How to get a mortgage when you’re self-employed

The COVID-19 pandemic has significantly affected the 15% of people that are self-employed in the UK due to the lack of traditional employee benefits, such as sick leave or the furlough scheme, and the fact that many self-employed people work in the arts.

According to an Enterprise Research Center (ERC) report “COVID-19 and self-employment in the UK”, self-employed people are “particularly vulnerable”. That said, Luminate’s “UK graduate labour market update” has found that “the sector has been more resilient than originally feared.”

The government also provided the following help for the self-employed: 1) Grants for businesses that pay little or no business rates, 2) Business Interruption Loan Scheme, 3) Bounce Back Loan, 4) Test and Trace support payments.

Self-employment in the UK was at a record high at the end of 2019, with over 4.9 million people choosing to run their own business and enjoy the freedom of being their own boss.

Sole traders, limited company directors, partnerships and contractors now make up 15% of the workforce and contributed £275 billion to the economy in 2019.Yet, despite their importance, as many as 68% of self-employed workers say they feel disadvantaged by their self-employed status when it comes to securing a mortgage, and over one million of first-time buyers believe they’ll never own a home or have a chance to get on the property ladder.

And although many lenders favour more “traditional” borrowers, getting a mortgage as a self-employed business owner is absolutely achievable.

In this post, we’ll show you what it takes to win lenders over, including how to plan for your mortgage, the documents you’ll need to apply and ways to improve your chances of landing a loan.

But before we get into building that mortgage-winning application, let’s first dissect what a self-employed mortgage truly is.

Table of contents

- What is a self-employed mortgage?

- What counts as self-employed when applying for a mortgage?

- Preparation is key: Start planning for your mortgage early

- Applying for a mortgage: What you need

- How to improve your mortgage chances

- Expert insights

- Wrapping up

What is a self-employed mortgage?

‘Self-employed mortgage’ is a commonly used (and searched for) term to describe mortgages for people running their own businesses and working for themselves.

But a term is all it is. There is no specific ‘self-employed mortgage’ just like there is no dedicated ‘employed mortgage’. There are only mortgages, and working for yourself does not restrict you to a certain type of product or interest rate.

The commonality of the term comes from the now abolished self-certification mortgages – a product that allowed a person to borrow money without having to prove their total income.

With self-certification mortgages, an applicant could simply tell a bank how much they earned and then receive a loan based on those figures.

On the one hand, this made it easier for self-employed business owners and people with multiple income sources to secure the funds needed for a loan. On the other hand, some borrowers would exaggerate their finances to secure a larger mortgage and then struggle to pay it back.

Because of this, self-cert mortgages became known as ‘liar loans’ and were banned by the Financial Conduct Authority (FCA) in the UK in 2011.

FCA rules now state that lenders must always conduct detailed affordability checks and get proof of income for every applicant. When you’re self-employed and without the regular income of a PAYE employee, this makes your application a bit more complicated and nuanced.

What counts as self-employed when applying for a mortgage?

Lenders will class you as self-employed if you own 20%-25% or more of a business and generate the majority of your income from that business.

You can be a sole trader, director of a limited company, member of a partnership or a contractor to be classed as self-employed.

If you’re self-employed but also earn money through PAYE, it’s important to make the lender aware of your income and ask them to take all earnings into account.

Top Tip: Did you know that one in four people in the UK currently has a side hustle? A side hustle can be started as a way to test a new business idea, fulfill a personal goal, or earn more money. The COVID-19 crisis has also driven people to get more creative when it comes to how they earn additional income. If you’re curious about what a side business could look like, the benefits of a side business and what exactly makes a great side business, read our guide to 5 side businesses you can start quickly and affordably 🔥

Is it more difficult to get a mortgage when you are self-employed?

According to a survey of 2,500 self-employed workers by the non-bank mortgage lender, Kensington Mortgages, a third of the group said they had been rejected for a mortgage by high street lenders. A similar number feel that banks are biased against them.

But, it’s not as simple as a bank writing off an applicant because they work for themselves. In reality, the process of applying for a mortgage as someone who’s self-employed is more complex than that.

If you boil it down, getting a mortgage rests on whether the lender believes you can pay back a loan. They judge the application based on how much you’re earning and spending and whether your level of income can be sustained.

For employees, showing earnings is straightforward. Employees generally have a set basic salary that they can prove with payslips and a P60 form. This makes it easy for lenders to see the applicant’s income and make an educated guess as to whether they can afford the repayments.

For self-employed business owners, levels of income are not guaranteed and therefore tend to be varied. There are also general outgoings that a lender will weigh against your income. For example, a self-employed person pays taxes on their income irregularly throughout the year, while someone who is employed usually has taxes deducted from every paycheck cycle.

A self-employed person, therefore, has to affirm that their savings are not claimed for taxes and that they do in fact have enough cash to afford repayments.

Things like this make it more difficult to prove earnings and more complicated for a lender to work out how much money can be paid back. Which, ultimately, makes it harder for them to give the green light.

In other words, employees are seen as a safer bet.

But there’s no reason that you can’t also be seen as dependable. If you’re able to organise your finances and provide a lender with the information they require, you’ll give yourself the best possible chance of securing a mortgage.

Top Tip: One of the best ways to prove you’re a reliable businessperson is by effectively managing your expenses. Expense tracking gives you a complete understanding of how you are spending your money, which helps you to make better decisions and ultimately improve your cash flow. To learn more, read our guide to how to keep track of expenses 🌟

Preparation is key: Start planning for your mortgage early

Preparation is the key to success and that’s certainly the case with mortgage applications. By laying the groundwork now, you’ll improve your chances of owning your dream home in the future.

When scrutinising your mortgage application, lenders look at three key areas of your business and personal finances:

- Your business accounts

- Your credit file

- Your debt-to-income ratio

Top Tip: The sooner you get these things in order, the better. But, that’s easier said than done. If you’re a new business owner looking for some help with your finances, take a look at our complete guide to accounting for startups 📣

1. Get your accounts in order

To prove your income when applying for a mortgage, the majority of lenders will ask for at least 2-3 years of certified accounts.

Certified accounts are books that have been prepared by a qualified chartered accountant.

So, if you’re planning on applying for a mortgage soon, an important first step is finding a trusted accountant. Accountants can also take care of parts of the application such as producing an SA302 form and completing an Accountant’s Certificate if needed (we’ll talk more about those soon).

Top Tip: With so many accountants to choose from, finding the right one for your business can be overwhelming. If you’re looking for some advice, check out our short guide on how to choose an accountant for your small business. Alternatively, to learn more about hiring an accountant online, which is especially useful during COVID-19, read our guide to getting an online accountant for your small business 💻

But, what if you don’t have two years’ worth of accounts?

Finding a lender may prove difficult, but not impossible. Lenders like Kensington Mortgages, for example, offer mortgages for self-employed workers with only one year’s worth of trading history if they’re able to put down a 15% deposit.

Vicki Harris, the Chief Commercial Officer of Kensington Mortgages, says that they are proud to be flexible.

“Mainstream lenders need to reassure self-employed borrowers that there are other solutions available and point them in the right direction. High-street lenders may have a stiff upper lip, but that doesn’t mean everyone does, and there are a number of specialist mortgage providers who can help.”

That said, the longer you’ve been self-employed, the easier it is to prove your income. Still, it’s worth shopping around no matter how long you’ve been trading in order to get a lay of the land.

When comparing mortgage lenders, you should take several factors into consideration. These include fixed rates, interest rates, % required to put down upfront, the ability to remortgage, the flexibility to under- or overpay need be, maximum and minimum contract length, and so on. It’s important to find a plan that will work best in both the short and long term.

2. Maintain a good credit score

Your mortgage application, like any other application for credit, will be subject to a credit check.

Your credit score helps to indicate what kind of borrower you are and how likely it is that you’ll be able to keep up with repayments.

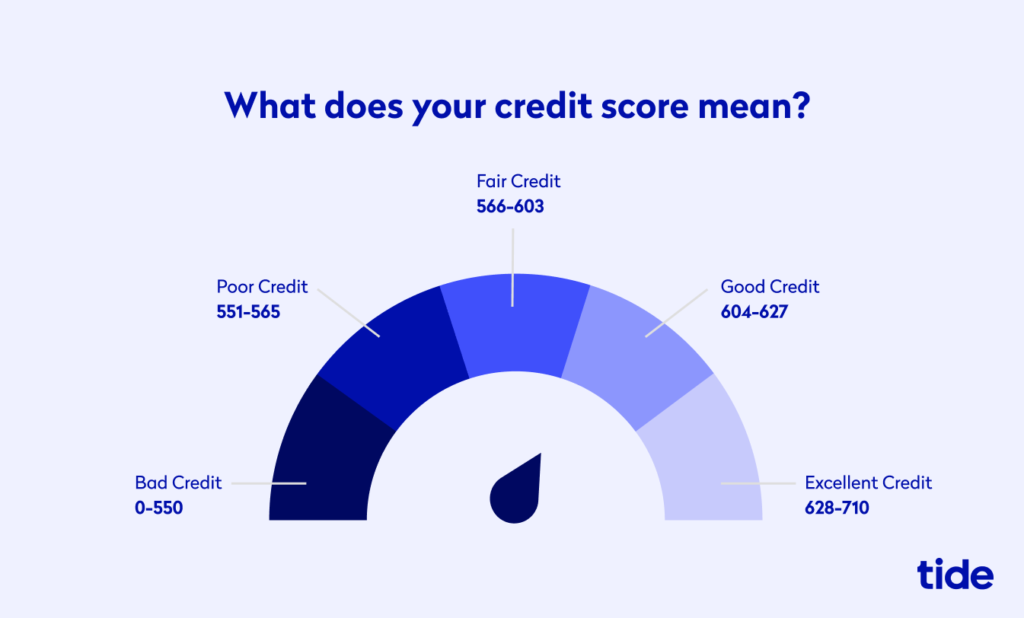

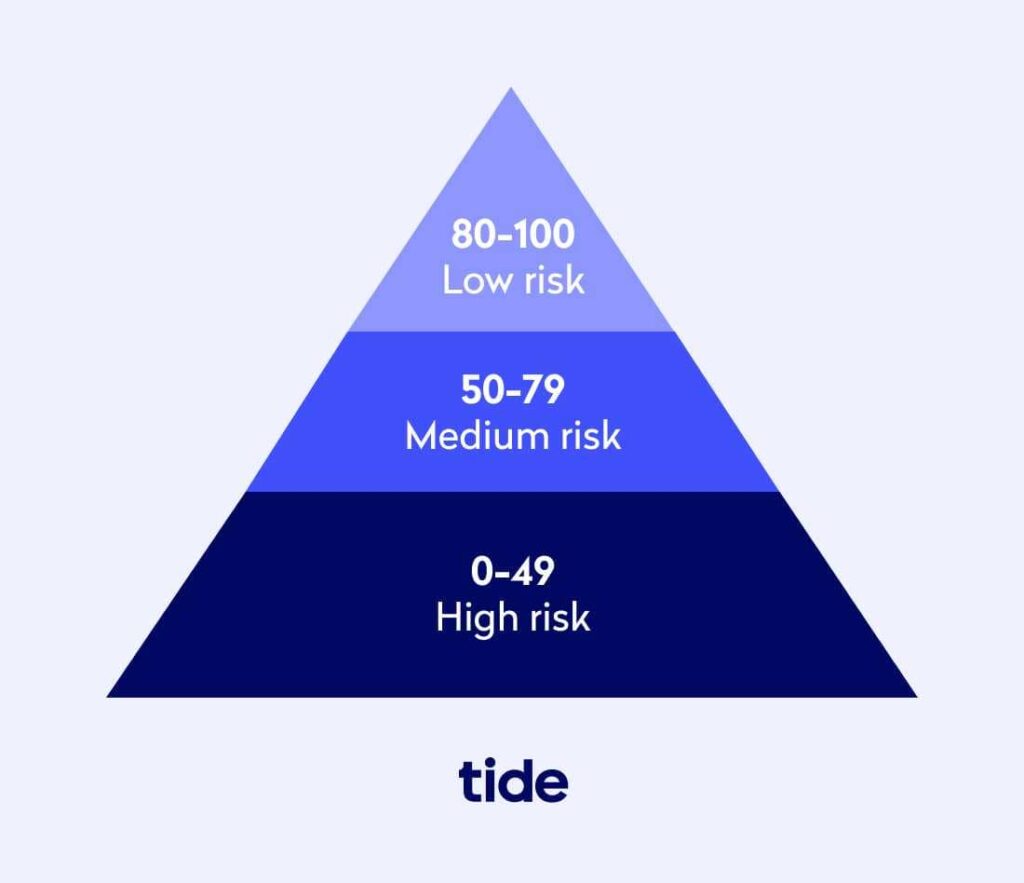

Depending on the credit rating agency, the range for your personal credit score spans from 0 to 999, with zero being ‘Very Poor’ and the highest number being ‘Excellent’. Your credit score is also based on a credit report that includes multiple factors, such as:

- Your history of credit payments

- How much credit you’re currently using, as well as your total debts

- Number of credit searches (how many other credit applications you’ve made)

- Your public records (e.g. county court judgements (CCJs) and electoral roll)

You can check your credit score for free by signing up to ClearScore, Experian or Equifax.

The higher your credit score, the more appealing your mortgage application. To keep your rating up in the high hundreds, it’s important to be sensible about how you use and apply for credit:

- Keep credit applications to a minimum: Every time you apply for credit, your score decreases. This is because lenders may see an application for credit as a sign you’re struggling financially (even if you’re not). So, try to avoid too many applications in a short space of time. This includes applications for credit cards, phone contracts, TV and broadband contracts, and other services. However, some companies do offer a soft credit check that will not affect your score, so make sure to check beforehand to decipher the company’s credit check process.

- Keep up with payments: Pay bills by direct debit, use credit cards wisely and pay balances in full when the bill is due.

- Close any unused credit accounts: Some lenders may view a larger overall credit limit as a negative.

- Get on the electoral roll (more on this later)

As well as a personal credit check, lenders will run a credit check on your business. A business credit score is on a range from 0 to 100, with 100 representing the best possible score you can get.

Top Tip: To learn more about why your business credit score is so important, how it’s determined, how to check it, the main differences between your business and personal credit scores as well as advice on 13 ways to improve your business credit score, read our guide to everything you need to know about your business credit score (and how to improve it) 💳

Before applying for a mortgage, it’s best to:

- Pay off any outstanding bills

- Make sure that any outstanding invoices are cleared

- Run a credit check on your business with the provider of your choice.

3. Stay on budget

As well as your business finances and credit history, lenders will carry out an affordability assessment that looks at your incomings and outgoings (bills, loan payments, car payments, monthly shopping spend, etc.).

How much you have leftover after your monthly expenses will impact:

a) whether you’re eligible for a mortgage

b) how much a bank will lend you

In the months before applying for a mortgage, try to keep monthly outgoings to a minimum. Cut back on anything that may be classed as a lavish spend unless it’s required (e.g. a new computer or watch when you already have said items). And if you have any loans or outstanding credit cards, make an effort to pay them off before applying for a mortgage.

Top Tip: The best way to stay on top of your business spending is to create and maintain a business budget. This way, you can monitor exactly how much and where you are spending your money and adjust it accordingly. To learn more, read our post that outlines 8 steps to create an effective business budget 🔍

What you need to apply for a mortgage

With everything in order as far as your business and personal finances are concerned, you’re in a good position to put forward a solid application.

The method of application will differ depending on your business structure (i.e. how you register your business), but there is a list of documents most lenders will ask for regardless.

- Identification: A photo ID such as a passport or driving licence that includes your current personal address

- Proof of address: A paper utility bill, council tax bill or bank or credit card statement that matches the address on your ID

- A completed SA302 form: The SA302 form shows your tax year overview and breakdown as well as evidence of earnings from your most recent Self Assessment tax return. This is used to prove up to four years of earnings, though most lenders will only ask for two or three years. Depending on the lender, you may be able to provide SA302s that you’ve printed off yourself or require an official covering letter from HMRC. The SA302 form can be printed from your HMRC account.

- Log in to HMRC and go to Self Assessment

- Go to More Self Assessment Details

- Click on Get your SA302 tax calculation and click on Print to print off the form

If you require a covering letter, contact HMRC directly via phone or live chat.

- Proof of income: This will vary depending on the lender but will include one of the following:

- A combination of profit and loss reports, balance sheets and bank statements

- An Accountant’s Certificate signed for by a certified account.

An Accountant’s Certificate is a specific form that serves as proof for company accounts, such as salary income, dividend income and company profits. These tend to be used where an SA302 and tax information is not fully representative of income. For example, if profit has been retained in your company rather than taken out as dividends, an Accountant’s Certificates will certify your additional income.

- Proof of deposit: Provided in the form of a bank statement

- Proof of outgoings: Lenders will ask for a completed expenditure form giving the information needed to carry out an affordability assessment. Details of expenditure will include all regular monthly outgoings such as bills and loan payments, as well as subscriptions, childcare costs, insurance and pension contributions.

- Bank statements: Paper statements including 3-6 months’ salary statements, 3-6 months’ business banking statements and 3-6 months’ statements showing rental

- Life insurance policy: A life insurance policy will need to be in place to cover the mortgage in the event of loss of life. Your policy summary will act as proof of this.

Applying for a mortgage as a sole trader

If you’re a sole trader, all of the net profits in your business belong to you. This makes it easier to prove your earnings. Lenders will look at your income for the past two or three years to work out your average income.

Before applying for a mortgage, ensure you have two years’ worth of full, finalised accounts and two years of SA302s, ending within the last 18 months.

Applying for a mortgage as a limited company director

If you run a limited company, your business is a separate entity and individual profits are separate from business profits.

Lenders will focus on income from your basic salary as well as dividend payments, so ensure you have completed records for both going back 2-3 years.

Some lenders may also consider retained profits as part of your income. Using retained profits allows you to boost your income without having to pay yourself in dividends (and increase your tax bill as a result). However, before taking this approach you should check with the lender first as this isn’t always an option.

Top Tip: Did you know that every year, £962m in expenses are left unclaimed from HMRC? Allowable expenses are business expenses that can be deducted from your income to reduce the amount of Corporation Tax you pay. If you run a limited company, learn more about how you can reduce your Corporation Tax liability in our guide to allowable expenses that limited companies can claim ✅

Applying for a mortgage as a partnership

If you operate as part of a business partnership, lenders will look at your share of the profits only.

You’ll need to prove income for 2-3 years in the form of partnership accounts and personal SA302s, ending within the past 18 months. Lenders will average out your profit over the period.

Applying for a mortgage as a contractor

If you’re a contractor or a member of the Construction Industry Scheme (CIS) where money is deducted from your payments for advance payments towards tax and national insurance, lenders will process your application in the same way as a sole trader. However, you’ll also need payslips from your employer or client dating back six months.

How to improve your mortgage chances

We’ve talked about getting your finances in order, managing your credit rating, balancing your budget and gathering the correct documentation. But in order to truly impress lenders, self-employed individuals need to go the extra mile.

Here are four tips for improving your mortgage chances even further:

Speak to a mortgage adviser

A mortgage adviser or broker is a person or company that works with you to give you mortgage advice and help you to decide what kind of mortgage you need. They’ll then match you with the best lender based on your criteria.

As many lenders have different criteria, an adviser’s market expertise and ability to find the best deals can reduce your chances of being rejected and thus prevent you from racking up failed credit applications.

Mortgage advisers may be tied to a specific lender, have access to deals from limited lenders or offer ‘whole of market’ advice. Naturally, the latter seems like the best option, but with some lenders only disclosing products when approached directly, ‘whole of market’ doesn’t cover everything.

The cost of their services will also vary from free to potentially thousands of pounds. According to Money Advice Service, the average cost of an adviser is £500, but how much you pay will depend on how you’re charged:

- Fixed fee: A set fee to find and arrange your mortgage

- Commission: Often advertised as being ‘free’ but advisers are paid by lenders. Before choosing a commission-based adviser, find out which lender they work with.

- Percentage: The fee is paid as a percentage of your mortgage. For example, if the fee is 1% and your mortgage is £200,000, the adviser’s services will cost £2,000.

Regardless of which adviser you go with, they are required by the FCA to recommend the most suitable mortgage for you.

You can find an FCA-registered adviser by using any of the following websites:

Save up a large deposit

The bigger your deposit, the better your chances of securing the loan you need. According to Which?, in the current market* you’ll need a deposit of at least 5% of a property’s value to get a mortgage.

* Due to economic issues caused by COVID-19, many lenders have withdrawn their low-deposit deals. Because of this, you may need a deposit between 10% and 15% during the pandemic.

So, if the property you wanted to buy was £200,000, you’ll need a deposit of £10,000. The lender would then lend you the remaining 95% (£190,000).

But if you can save more than 5%, you’ll benefit from cheaper monthly repayments and increase your chances of being accepted, as lenders will see you as being more likely to afford repayments.

To find out how much deposit you’ll need, try using a mortgage repayment calculator.

Work out repayments based on a loan for 95% of a property’s value. If you can afford the repayments, a 5% deposit may be enough, if not you’ll need to save more.

Maintain good business relationships

Lenders expect to see a good track record of work and will look favourably on any guaranteed work you have planned in the future. It will work to your advantage if you have good relationships with clients and customers.

If your business involves providing a service to clients, look at ways to secure long-term contracts or retainer arrangements. These will prove to a lender that you’re able to maintain or increase your income going forward and give assurances that you’re a safe choice.

Sign up to the electoral register

Signing up to the electoral register will not only help you improve your credit score, but it will also give your mortgage chances a boost. Lenders use the electoral register in their background checks to verify your identity and address.

Make sure that you’re registered to vote at your current address by contacting your local council. If you have concerns for your privacy, ask that you’re only added to the register that is not publicly viewable.

💡 Expert insights

Simon Butler is the Head of Mortgage & Protection at CMME. Simon’s career within the mortgages and protection sector spans more than 15 years.

Since joining CMME, Simon has helped the company become the largest provider of niche financial advice to independent professionals. He has been actively involved in assisting mortgage lenders to evolve their lending policies to better understand and cater for the bespoke needs of freelancers, contractors and the self-employed.

Now as the Head of Mortgages and Protection at CMME, alongside the management of the day to day operation, Simon continues to play an active role in advising mortgage lenders and industry bodies to champion the cause of the independent professional.

What are some of the unique challenges self-employed people face when it comes to getting a mortgage?

Self-employed people may face specific challenges when seeking a mortgage, depending on the way they work:

- If a contractor, be aware that gaps in contract can be prohibitive and are treated differently from lender to lender. As a rule of thumb any gap longer than 8 weeks will be a potential issue. If the time was taken for professional development or a significant life event, some lenders may consider an application but it’s essential to check this up front.

- If working under an umbrella company (and an estimate 1/3 of the contractor community have shifted to this way of working post IR35), bear in mind that lenders tend to review the most recent three months’ payslips alongside your contract and bank statements. It’s best to avoid applying for a mortgage after taking a break or holiday for this reason as the reduced level of income in that period will impact your borrowing potential.

- If working on a PAYE fixed term contract for the first time you may find that many lenders will not support a mortgage application until the first 12 months under contract have been completed. Bear in mind that there are lenders in the market that would consider an application immediately or after at least three months under contract has been completed. But this is subject to evidence of experience for at least two years in a similar profession. Check this before applying.

- Lenders are placing particular focus on the first year of the pandemic for self-employed applicants. Some will consider allowing 2019’s accounts to be used in conjunction with more recent years to provide a clear picture of “normal” income streams. This is key as lenders generally tend to average income over a 2–3-year period, so a low level of income in 2020 will be detrimental.

- If you have utilised either the SEISS grant or bounce back loan you will find that lenders may choose to treat these funds as personal, rather than business expenses/debt. This could mean that a lender will reduce the level of borrowing available so make sure that this is discussed before proceeding with an application.

- Most lenders tend to require 2-3 years of trading accounts, backed up by tax overview statements to assess a self-employed application. However, there are a small number of lenders that would consider lending based on the first year of trading accounts, subject to confirming the applicant has previous experience in their field.

- While most lenders assess borrowing based on the individual or joint applicants’ salary and dividend drawings, there are a small number of lenders that will consider lending against a director’s share of or the full LTD company net profit, plus salary drawn for a mortgage application – depending on the applicants share of the company profits. This can significantly increase the volume of lending available.

Wrapping up

Lenders aren’t against you because you’re self-employed, they just need to be sure that you can afford to repay the money you borrow.

To increase your chances of being accepted for a mortgage, you should:

- Start planning for your mortgage early by organising your accounts, maintaining a good credit score and staying on budget

- Get all of the required documents in order and work with an accountant to complete the necessary paperwork

- Improve your mortgage chances by speaking to a mortgage adviser, saving for a deposit and securing long-term work

Follow these tips and you’ll be on the road to procuring a well-deserved loan. And if you are looking for another way to improve your credit score, a separate business current account makes it much easier to track and manage your personal vs. business finances. Join the more than 250,000 business owners have chosen Tide and open a free business bank account today.

Photo by Maria Ziegler, published on Unsplash