How to conduct market research for your business idea

What is market research?

Demand: Is there a desire or need for your product or service? If so, what problem or pain points does your offering solve and how can you better align it to suit this demand? Market saturation: How many similar options are already available to consumers? Further, what are those businesses who are already in the space doing well and where are they missing opportunities? What can you do differently to fill in these gaps? Market size: How many people would be interested in your value proposition? This will help you to forecast your startup budget or, for businesses that are post-launch, this new product or service budget. From there, you can also predict revenue and profitability. Economic indicators: What’s the income range and employment rate of your target audience? This is the first step in customer research and it will help you to create detailed customer personas (more on these later on). Location: Where do your customers live and hang out, both geographically and online, and where and how can your business reach them? Pricing: What do potential customers pay to your competitors? This will help you to figure out exactly how to price your products or services so that you can stay competitive and achieve profitable markups.

Why is market research valuable?

Types of market research

Qualitative research | Quantitative research |

|---|---|

Words | Numbers |

Identify | Measure |

Explore | Analyse |

Understand | Validate |

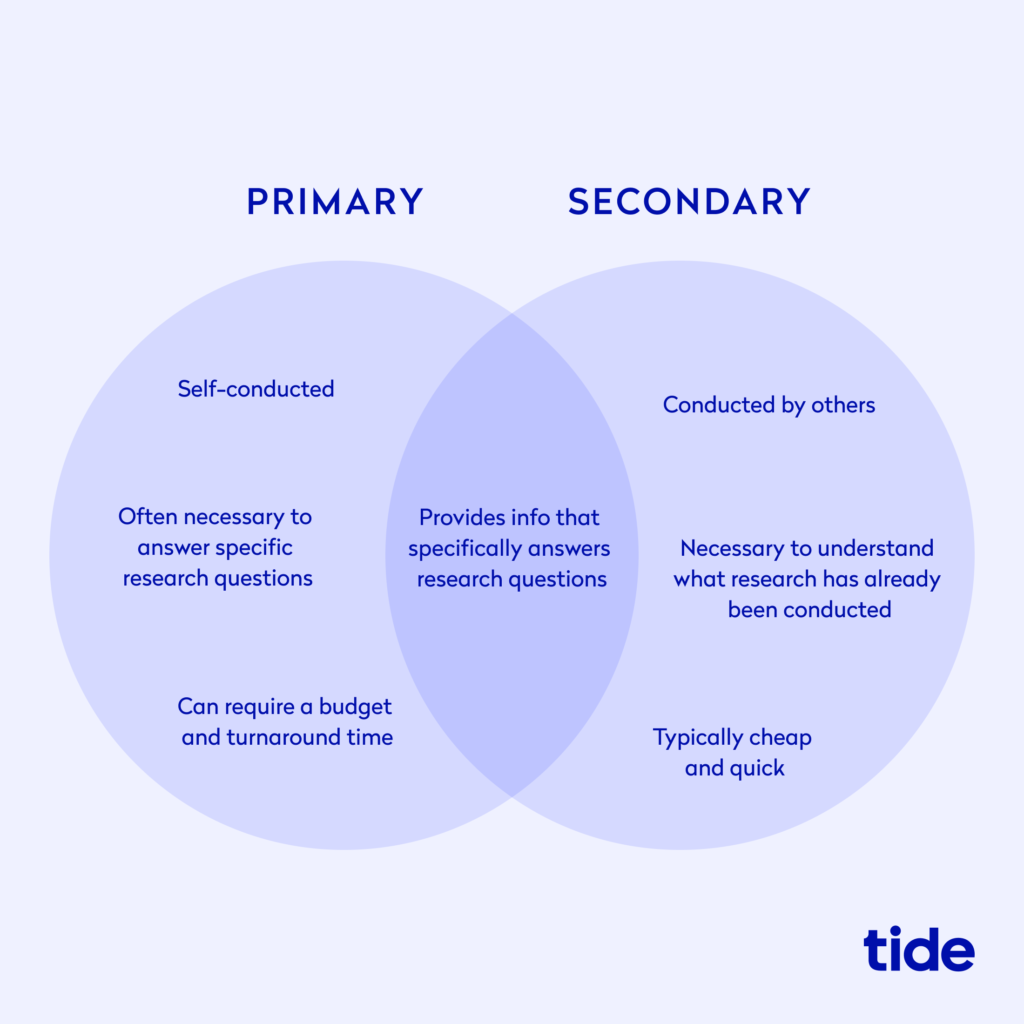

Secondary Research

Public Sources: These include government statistics, academic databases, news sources, published books, published studies, and so on. Publicly sourced information is often free and you can find it online or in libraries. Such sources in the UK include the Office for National Statistics , the British Chambers of Commerce and the Federation of Small Businesses and more. Commercial Sources: These sources are often in the form of statistics from private-groups that you have to pay money to gain access to. Such companies include Forrester , Gartner , International Data Corporation (IDC) , Everest Group , Mintel , Euromonitor , YouGov and more. You can also use online sources (both free and paid) that analyse online behaviour and trends like Google Trends , Product Hunt , Social Mention and SimilarWeb .

Primary Research

Exploratory research: This involves talking directly with people. You should have an initial sense of your target audience from your secondary research, so this is the first time you’ll be communicating directly with them. Start with broad, open-ended interviews in an attempt to narrow down this group into a more niche audience. Specific Research: Once you’ve generated this smaller, more niche group, use the same methods that you applied to your exploratory research. But this time, ask more specific questions to get more valuable and intent-driven answers. Internal Sources: If you’ve already launched your business and are conducting market research to see if the industry has changed since launch, collaborate in-house to see what your existing customers are saying. What were their challenges and pain points at launch and how have they changed? What are your customer’s biggest needs now? What do they say you can be doing better? The idea is to learn from and improve upon your original research by combining historical with updated customer-driven insights.

How to conduct market research

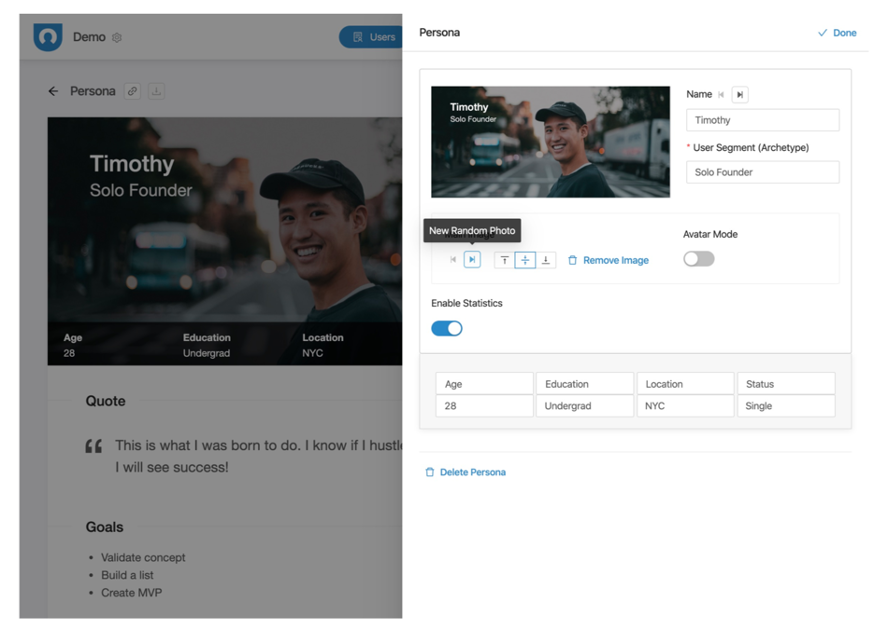

1. Define your buyer persona

Who are your customers and why are they interested in buying your product or service? What characteristics, interests, desires, pain points and needs do they share? Where do they live? How old are they? What is their education level? What is their income range? Which types of websites do they frequently visit? Where do they currently buy similar products? Which languages do they speak? What industry do they work in?

2. Engage with a small target sample

Surveys: Use online surveys to ask a group of people a set of questions. Often, an online survey is delivered via email, but it can also be posted on social media platforms or online forums. Surveys are easy and cheap to conduct, the results come in quickly and the data is straightforward to analyse. You can use platforms like Survey Monkey , JotForm , Google Forms , LimeSurvey and more. Emails: Send a cold email asking if they will be open to answering some of your questions. You can attach your survey to this email and/or use it as a platform to schedule a more in-depth phone interview. Phone calls: Phone interviews allow you to speak directly with your potential customers. Use their answers to formulate your follow up questions to dive deeper into intent and expose insightful trends. Face-to-face: This will be exactly the same as the phone interview, but one-on-one in person. In-person or interviews via video conferencing can be more valuable than phone calls as they give you the opportunity to see body language. Sometimes, you can learn more about what a person is feeling based on their body language rather than their words. Observation is key in face-to-face meetings. Focus groups: Focus groups bring together a group of selected participants to answer questions in real-time. Usually, a trained moderator will lead the discussion and ask questions about your product or service, user experience, user expectations, competitor products or services, marketing and branding messaging and more. Call for participants via social media: Post on social media platforms to generate interest about participating in any of the above methods. Make sure you are posting your questions in the places that your target audience hangs out online, such as LinkedIn , Facebook groups, X , Reddit , and so on, so that you attract people that align with your unique customer personas. Leverage your network to get participants: Apply the same methodology as your social media call for participants when leveraging your own network. Reach out to friends, former coworkers, family members and more to see who among them fits into your customer persona and is willing to participate.

3. Identify competitors

Industry competitors: Industry competitors are those that saturate your target marketplace. For example, if you are selling a SaaS video conferencing tool, your competitors will be businesses like Zoom or GoToMeeting. Content competitors: Content competitors may not be competing in terms of the products or services they sell, but they are competing in terms of content creation. For example, if you run a leadership training business, a content competitor will be a business that creates content about how to be a great leader. This content competitor could run a finance business, a retreat business, a SaaS business or so on, but because they create content that targets similar keywords, they are a competitor in that specific space.

4. Analyse data

Sort your data into groups to better understand the big picture Create several distinct customer personas if you learn that you have more than one audience type Build a matrix chart to see how often pain points, desires, needs and attributes overlap Generate a customer journey map to outline the journey from awareness to purchase, using free or paid tools like LucidChart , HubSpot or Visual Paradigm .

Customer Journey: Buyer’s Journey | Awareness Stage | Consideration Stage | Decision Stage |

|---|---|---|---|

What is the customer thinking or feeling? | |||

What is the customer’s action? | |||

What or where is the buyer researching? | |||

How will we move the buyer along his or her journey with us in mind? |

5. Summarise findings

5 common market research questions

1. What do you look for in a brand?

2. What are the reasons or actions that drive you to make a purchase?

Do you prefer testing products with free trials, or are explainer videos sufficient to pique your interest? Do you prefer when a company is active on social media or do you not care so much? How much does a business’s customer service response influence your brand loyalty?