What allowable expenses can limited companies claim?

Every year, £962m in expenses are left unclaimed from HMRC.

What’s more, according to research by Barclaycard, as many as 60% of people don’t claim expenses properly or at all.

This is all money that can be saved and reinvested into your limited company to help you improve your cash flow and grow your business.

So that you don’t miss out on claiming what you’re entitled to, this guide covers what allowable expenses are, what you’re entitled to as a limited company and how to make a claim.

Table of contents

- What are allowable expenses?

- 10 expenses your limited company can claim

- 1. Staff expenses

- 2. Pension contributions

- 3. Office and equipment expenses

- 4. Business travel expenses

- 5. Professional fees, products and services

- 6. Marketing, advertising and PR

- 7. Professional development

- 8. Eye tests and glasses expenses

- 9. Charitable donations

- 10. Pre-trading costs

- How to claim allowable expenses as a limited company

- How to keep track of limited company expenses

- Wrapping up

What are allowable expenses?

Allowable expenses are business expenses that can be deducted from your income to reduce the amount of Corporation Tax you pay.

For example, if your revenue is £40,000 and your allowable expenses are £5,000, you’ll only be taxed on £35,000.

For an expense to be eligible for tax relief, it must be on HMRC’s approved list (more on what’s on that list soon) and it must be an expense incurred wholly and exclusively in the day to day running of your business.

This means you won’t be able to claim for personal expenses. That said, you may have expenses that you use dually for personal and business purposes. In that scenario, you’ll only be able to claim for the business costs.

For example, if you took a four-day business trip and extended that trip by three days to enjoy some leisure time, you’ll only be able to list the four business days on your tax return.

Any allowable expense claim you make will also need to be backed up with records of invoices, receipts and purchase orders. This means that keeping accurate expense records is absolutely essential, which is why we’ll outline the best practices to maintain these records in a later section in this article.

Top Tip: If you’re a sole trader or work in a partnership, you can find out which purchases you can claim on your tax return in our guide to reimbursable expenses and how to claim them 🔑.

10 business expenses your limited company can claim

Let’s take a look at what HMRC says you can claim as a limited company.

1. Staff expenses

Employees are one of, if not the main, ongoing cost for many companies. The good news is that because staff are a business expense, the costs associated with employment are deductible from your profits.

As an employer, you’re able to claim for the following staff expenses.

Wages and salaries

This includes National Insurance Contributions (NICs) and Pay as you Earn (PAYE) tax that you pay to HMRC.

It also includes your own salary and NICs as an employee of your company. But if your salary exceeds the relevant NI threshold, you’ll need to pay NICs.

Top Tip: Getting payroll right can save your business valuable time and money. Learn more about what payroll is, what HMRC expects from you and how to correctly pay your employees in our guide to payroll for small businesses 💷.

Benefits in kind

Gifts and trivial benefits that you give to employees can be claimed as allowable expenses without notifying HMRC if they:

- Aren’t a reward for performance

- Aren’t included in the terms of a contract

- Cost £50 or less

- Aren’t provided as cash or a cash voucher

If you provide financial support towards medical insurance for employees, this also qualifies as a benefit in kind and can be claimed as an expense.

However, you will need to pay NICs at 13.8% (2020/2021 tax year) and your employee will pay personal tax.

Annual medical check-ups and medical insurance for employees who work abroad are also exempt from tax and National Insurance and can be added to your tax return.

Annual events

If you hold a yearly celebration such as Christmas party for your staff you can claim £150 (including VAT) per guest.

So if your employee brings a guest, you’ll have a budget of £300.

£150 per guest is a yearly budget so you’re able to claim for more than one staff event as long as your costs stay within that budget.

The main thing to remember with social functions and parties is that your event must be to entertain staff, meaning most of the guests must be employees and their plus-ones. You cannot claim business entertainment costs for entertaining clients or potential clients.

Childcare costs

Generally speaking, childcare is not an allowable business expense. However, as an employee of your own company, you can claim tax relief through your salary via the Tax-Free Childcare Scheme.

Under the scheme, the government will pay £2 for every £8 you pay to a registered childcare provider up to a threshold of £2,000 a year per child.

You can find out more on the tax-free childcare scheme on the GOV.UK website.

2. Pension contributions

If you have a contract with a pension provider you can claim 100% tax relief on contributions as an allowable expense up to a set limit. For the 2020/2021 tax year, the annual allowance is £40,000.

Because of the complex nature of pension schemes, it’s recommended that you seek advice from an independent financial advisor before making any contributions.

You can find a trusted expert by using one of the impartial workplace pension services recommended by GOV.UK.

Top Tip: As an employer employing staff, it is your legal duty to enrol your staff into a workplace pension scheme. To learn more about pension plans and your responsibility as an employer, specifically the two main types of private workplace pensions you can choose from, the automatic enrolment rules you need to pay attention to and the different categories of workers that are eligible for automatic enrolment, read our detailed guide to everything you need to know about workplace pension schemes 📌.

3. Office and equipment expenses

Office and equipment expenses are divided into four categories:

General office expenses

Basic office costs such as stationery, postage, printing costs and other ongoing office supplies, as well as equipment such as uniforms, tools, computers, software and office furniture can all be claimed as business expenses.

Communications

Communications covers mobile phone, landline and broadband costs, but what you can claim as an expense depends on how you use them.

If your mobile or landline contract is set up in your company name and your phone is used solely for business purposes, you can claim for 100% of the bill. If the phone has dual business and personal use, however, you’ll only be able to claim for the costs incurred for business purposes.

For example, if your mobile phone bill is £50 a month and you use your phone for business calls 50% of the time, you’ll be able to claim for half the bill, £25 a month.

It’s a similar case with broadband. If your contract is in your company name, you can deduct the total cost of the bill as a business expense, providing private use is deemed insignificant (e.g. a few days rather than a few weeks over the tax year as a whole).

If your broadband has a dual purpose, you’ll need to cover your personal use with a benefit in kind payment on the amount paid for by the company.

If you have a personal broadband plan, you can claim expenses on business use by demonstrating what percentage of the bill is for business purposes.

Building costs

Buildings costs that you can claim include:

- Rent for business premises

- Business and water rates

- Utility bills

- Property insurance

- Security

- Using your home as an office (only the part that’s used for business)

If you work from home, as many have this year in response to the COVID-19 pandemic, you can claim a flat rate of £4 per week tax-free without the need to keep receipts.

But to reclaim the full costs of running a business at home such as heating and lighting you’ll need to work out a proportion of the costs by dividing the number of rooms in your home by the amount of time you spend working there.

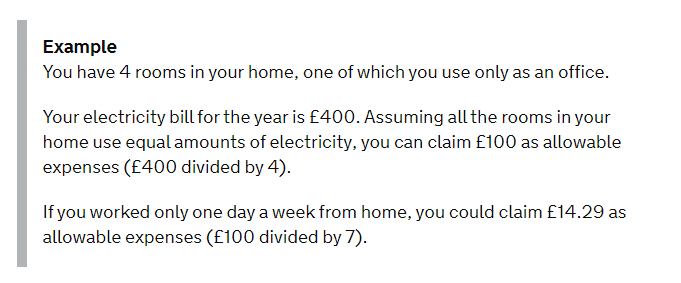

Here’s an example from GOV.UK on how you might calculate this:

You may also be able to claim reasonable costs for furnishing your home office if you can show that your purchases are solely for business use.

It’s also possible as a limited company to rent workspace in your home to your limited company and claim it as an expense in the same way you would rent office space in commercial premises.

But doing this does require you to meet strict criteria:

- You must own your home

- Any amount over £208 per annum must be classified as a rental expense

- You must have a rental agreement in place that states that the space is intended for office use only at specific times of the day and no other parts of the house are used

As the rules on rental agreements can be complicated, it’s recommended that you seek advice from an accountant.

Top Tip: An accountant can be a priceless consultant when it comes to making critical financial business decisions. They are also experts at the ins and outs of taxes and can provide assistance when it comes to managing and filing your taxes throughout the year. If you don’t have an accountant and are unsure about what to look for, read our guide to how to get an online accountant for your small business.

Repairs and maintenance

Costs for general repairs and maintenance of your equipment and business premises can be claimed as expenses.

Other expenses such as water heating systems and integral parts of the building can’t be listed as allowable expenses but can be claimed as capital allowances using your Annual Investment Allowance.

Top Tip: Annual Investment Allowance is one of many tax reliefs you can benefit from as a limited company. Find out what other tax breaks are available to you in our guide to tax breaks for small businesses.

4. Business travel expenses

HMRC lets you claim travel costs on trips that are necessary for work and where you are present at the destination for business purposes. This includes:

- Travel between workplaces

- Travel to visit clients

- Travel to a temporary workplace

- Travel to complete work (e.g. making a delivery or providing a service)

If you use your own vehicle for these trips and pay for your own fuel, you claim the following business mileage rates:

| From tax year 2011 to 2012 onwards | First 10,000 business miles in the tax year | Each business mile over 10,000 in the tax year |

|---|---|---|

| Cars and vans | 45p | 25p |

| Motor cycles | 24p | 24p |

| Bicycles | 20p | 20p |

In addition to mileage, you can also claim related expenses including:

- Parking costs

- Toll costs and congestion charges

- Vehicle insurance

- Repairs and services

- Transport fares for flights, train tickets and bus and taxi fares

- Accommodation costs

- Food and drink on overnight trips

You can’t claim for:

- Fines

- Mileage for a daily commute to and from the same place of work

Top Tip: If you’re sending employees on work trips, keeping track of their expenses is a key factor in your ability to accurately claim business travel expenses. To learn more, read our guide on how to manage employee expenses 💯.

5. Professional fees, products and services

Professional fees and expenses are divided into three categories.

Business Insurance

The costs of insurance policies that you need to run your business can be claimed as allowable expenses. Depending on what type of company you run, this might include:

- Professional indemnity insurance

- Public liability insurance

- Employer liability insurance

- Business contents insurance

- Business property coverage

- Business interruption insurance

Legal and financial services

You can claim for the costs of fees to legal and financial services that you use for your business, such as accountants, solicitors, surveyors and architects, as long as their services are strictly business-related.

You can’t claim expenses on:

- The legal costs of buying property or machinery (these will need to be claimed as capital allowances)

- Fees for services related to you breaking the law in any way

Financial costs

To help make budget management and cash flow forecasting a little easier, you can claim the following financial charges:

- Bank charges (including overdraft charges)

- Credit card charges

- Interest on bank and business loans

- Interest on hire purchase

- Leasing payments

- Alternative finance payments

Bad debts can also be listed as an allowable expense if the value of the transaction is included in your annual turnover and you’re sure that the debt will never be recovered.

6. Marketing, advertising and PR

To establish your company and make it a success, marketing, advertising and PR are essential investments. Allowable expenses for promoting your brand include both one-off and ongoing costs as long as the service is exclusively for business.

Here are some examples of expenses you can claim:

- Website costs for designing, developing, registering and hosting your site

- Advertising costs for online, print and media ads

- Direct mail costs for designing, writing, printing and posting letters or brochures

- Costs for the creation and distribution of press releases and media kits

7. Professional development

Professional development expenses can be claimed for purchases you make that help you improve your skills or knowledge. There are two categories here:

Training courses

Any class or training course that you take to enhance the skills and knowledge that you use in your business falls under the category of personal development and the full cost can be claimed as an allowable expense.

However, the course or class must be related to your trading activity and not used as a way to offer a different service or expand into a new market.

Professional subscriptions

Subscriptions to professional organisations, trade publications or journals that benefit your business can be claimed so long as they are directly relevant to your industry and work.

In the case of professional organisations, these must be included in HMRC’s list of approved professional bodies.

You can check to see if you can claim tax relief on your membership fees and subscriptions on the GOV.UK website.

8. Eye tests and glasses expenses

If your work requires you to regularly use a computer monitor or screen you can list eye tests as a tax deductible expense.

If the results of your test require you to wear glasses or contact lenses whilst using a monitor or screen, you’ll also be able to claim tax relief on the cost of your prescription. However, the prescription must be for screen-based work and not general wear.

9. Charitable donations

While charitable donations aren’t strictly an allowable business expense, you can claim tax relief by deducting the value of donations from your taxable profits.

You’ll lower your Corporation Tax bill if you gift any of the following to a registered charity:

- Money

- Equipment or trading stock (items that you make or sell)

- Land, property or shares in another company (shares in your own company don’t qualify)

- Employees (on secondment)

- Sponsorship payments

Find out more on tax when your company gives to charity on the GOV.UK website.

10. Pre-trading costs

While allowable expenses are designed to help you manage the ongoing financial burden of running a company, it’s also possible to recoup some of the costs incurred before incorporating your company.

Start-up costs such as stock, assets, goods and professional services can be claimed from up to seven years before your company was formed so long as they are legitimate costs directly related to your current business.

Top Tip: Wondering how much the average UK startup spends in their first year in business? Find out the answer, as well as how to figure out how much cash you’ll need to get started and how to calculate your own costs in our post on how much it costs to start a business.

How to claim business expenses as a limited company

As a limited company director you can claim allowable expenses in one of two ways:

1. By paying for expenses directly from your business bank account

2. By paying for expenses personally and claiming them back as a reimbursed expense

For the second option, you will need to add the purchase into your account as a business expense. This will then be added to your director’s loan account as money you’ve put into the company. Using this method, expenses can be reimbursed at any time as a director’s withdrawal.

Whichever method you choose, it’s vital that you keep precise records of all expenses for yourself and your employees.

How to keep track of limited company expenses

For your claim to be accepted by HMRC and to receive the full amount of tax relief you’re owed, it’s important to meticulously record every business expense.

We’ve gone into depth on how best to do this in our post on how to keep track of expenses, but here’s an overview of four ways you can track expenses.

1. Open a dedicated business account

Business accounts allow you to separate your business expenses from personal expenses. This makes it easier to track the money going out of your company and makes your company look more professional and credible.

A business current account with Tide gives you access to powerful features that allow you to consolidate your business finance admin in one app. Schedule payments, manage limits, categorise your income and expenditures, integrate with your favourite accounting software, send invoices and more when you open a business bank account that works for you.

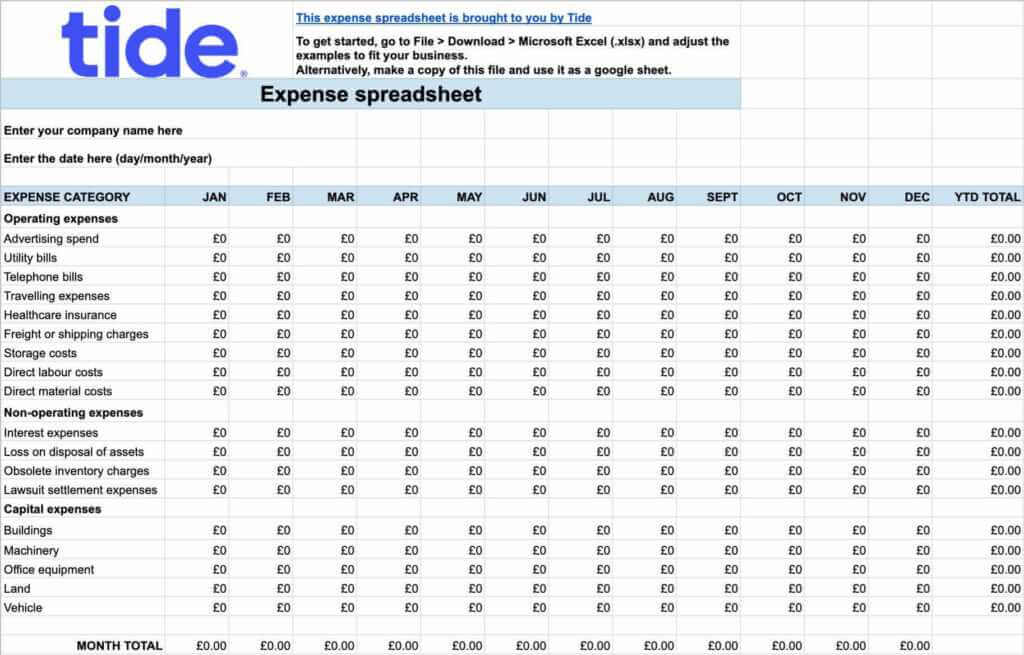

2. Create an expense spreadsheet

You can use a tool like Microsoft Excel or Google Sheets to record spending by expense category throughout the year.

To make things easier for you, we’ve created a free expense spreadsheet that you can get started with today.

3. Maintain a backup of your expenses

Having copies of receipts is important to avoid falling foul of HMRC. While it’s not necessary to show receipts when filing your tax return, you are required to keep records for six years after filing. HMRC can decide to investigate your business at any point during this period. If you’re unable to show expense records, you may be hit with a fine.

You can backup expenses by keeping physical duplicate copies of receipts or digital copies on an external hard-drive or cloud storage systems such as Google Drive, Dropbox or OneDrive.

4. Invest in accounting software

Manual entries take up valuable time that accounting software gives back to you. Most accounting software automatically records transactions in real-time, which helps you to keep a pulse on your business finances anywhere, anytime.

Tools like Tide’s mobile expenses tracker integrate seamlessly with leading accounting software such as Xero, Sage, FreeAgent, Kashflow and Intuit QuickBooks to save you time and eliminate human error.

If you have employees that claim expenses, you should track their expenses with the same precision as you track your own. Make sure you have policies in place that detail how much employees can spend, when and what on.

Top Tip: A well-defined company policy will help you get ahead of any questions your employees may have about the expenses process. For example, will you provide employees with a company card, petty cash, or ask them to spend their own money and submit a request for reimbursement? Is there a limit on how much they can spend on a flight or hotel room? To learn about what you should include in your company expense policy and how to write an effective one, read our guide to how to create a company expense policy ✅.

Wrapping up

Claiming allowable expenses benefits both the short-term and long-term future of your company.

In the short-term, you reduce your Corporation Tax liability and save money. In the long-term, you can account for these savings in your cash flow forecasts and invest the money in growing your company.

To take advantage of the allowable expenses we’ve talked about in this guide, remember:

- Expenses must be wholly and exclusively for business purposes.

- You must maintain accurate records of expenses to justify your claims if they’re queried by HMRC.

If you’re a new company, consider tracking and managing your expenses with Tide’s company expense cards. Our desktop and mobile apps are designed to help auto-categorise outgoings so you can easily see what counts as an expense spend. You can also upload bulk receipts so that they’re stored safely and send reports to your accounting software to save time when filing your tax returns. Open a free business bank account today to get started.

Photo by Austin Distel, published on Unsplash