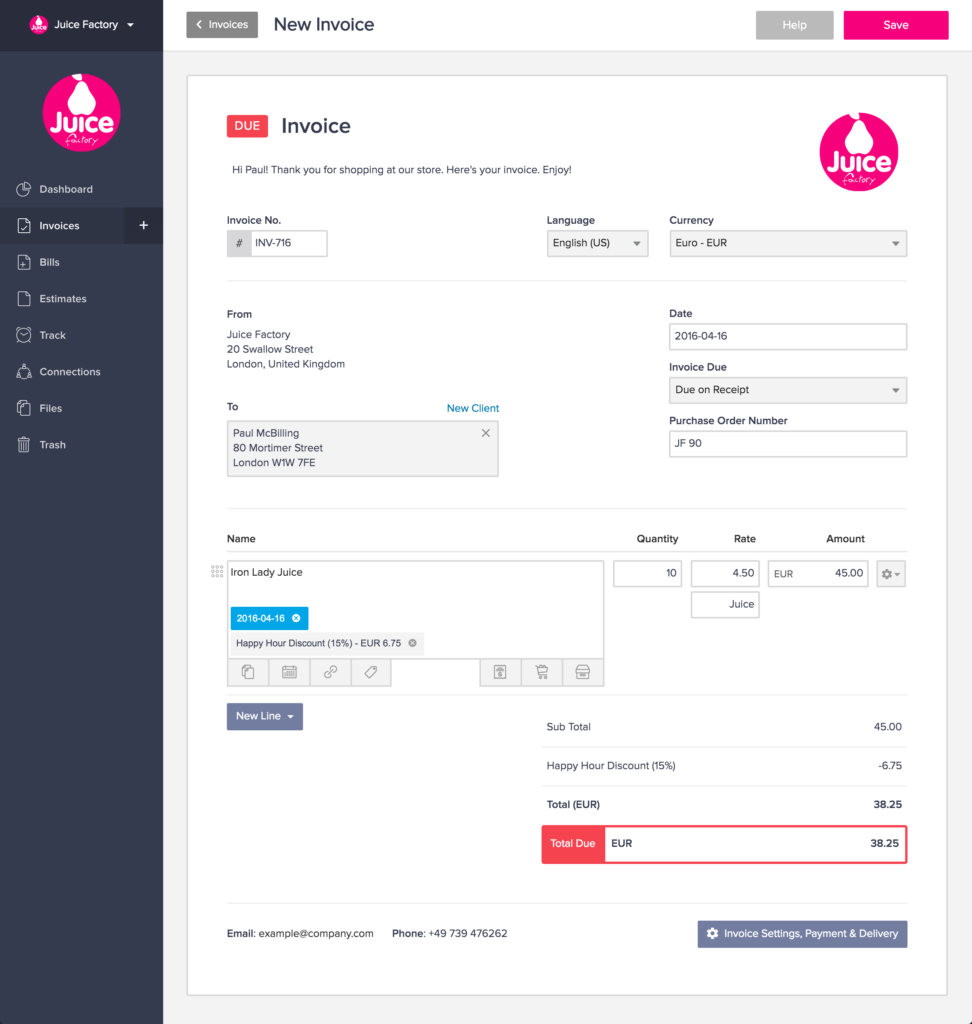

10. Invoice Ninja

Invoice Ninja is an open-source invoicing software solution, supported by a growing community of developers around the world. What this means is that the product is always evolving and improving to meet the needs of its 120,000+ customers.

The range of features packed into Invoice Ninja is vast, including everything you need for invoicing and automated billing, online payments, quotes and proposals, streamlining workflows, tracking work time and managing expenses.

What’s even more impressive is that these features are all included in the ‘Forever Free’ plan, which lets you send unlimited invoices to up to 100 clients. This option is well suited to new and small businesses, but if you want to stick with Invoice Ninja as you grow, both the ‘Ninja Pro’ and ‘Enterprise’ plan offer unlimited clients and additional features such as multiple custom invoice designs, custom URL and a branded client-side portal.

Invoice Ninja was awarded ‘Great User Experience’ and ‘Rising Star’ by FinancesOnline in 2018 and ranked as ‘Top 3 Most Worthy Software in Billing and Invoicing’ by Saasworthy in 2019.

Pros:

- Free invoicing software

- User-friendly app and online platform

- Wide range of customisation and integration options

- Client-side invoice and payment history portal

- Invoice alerts for sent, viewed and paid invoices

- iOS and Android apps

Cons:

- Invoices are watermarked with Invoice Ninja logo in the free version

- No phone support

Cost:

- Forever Free (for up to 100 clients)

- Ninja Pro Plan: $10/mo

- Enterprise Plan, from $14/mo

11. Invoicely

Unlike other apps in this list that provide invoicing software as part of their wider accounting package, Invoicely (formerly known as Invoiceable) does things the other way around, offering accounting tools as part of its invoicing product.

Invoicely aims to bring free cloud invoicing to as many people around the world as possible and is currently trusted by over 100,000 small businesses. The tool lets you create and send professional and elegant looking estimates and invoices in any language or currency in seconds, receive online payments, track time and expenses and keep on top of your finances from a single user-friendly dashboard. All for free.

Better still, there are no limits on how many invoices you can send or how many clients you can add. You can also use an unlimited number of businesses in tandem on their platform. For example, if you have one registered company but two trading names, you can send and track invoices from each trading name from your Invoicely account.

But the free plan isn’t without limitations in other areas. If you want to add team members, accept online payments from a payment gateway other than PayPal or set up recurring invoices, you’ll need to upgrade to the ‘Basic’, ‘Professional’ or ‘Enterprise’ plan.

Pros:

- User-friendly design

- Generous free plan

- Let’s you add multiple businesses to a single account

- Real-time reporting

- iOS and Android apps

Cons:

- No custom branding in the free plan

- Fewer customisation options than some competitors

- Email-only support

Cost:

- Free

- Basic Plan: $9.99/mo

- Professional Plan: $19.99/mo

- Enterprise Plan: $29.99/mo

How to choose the right invoicing software for your business

The above list of invoicing software includes options that are suitable for all types of small business, no matter where you are in your business growth journey.

That said, it’s up to you to pick the one that best aligns with your business needs, goals and budget.

Here are some questions to ask yourself in order to figure out what software is best for both right now and in the months and years to come.

What type of invoicing software do you need?

- Do you want a simple solution that lets you quickly create and send invoices without unnecessary bells or whistles, or do you want a set up that also lets you track time, manage expenses and monitor the cash flow of your business?

- Who’s going to be taking care of invoices? If you want to add additional team members, you’ll need software that lets you add users and control usage rights whilst syncing information so that everyone is kept in the loop.

- Can you add your other tools? Integrating other software such as banking apps and CRM platforms helps bring all of your important financial and customer information together, saving you time and helping to keep business running smoothly. All of the software we’ve mentioned offers integration and if you’re a Tide member, most of the tools work seamlessly with our platform. But not every solution will integrate with every tool, so it’s important to check, especially if you’re signing up to a paid plan.

What are your goals for your invoicing software?

- Can your invoicing software grow with your business? While none of the invoicing software we’ve featured ties you down to a contract, you could do without the hassle of signing up to a platform only to find that it can’t scale with your business. For example, while a platform like Bokio works well for small businesses, if you plan to grow your company and employ a finance team, a platform like Invoice Ninja, which offers enterprise plans for up to 20 users may be a better solution.

What is your invoicing software budget?

- How much can you afford to spend on invoicing software? If you’re just starting out in business, free software is a great way to streamline the invoicing process without the financial commitment. However, some plans come with restrictions. Other solutions offer attractive signup deals that increase after the introductory period. Will your business be in a position to afford the increase?

Keep these things in mind when weighing up your options. Come up with a shortlist of software solutions from the ones we’ve highlighted and take a close look at their features, plans and whether they match your business objectives. Take advantage of free trials too. They’re designed to let you thoroughly test out a platform before committing and are the best way to find out whether the software is right for you.

Wrapping up

Invoicing software helps to save you time, avoid mistakes and prevent late and missed payments, making it an essential tool for every business, regardless of size or sector. The software we’ve featured in this list has been chosen specifically to benefit small businesses, providing you with the key features you need to streamline the invoicing process.

Weigh up the pros and cons, visit websites and compare the costs and features of software that meets your needs, goals and budget to find the tool that improves your business.

If you’re a small business owner, Tide is a great solution for invoicing. Our platform is designed to make your life easier and save you time and money. You can open a business current account and register your business, all in one go. Then, take advantage of our powerful features like invoicing and accounting integrations so that you can focus on doing what you love—running your business. Sign up today and start your journey to better business financial health.

Photo by Yan, published on Pexels