What is an SA302? A complete guide on Self Assessment statements

If you’re self-employed as a sole trader or run a limited company, you need to be able to prove your income.

Unlike employed individuals with regular pay slips and a guaranteed monthly income, you can show evidence of what you’ve earned with an SA302, also known as a Self Assessment statement.

If you’re registered with HM Revenue and Customs (HMRC), you’ll have access to this very important document. The SA302 is a tax calculation that lets banks and lenders check your income history and decide your creditworthiness.

Table of contents

- What is an SA302?

- What does an SA302 Self Assessment form include?

- When do I need an SA302?

- How do I get my SA302 tax form?

- How Tide can help with your Self Assessment

What is an SA302?

An SA302, also known as the SA302 tax calculation form, summarises the income you’ve reported to HMRC. It’s a statement based on your Self Assessment tax return.

The SA302 shows your income, tax allowance, tax you’ve paid/owe, and any tax owed to you for a particular fiscal year.

The form effectively documents exactly how much income you have declared. This way, lenders can verify that the income on a loan application matches what you’ve reported to HMRC.

Who needs an SA302?

An SA302 form applies to anyone who is self-employed or earns income outside of PAYE The ‘Pay As You Earn’ model refers to those who pay their income tax and national insurance through their wages.

If you’re self-employed, you need to register for Self Assessment and fill out a Self Assessment tax return, which will be used to generate an SA302 tax calculation.

The SA302 can be used as proof of income, and is especially beneficial to those looking to take out a business loan. Individuals in the following roles may find the SA302 useful:

- Freelancers

- Sole traders

- Landlords

- Self-employed individuals

- Some company directors

- Employees with multiple jobs

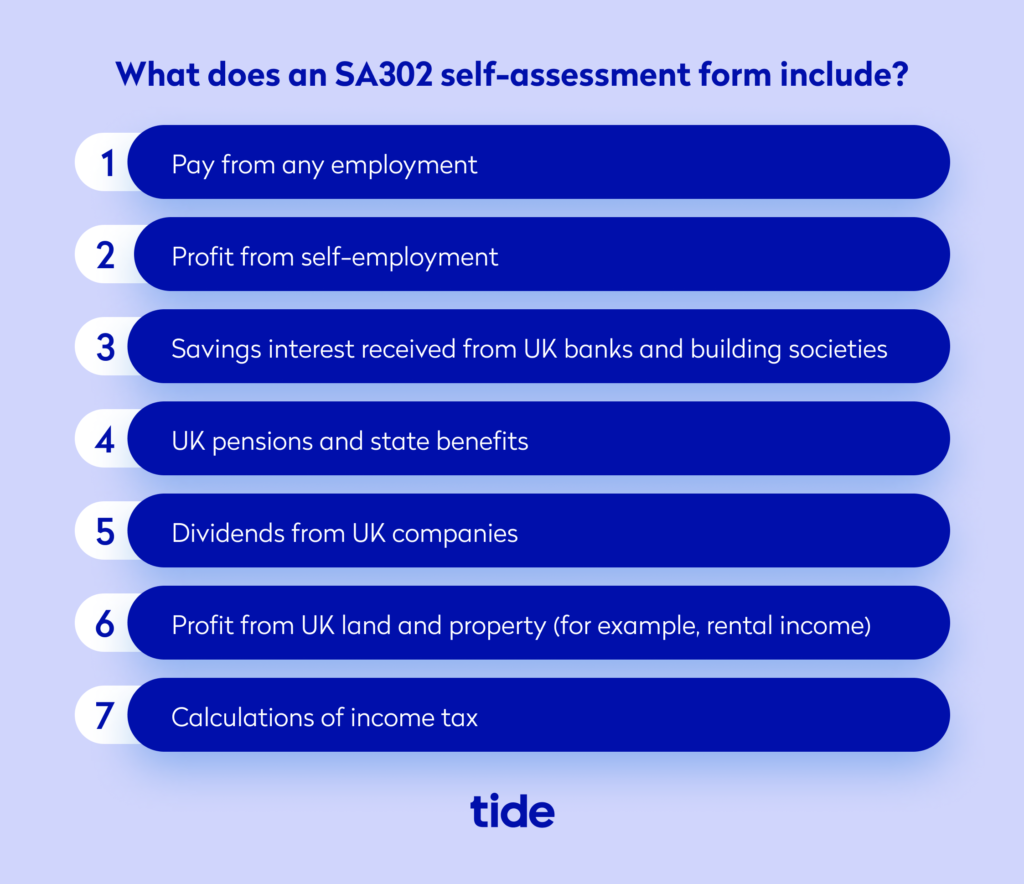

What does an SA302 Self Assessment form include?

The SA302 provides accurate evidence of your earnings and income for a given tax year. The form comprises two parts: Tax Calculation and Tax Overview.

- Tax Calculation section: summarises your total declared earnings and tax payable. This calculation is based on the Self Assessment for the relevant tax year.

- Tax Overview section: shows the status of your tax payments.

While mortgage lenders may sometimes be interested in the Tax Overview, the Tax Calculation section is more important to your mortgage application. This section considers all your sources of income and gives a detailed picture of where your earnings come from.

Top Tip: Your SA302 displays a detailed breakdown of all your taxable income. Your taxable income may be affected by the expenses you can deduct as a small business or self-employed individual. To get a better understanding of what expenses you can claim and how to claim them, read our helpful guide to Self Assessment expenses 🔑

When do I need an SA302?

You’re most likely to request an SA302 when applying for a business or personal loan. Most frequently, the forms are used to verify the income figure on mortgage applications.

Strict UK legislation requires banks and mortgage lenders to see proof of a mortgage applicant’s income to guarantee you can afford the monthly repayments.

An SA302 could be requested for:

- Residential mortgages

- Business/personal loans

- Residential re-mortgages

- Buy-to-let mortgages

- Holiday let mortgages

- Second home mortgages

- Homeowner loans

Full-time employees can prove their income through payslips, corresponding bank statements and P60 forms. However, those who aren’t full-time employees will need a Self Assessment statement in place of these other options.

It’s important to note that people with multiple jobs may also have to obtain an SA302 when applying for a mortgage.

For reasons outside a mortgage or business loan application, you may be asked for previous Self Assessment calculations to show your business activity. For example, hiring a new accountant.

SA302 example

The document gives an overview of an individual’s tax calculation, providing details of all taxable income streams and tax liability.

How do I get my SA302 tax form?

If you need a Self Assessment tax calculation form, you’ll have to request one from HMRC. While you need to take the initiative, getting a form is fairly simple. You have three options for obtaining an SA302.

Option 1: Download your form online

If you (or your accountant) filed your Self Assessment tax returns online, you can log into your HMRC online account to get the forms. Your tax calculation and SA302 details for the past four years are available in your account.

Once you’ve registered for an online account, there’s a straightforward process for getting the form.

- Log into your HMRC online account using your Government Gateway credentials

- Go to “Self Assessment”

- Select “More Self Assessment Details”

- Select “Get Your SA302 Tax Calculation”

- Choose the option to print and select the year you want to print

- View and print your full calculation

Note: To get an SA302 for a different tax year, click “Tax Return Options” in the menu and select the relevant year.

Option 2: Get a copy from your accountant

Your accountant can use their accounting software to generate, download and, if required, print your SA302 as proof of your annual earnings.

The commercial software should be the same program the accountant used to do your Self Assessment tax return, so they have all the necessary information.

If your accountant provides the copy, they’ll need to certify the document to make it acceptable to your potential lender.

Note: The SA302 form might be called something different, like “tax computation”, in commercial software.

Option 3: Request a printed copy from HMRC

If you filed a paper tax return or want a copy sent directly to your lender, you can get a printed SA302 from HMRC. You need to contact HMRC by phone to request it, then they’ll send it via post.

Your National Insurance number and Self Assessment Unique Taxpayer Reference (UTR) is required to verify your account. You’ll also need to let them know which years you require.

You’ll also be asked to provide details like your name, address and date of birth. Ensure your personal information is up to date – HMRC only sends documents using the address you’ve registered with them.

Note: It can take up to two weeks to get your form with this option, so be prepared to wait.

When can I get my SA302?

Forms are available at the end of the tax year. You can request an SA302 for the previous tax year 72 hours after filing your Self Assessment tax return.

Is SA302 the same as a tax overview?

The SA302 and tax overview are related documents, but they serve different purposes in the context of UK taxation.

The tax year overview is a summary document issued by HMRC, that outlines the total tax paid and any amounts owed or due for a specific tax year.

The SA302 is a detailed tax calculation form issued by HMRC that provides a breakdown of an individual’s income, tax liability, and any reliefs claimed for a specific tax year. It is often used for mortgage applications or loan approvals, as mentioned above.

While the SA302 offers a more comprehensive view of an individual’s tax situation, the tax overview provides a concise summary of the financial aspects related to their tax affairs. Both play a crucial part in financial planning and verification processes.

Will lenders accept a printed form?

Some banks and lenders require a copy of the SA302 sent directly from HMRC.

However, most will accept self-printed forms from your online account or accounting software. To help you determine what you need, HMRC has compiled a thorough list of mortgage providers who accept printed forms.

How Tide can help with your Self Assessment

Understanding the SA302 Self Assessment statement is crucial if you’re a small business owner or self-employed individual. This option for proving your income helps meet loan requirements when you’re not traditionally employed.

Using Tide Accounting software, you can save time on your financial admin with our suite of tools, designed to make filing your taxes much easier.

Upload receipts in real-time and categorise your transactions easily in the Tide app – with automated estimates of your turnover and expenses, you can ensure you submit an accurate Self Assessment.

Your Self Assessment statement is also a record of your taxes paid or owed to HMRC. Staying on top of your tax obligations helps you avoid any surprises when managing your finances.

Sign up to Tide today for a free business bank account and get a 2 month free trial of our Tide Accounting software. 🚀

Photo by Anthony Shkraba, published on Pexels