What is a proforma invoice? How and when to use one for smoother transactions

There are some situations where a business might want to send an invoice as a projection of costs involved in the upcoming sales agreement.

This is where a proforma invoice comes in. Proforma invoices are a representation of future transactions and therefore do not represent an official receipt.

In this article, we’ll help you understand what a proforma invoice is, when to use it and how to create one for your own business.

Table of contents

- What is a proforma invoice?

- When to use a proforma invoice

- What is the difference between a proforma invoice and a commercial invoice?

- Step-by-step: How to create a proforma invoice

- Streamline your sales process

What is a proforma invoice?

A proforma invoice is a preliminary sales document issued by a seller to a buyer before goods or services are produced or delivered. It’s essentially a final quotation detailing the description of goods and estimates of any included costs that businesses can issue to customers before sending a proper invoice for payment.

These financial reports are used as hypothetical projections, allowing business owners to make decisions around assumptions that could impact cash flow.

For example, consider that you’re the owner of a UK robot vacuum cleaning business and you receive an order from Spain for a shipment of 100,000 units.

Even before you’ve started procuring raw material or hiring the required workforce, you can send a proforma invoice to your international client as a preliminary bill of sale.

This helps you provide your customer with the expected details of the final transaction, such as the total including shipping costs, in a format that can be altered if necessary.

Top Tip: Before we dive into proforma invoices, it’s important to understand what a standard invoice template looks like, what information must be included in it and how to make sure you get paid on time to protect your cash flow. To learn more, read our complete guide on how to raise an invoice and get paid 💸

What is the purpose of a proforma invoice? 4 key benefits

Proforma invoices let buyers know exactly what to expect in terms of cost so that they can decide whether to go ahead with the sale. This helps to set expectations and leave time for changes before it’s finalised and approved.

While proforma invoices aren’t legally binding documents and they can’t be used for accounting purposes, they do have some unique functionality.

Here are four reasons to use a proforma invoice over other invoice types at the early stages of the sales process:

- It helps the customer know what to expect from the purchase. Aligning both parties before any products are produced or services are delivered prevents relationship-damaging surprises later in the transaction.

- It’s a negotiating tool between you and your customer. It’s an opportunity for you and your customer to negotiate the terms of the sale before legally committing. This ultimately contributes to a strong, lasting business relationship.

- It works as a declaration of the value of goods for customs purposes. Some countries use proforma invoices as part of their import licensing procedures, as they include buyer information, weight and size of consignment, delivery fees and other details. Having one ready helps to ensure a smooth delivery process.

It requires less detail. As it’s not a finalised sales invoice, a proforma invoice can easily be adjusted. While it’s good practice to include as much information as possible, so the buyer knows what to expect, you can leave out details that are legally required on a final invoice if they’re not yet available.

Can payment be made on a proforma invoice?

You can invite payment on a proforma invoice (if, for example, you aren’t sure if the customer can pay you), but if payment is made, you must issue a standard invoice for accounting purposes.

For you and your customer, this means:

- Customers and clients are not legally required to pay any amount on a proforma invoice

- They can’t be used to reclaim VAT

- Any amounts given on your proforma invoices won’t be included in financial reports

In order to accept payments, you must raise and issue a full invoice as you would any product or service. Proforma invoices do not include invoice numbers or labels, and so do not meet the requirements of a standard sales invoice.

By issuing a standard invoice, the payment will be recorded within your accounting reports (or invoicing software) and on your financial statements. However, proforma invoices do not appear within any financial reports; thus payment cannot be made on them.

Can a proforma invoice be cancelled?

Again, as it’s not a legal document, it doesn’t need cancelling or processing in the same way as a standard sales invoice. It won’t be recorded in your financial statements or accounting software, which means it does not need processing after it’s issued.

When to use a proforma invoice

A proforma invoice is more of a “good faith agreement” than a payment demand. It helps both the seller and the buyer get on the same page about costs from the get-go.

These invoices are used to provide a general picture of the final invoice and can be adjusted at a later stage in case there’s a change in cost during the process.

For instance, a supplier may end up asking for more money if there is an unexpected increase in labour or procurement costs. Or, a request from the customer mid-project may add charges to a service delivery.

Proforma invoices are commonly used as final quotations and for international transactions.

In fact, a proforma invoice may be required by some countries as part of their import licensing procedures, since it includes buyer information, weight and size of consignment, shipping costs and other details.

Some countries also use commercial invoices to control imports. Make sure you always prepare invoices according to the client’s local policies.

Proforma invoices can also be used to open letters of credit for importers. Plus, these invoices look similar to a commercial invoice, which most traders are already familiar with.

Once you’ve held your side of the bargain and prepared the final order for your client, you can convert your proforma invoice into a final invoice, and then issue it for payment purposes.

Top Tip: Any type of invoice needs a proper invoicing process in place. This includes setting an invoice schedule, maintaining accurate records, regularly following up with clients and automating what you can. To learn more, read our guide on how to streamline your invoice process ⚡️

What is the difference between a proforma invoice and a commercial invoice?

The content of a proforma invoice and a commercial invoice is very similar, but when and why you use each invoice is different.

Proforma invoices work like price quotations but are prepared in invoice form.

Proforma invoices are used to begin a sale and are shared with prospective customers who have either placed an order or requested a formal type of quotation. This helps both you and your customer gauge projected financial results, including net income from this deal in the making so that you can update your cash flow forecast and balance sheets.

You can learn more about both of these accounting principles in our guide to accounting for startups.

To be able to send a proforma invoice, you don’t necessarily have to begin the production of goods.

Commercial invoices, on the other hand, are prepared after a sale takes place and act as the true invoice.

It is the final bill sent by a seller to a buyer, mentioning that they have completed the production and delivery of goods.

Commercial invoices are mostly used in import and export situations. Governments may also use them to determine the true value of goods and to assess whether customs duties have been paid or not.

Top Tip: Purchase orders and proforma invoices are incredibly similar, but a purchase order is issued by the buyer and a proforma invoice is issued by the seller. To learn more about purchase orders and how they work, read our guide on purchase orders vs invoices💡

Step-by-step: How to create a proforma invoice

There is no single way of creating or designing a proforma invoice, meaning most businesses’ will look different even if they contain the same types of details.

However, you should follow some specifics or best practices when creating your proforma invoices.

Many countries will have proforma invoice requirements, such as including duty taxes. So, if you sell physical products abroad, find out what these are in the countries where you do business.

Top Tip: The best way to avoid getting into financial trouble is by hiring an accountant or a bookkeeper who will help you manage your small business finances. To learn more about how these key roles can help you navigate proforma financial statements, read our guide on the difference between an accountant and a bookkeeper 🙌

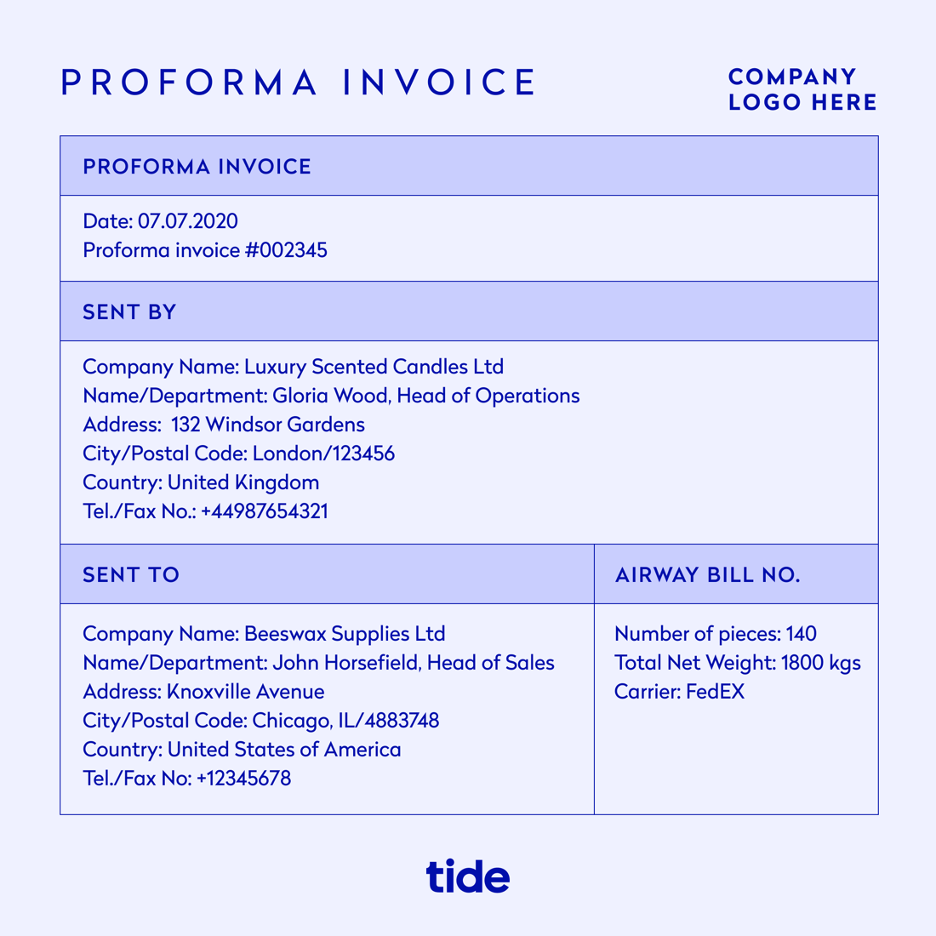

Here’s what a proforma document should ideally include:

- The term “proforma”

- Invoice date (date of issue)

- Seller information

- Buyer information

- Shipment information

- A description of the goods to be sold

- Terms and conditions

- The phrase “This is not a VAT invoice”

Follow this step-by-step guide to create a proforma invoice for your own business.

To outline this step-by-step process in detail, we’ll use a fictional example of a textile company called “Luxury Fabrics” (seller) and a furniture company called “Falcon Furniture” (buyer).

Step 1: Fill out the basics

The first step is to jot down all the essential information related to the seller, buyer and shipment.

Seller information should ideally include your company name, logo and contact information, such as your mailing address, phone number, email address, website and country of origin.

If your invoices are created on the official company letterhead, your seller information may already be entered. Still, make sure everything is up-to-date.

Buyer information also includes their company name, contact number, email address, mailing address (and billing address if different), city, country and other details.

Additionally, make sure you add the words “proforma invoice” at the top of your document.

You could also include some important dates in your invoices, including invoice request date, invoice creation date and invoice expiration date.

You don’t necessarily need to include an invoice number in your proforma invoice, as it cannot be used for official accounting purposes.

Another essential item to include in your proforma invoice if you sell and ship physical items is shipment information.

This includes the number of items you’re sending, the total weight, and the mode of transportation you’re using to ship the items (by air, rail or water).

Here’s what the upper section of your invoice should look like:

Step 2: List all product and pricing details

The next step is to list down all the information related to the goods you’re selling.

This part is the crux of your proforma invoice. Here, you’ll include the details for every item you’re shipping, including name, quantity, unit price and the grand total.

Ideally, list this information in a table so all parties can easily read it.

It’s good practice to list each item separately, as well as mention a brief description next to the item name or ID.

Lastly, make sure the total amount due is mentioned in a clear and bold font so your customer knows what to expect from the purchase.

Going back to our example, consider that Luxury Fabrics has received an order of sofa cloth from Falcon Furniture.

Here’s what the product and pricing section of their proforma invoice would look like:

| Sr. # | Product ID | Product Description | Quantity | Unit price(£) | Total(£) |

| 1 | WF-2550 | Suede sofa fabric, grey colour, full roll | 250 | 167.99 | 41,997.50 |

| 2 | WC-1020 | Knitted sofa fabric, black colour, full roll | 150 | 207.50 | 31,125 |

| 3 | WK-1250 | 100% polyester sofa fabric, beige colour, full roll | 300 | 125.00 | 37,500 |

| 110,622.50 |

You can also mention any discount offers in this section.

While creating your proforma invoice, check all relevant laws of the countries involved, including applicable taxes, and include them in the invoice.

Top Tip: You cannot use proforma invoices to reclaim VAT if your business is VAT registered. While you are not required by law to include VAT information on your proforma invoice, it is important information for your customers to know the total cost. To learn more about adding VAT onto invoices, read our guide on VAT invoice requirements ✅

Step 3: State your financial and shipping conditions

Your proforma invoice should also include any payment terms and conditions, along with the reason for sending goods to another country (if applicable).

This information usually goes at the end of your proforma invoice.

In case you’re in the middle of a temporary trade, where your exported items will be returning back to the country, mention “temporarily exported” on them to avoid any hassle in the shipment process.

Also if your items or services are subject to specific terms and conditions (eg, “provided the client provides clear access to the site”), you can mention these here as well.

If shipping is not a part of the service you deliver (eg, you offer gardening services and are issuing a proforma invoice as a final quote), you can leave this part out.

Step 4: Sign your proforma invoice

The last step of creating your proforma invoice is to sign it. This step is not a universal requirement, but if you ship items internationally, some countries may ask for it as a seal of proof.

If that’s the case, make sure you include your full name and signature. Companies issuing physical invoice documents will sometimes add an official company stamp as an extra layer of security.

Finalise the sale with an invoice template

Once the sale is complete, you’ll need to create an official invoice to get paid. Even when you know exactly what to include, creating a final sales invoice from scratch can be time-consuming.

Tide’s free smart invoicing template allows you to create professional invoices in seconds. The ability to add company, customer and payment details, then send directly from the Tide app, helps you issue invoices and get paid faster. Simply connect your existing business account to Tide and start creating professional invoices.

The biggest benefit of using an invoice template is that you don’t need to worry about the design. We’ve included all the important data fields, laying them out in a way that makes the document easy for you and your customer to use. You can focus on adding the correct information about your business, client and transactions.

Streamline your sales process

Proforma invoices are useful for giving customers an idea of what to expect. If your company is involved in international buying or selling, it’s especially important to be aware of proforma invoices and how they can benefit your business.

Knowing the difference between proforma invoices and other types can help you develop better relationships with the businesses you deal with, avoid issues with country-specific import or export laws and ensure a smooth delivery process.

Photo by Bongkarn Thanyakij, published on Pexels