What is a sales invoice (and what to include)

A sales invoice is a document issued by a business to outline the goods and services provided to a client.

Sales invoices serve as a record of sale and typically include:

- A description of the service provided or goods purchased

- The date the service was provided along with the payment due date (typically within 14, 30, 60 or 90 days, though 30 days is the most common)

- Instructions for how to pay

Once issued, a sales invoice becomes a legally binding contract that creates an obligation for the customer to pay. Because of this, it cannot be cancelled or removed from sales records.

In this article, we explain what a sales invoice is and why you need them. We’ll also run through the ins and outs of creating a sales invoice and provide you with our very own template.

Top Tip: Before you issue your first sales invoice, it’s important to fully understand how invoices work. To take a deep dive into the various types of invoices and how to avoid common mistakes, read our guide to raising invoices and getting them paid 🌟

Table of contents

- Why are sales invoices important?

- How to create a sales invoice?

- What is the difference between a sales invoice and a sales receipt?

- What is the difference between a sales invoice and a purchase order?

- Wrapping up

Why are sales invoices important?

Sales invoices are important because they outline how much money your clients owe you. After all, cash inflow is the heartbeat of your business.

But besides simply tracking money owed, sales invoices also help you to:

Organise bookkeeping and accounting

Once issued, you (or your bookkeeper or accountant) can keep track of sales invoices as accounts receivable.

This helps you stay on top of revenue that’s expected (but not yet paid) and makes it easier to stay organised when following up on overdue payments.

Being organised in this way is incredibly important, as the average UK small business owner is chasing five outstanding invoices at any one time. This amounts to an average of £8,500 being owed, which can lead to cash flow problems (not to mention lost valuable time spent chasing invoices).

Top Tip: While cash flow problems from unpaid invoices are stressors, you can pre-empt major problems by creating a cash flow forecast. A forecast helps you predict cash flow shortages, plan for loans and ultimately make better business decisions. To learn more, read our guide on what a cash flow forecast is and how to create one 💭

Gain insight into budgeting activities

Business budgets are an essential part of business plans. More importantly, an effective business budget helps you understand where to spend your money and when to align your spending with your needs and goals.

Therefore, organising your sales invoices allows you to predict future cash inflow and make key business decisions based on that data.

For example, if your sales invoices indicate several large payments are due at the end of the month and you’ll have runaway to spend, you can plan to invest in a new piece of equipment that will improve efficiency.

Critically, this helps you avoid overspending on one-time costs if your cash flow doesn’t support them.

Adjust inventory and marketing strategies

A valuable feature of sales invoices is the ability to pinpoint your most popular products and services.

This knowledge is especially helpful when planning holiday sales, seasonal promotions or special offers, as you can prioritise best sellers (and adjust your inventory to meet demand) to drive sales throughout that period.

Stay on top of tax

Maintaining an accurate record of your income and expenses is important for tax purposes, but it may also come in handy in the event of an audit.

Your sales invoices will act as proof of revenue and satisfy HM Revenue and Customs (HMRC). For more information on meeting invoice requirements, visit the GOV.UK invoicing page.

Steer clear of legal issues

An accurate and punctual sales invoice will demonstrate that you have completed your end of a transaction.

It will also clearly indicate the goods and services delivered and the payment terms you have agreed with the customer. In the event of confusion, or even a lawsuit, it is vital to have this information intact as sales invoices are legal documents.

Top Tip: If you do run into legal issues, you should be aware of your options and how to move forward. To learn more, read our advice for seeking legal advice & mediation 📌

How to create a sales invoice

When creating your sales invoice, it’s essential to include as much relevant information as possible to avoid:

- Mixing up orders

- Delivery delays

- Failed payment attempts

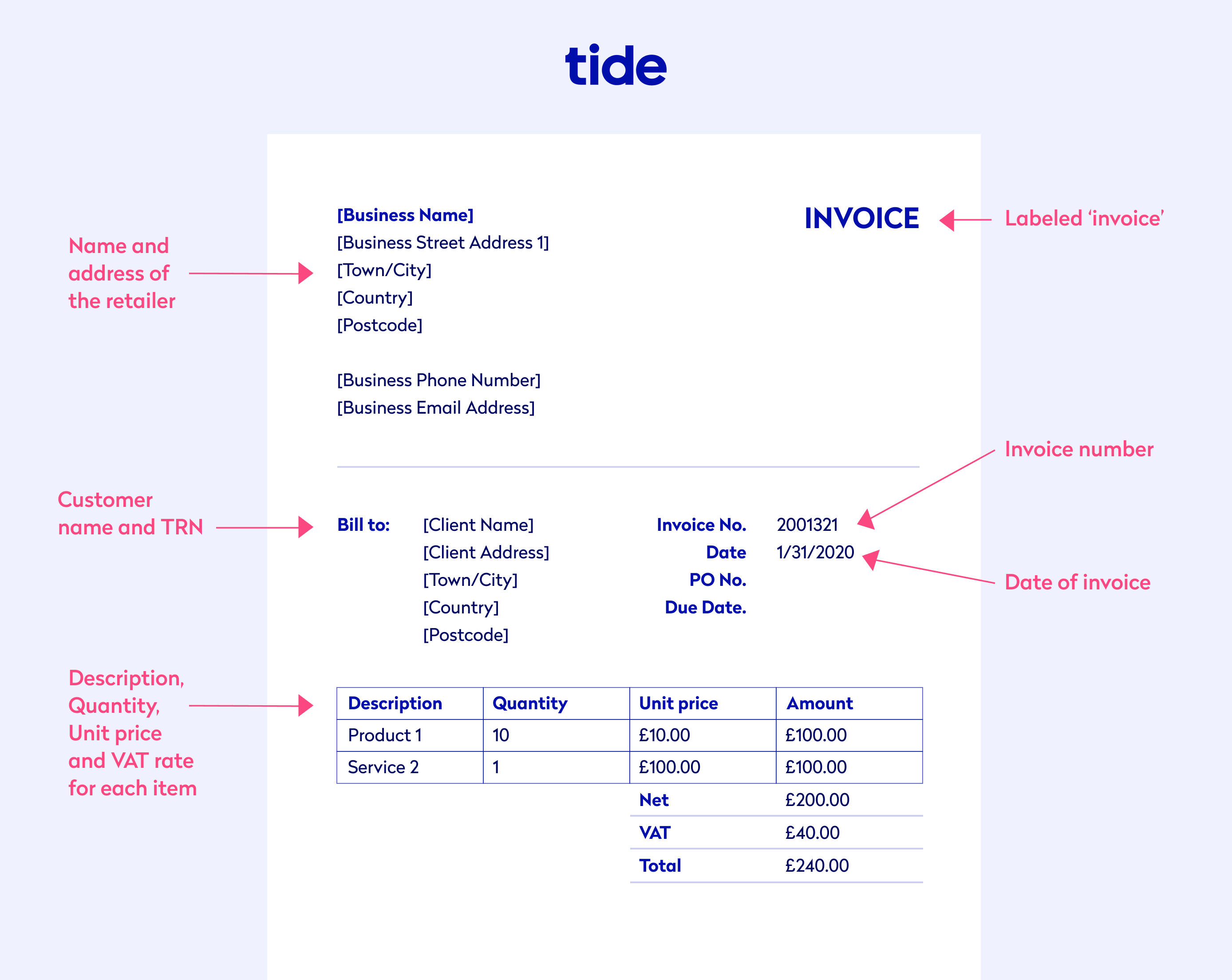

To ensure everything goes smoothly, your sales invoice should feature:

- Contact information. Clearly display your business name, your customer’s name and company name, your business addresses, the address of the customer and all other relevant contact information (e.g. email or phone number). This will limit the chance of delivery hiccups and make it easy for your client to get in touch if they wish.

- The invoice date. Record the date you created your sales invoice. This will mark the start of a transaction and is important for bookkeeping purposes. By sorting your invoices by date, you’ll save yourself valuable time in the future when you need to refer to them.

- The invoice number. Invoice numbers, also known as order or reference numbers, are used to track orders. They are usually sequential, for example, #00001, #00002. Invoice numbers are unique to each order and come in handy when referring to previous sales and tracking individual orders.

- Payment terms. Payment details and terms are usually agreed upon between the buyer and the seller before initiating a transaction. They allow the buyer to clearly see the due date for payment and outline the acceptable payment methods.

- A list of goods or services provided. Your invoice should clearly outline the list of products or services delivered. Include a brief description of each item, the unit price and the quantity supplied. The more information you provide, the more likely you will be paid on time (and in full).

- The total amount due. Your sales invoice should feature the total amount due, including applicable sales tax and any discounts you may have agreed upon. If you are VAT registered and include VAT or sales tax, you must also include the net amount, the total amount of VAT and the total amount due. This way, you’ll make it as simple as possible for your client to understand the costs and pay you.

Top Tip: If your business is VAT registered, you will need to include additional VAT information on your invoices. Read our guide to find out what you must include on your VAT invoice 📚

Sales invoice template

As a business owner, you want your clients to see you as professional and organised, so make sure that your invoice is error-free and accurate.

Here’s an example of what a sales invoice looks like:

Note: This sales invoice example includes VAT (also known as sales tax). You must include sales tax or VAT (along with the VAT rate) if you are VAT registered. If you are not VAT registered, you cannot include it.

To start creating your own sales invoice today and excel at looking professional, download our sales invoice template for free.And if you’re a Tide member, you can create, customise, send and manage your invoices directly from the app with Tide invoicing. ⚡️

Top Tip: To learn more about how invoicing software and automation can help you to streamline your invoice process and avoid late payment, read our guide on the 11 best invoicing software solutions for your small business 💻

What is the difference between a sales invoice and a sales receipt?

While sales invoices and sales receipts both list the key details of a sale, they are issued at different stages in the buying journey.

A sales invoice is presented to the customer upon delivery of goods and services. It provides details of the sale, including the terms of payment and the total amount owed to the seller.

When you issue a sales invoice to your customer, you are yet to be paid for goods or services.

A sales receipt, on the other hand, is issued after payment has been made for goods and services. It acts as a record of purchase for the customer and marks the completion of a transaction.

An everyday example of a sales receipt is the piece of paper you’re handed (or emailed if you go paperless) after making a purchase at a shop. You’ve already paid, so the receipt acts as a record of payment.

Top Tip: For a more in-depth explanation of how sales invoices and sales receipts work and what situations they apply to, read our guide on the difference between an invoice and a receipt 🔍

What is the difference between a sales invoice and a purchase order?

While sales invoices and sales receipts are issued by the supplier to the customer, a purchase order is issued in the reverse order (e.g. by the customer to the supplier).

That’s because it is produced before a sale takes place and acts as a sales order rather than a receipt. This gives the supplier ample time to organise inventory and prepare accordingly for the requested delivery date.

A purchase order may include:

- A list of the goods and services the customer requires

- The desired delivery date of the goods and services

- The customer’s preferred payment method(s)

- Transport arrangements (if applicable)

Top Tip: Sales invoices and purchase orders are essential to organise your business operations and stay on top of your accounting and bookkeeping. To learn more about the difference between the two, read our complete guide to purchase orders vs invoices ✅

Wrapping up

Sales invoices not only inform your clients about how much they owe you for goods and services, but they also contribute to the well-oiled machine that is your small business.

They provide you with cash flow transparency, allow you to plan your spending and act as proof of transaction in the event of communication and legal issues.

Photo by RODNAE Productions, published on Pexels