What is VAT exemption (and who does it apply to?)

VAT exemption means you cannot register for any VAT scheme because you do not sell any taxable items to your customers. That said, you may still need to buy some taxable items to conduct your business, in which case you must still pay VAT on those items and cannot reclaim VAT credit for those purchases.

On the other hand, partially exempt businesses can become VAT registered and thus can reclaim VAT on certain taxable purchases.

In this article, we’ll unpack the spider web of what qualifies as taxable goods and services, explore the types of VAT exemption and examine the benefits and drawbacks of being VAT exempt.

Table of contents

- How does VAT work?

- What is VAT exemption, and who does it apply to?

- How to apply VAT relief for people with disabilities and older people

- The benefits and drawbacks of VAT exemption

- VAT exemption doesn’t have to be complicated

How does VAT work?

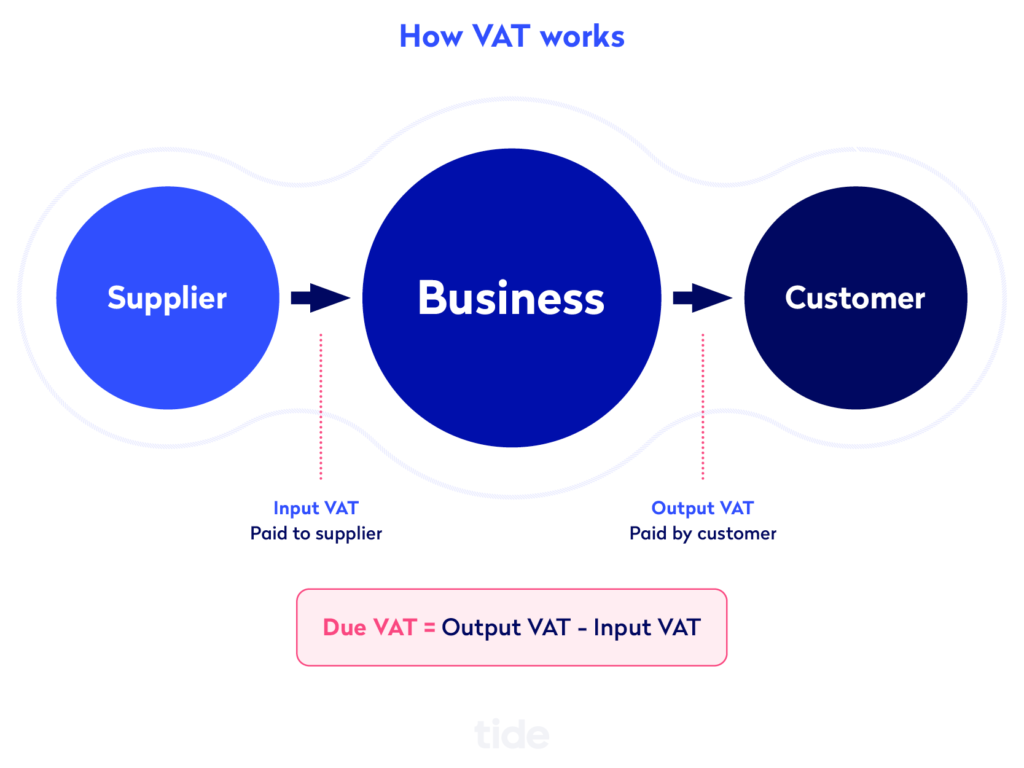

Before we dive into the specifics of VAT exemption, it’s important to fully grasp the basics of VAT. VAT represents the ‘value-added tax’ to goods or services as they move through the supply chain (eg, from the manufacturer or supplier to the business, which is you, and ultimately the customer).

VAT is a consumption tax that applies to many types of goods or services, both physical and digital. Essentially, VAT-registered businesses collect VAT on behalf of the government and pay it back to them throughout the year. The exact payment schedule and amount depend on your chosen VAT scheme and/or your specific industry rate.

VAT-registered businesses are responsible for charging an output tax to customers (similar to sending an invoice) and also paying an input tax to suppliers (similar to paying an invoice).

If your business has paid more VAT to suppliers than you charged customers, HM Revenue and Customs (HMRC) will usually repay you the difference. If the opposite is true and you’ve earned more VAT from customers than you’ve paid to businesses, you must pay the difference to HMRC.

As you are simply acting as a tax collector for HMRC, the idea is that you pay as much as you collect, or reclaim the difference, and ultimately break even.

As we will explore in detail in the next section, if your business only sells VAT-exempt goods or services, you cannot register your business for VAT because you are a VAT-exempt business. However, if you are partially exempt because you sell some goods or services that are exempt and others that are not, you must still register for VAT if you meet the threshold requirements.

At the time of writing, the VAT registration limit or threshold is £85,000, meaning that if your annual sales exceed the threshold, you must register your company for VAT, regardless of your business type.

Alternatively, you can voluntarily register for VAT even if you know that you won’t meet the threshold. That way you can reclaim the VAT that you pay to other businesses by passing the charge onto your customers.

Top Tip: There are many benefits and drawbacks to voluntarily registering for VAT. Learn more about what those are, as well as the alternative VAT schemes you can choose from to save money as a small business and more in our VAT guide 💡

What is VAT exemption, and who does it apply to?

VAT works like a well-oiled machine when VAT-registered businesses that buy and sell taxable items do business with each other. It gets complicated when exempt, out of scope, reduced rate and zero-rated items come into the picture.

While complicated, these exceptions are meant to be helpful. They exist to make certain goods or services more accessible to the general public, especially those experiencing financial difficulties.

Often, the nature of those goods or services is considered necessary for the public to easily access. Examples include healthcare and medical services, charitable organisations, grants or loans, energy and maternity products (we’ll get more specific in the subsequent sections).

Therefore, the government does not want those businesses to increase their prices by charging VAT to their customers. Fully exempt businesses do not charge VAT, whereas partially exempt businesses have to navigate some complicated rules, regulations and paperwork (more on that below).

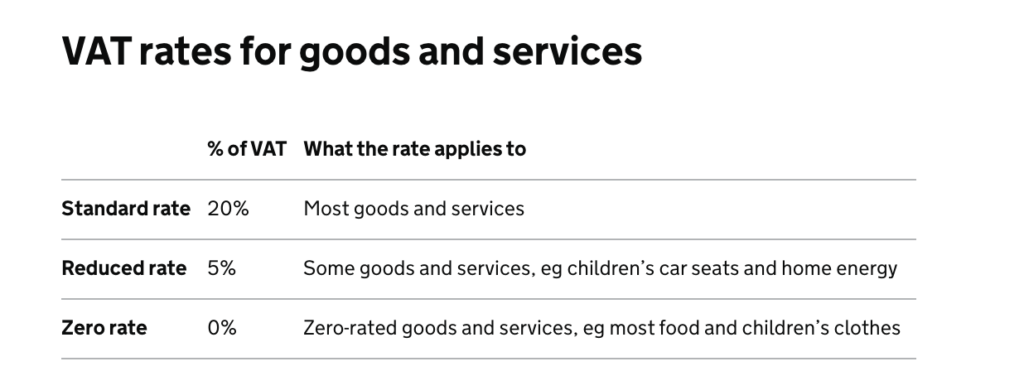

Note: At the time of writing, the standard VAT rate is 20%, the reduced rate is 5% and the zero rate is 0%.

Exempt goods or services

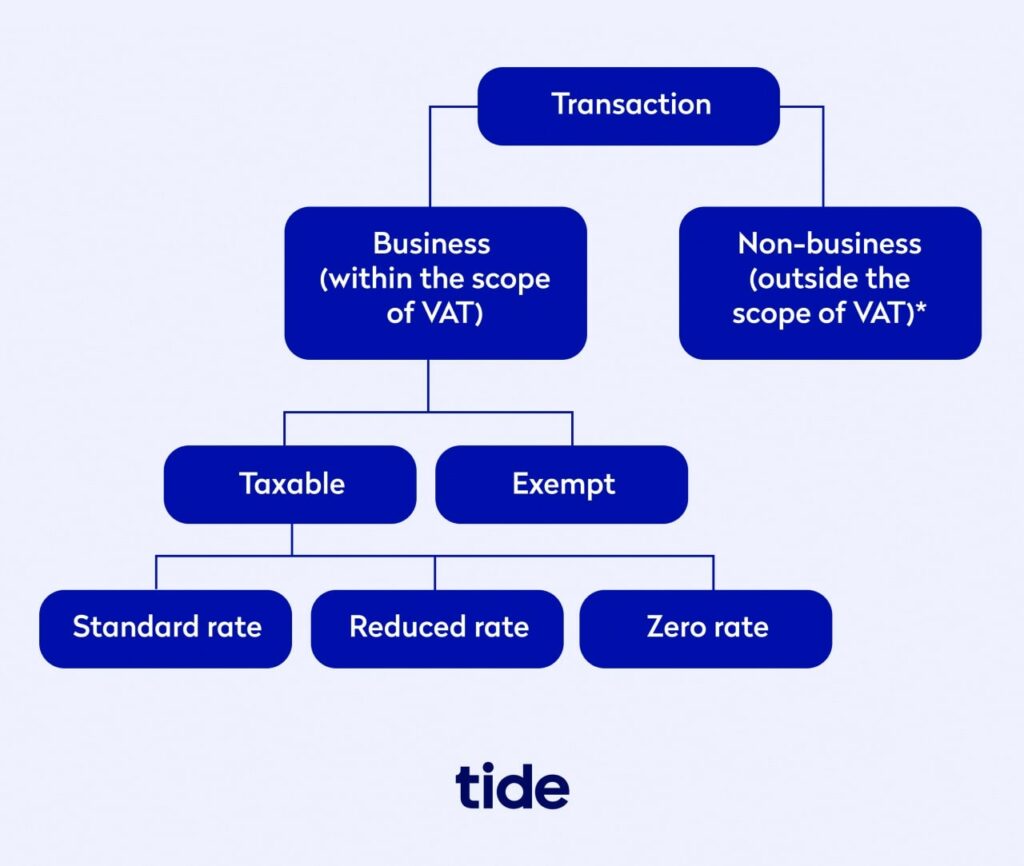

Some items are entirely exempt or out of the scope of VAT, including:

- Insurance, financial services and investments

- Public postal services provided by the Royal Mail

- Health services provided by registered doctors, dentists, opticians, pharmacists and other health professionals

- Education and training provided by eligible schools, colleges or universities

- Sports, leisure and cultural activities

- Charitable fundraising events, sponsored charitable events and voluntary donations to charities

- Selling, leasing and letting of commercial land and buildings — this exemption can be waived

Reduced rate items

Some items are set at a reduced rate of 5%, including:

- Children’s car seats, booster seats and booster cushions

- Energy-saving materials installed in residential dwellings and buildings

- Installation, repair and maintenance of heating systems

- Mobility aids for older people

- Smoking cessation products

- Power (electricity, gas, heating oil and solid fuel) for domestic and residential use or non-business use by a charity

- Renovating a dwelling that has been empty for at least two years

Zero-rated items

Zero-rated items have a 0% rate applied to them. Items given a zero rate are considered highly necessary or critical components in a supply chain, and therefore, the 0% rate makes them more affordable for buyers.

Zero-rated items include:

- Children’s clothes and footwear

- Publications such as books, magazines, newspapers, brochures, leaflets, pamphlets and more

- Prescription medicines, incontinence products, and maternity pads

- Food and drink, with some exceptions such as alcoholic drinks, soft drinks, confectionery, crisps and savoury snacks, hot food and ice cream

- Certain animals, animal feeding products, plants and seeds

- Donated goods sold by charity shops

Some businesses will buy zero-rated items and then use those materials to produce standard-rate items that they must charge a higher percentage of VAT on. This is often the case in restaurants, as raw food and drink materials are often zero-rated, but standard VAT must be charged on the final product.

It’s important to note that zero-rate is not the same as exempt. Even though zero-rated goods are VAT free, it’s still a rate of tax and thus must be recorded in VAT accounts and reported in VAT returns.

For example, if you sell a mixture of zero-rate or reduced-rate items, you must still tally the net value of the sale as part of your VAT taxable revenue. GOV.UK has issued a how to fill in and submit your VAT Return (VAT Notice 700/12) notice, which details how to fill out your VAT return. Section “3.7. Filling in box 6” explains exactly how you can show the total value of your sales while excluding reduced rate items.

Exempt businesses

If you only sell exempt or out of scope goods or services, you cannot register for VAT and you will be a VAT-exempt business.

As an exempt business, you cannot reclaim VAT credit for items you purchase for your business operation. For example, all health services provided by registered doctors, dentists, opticians, pharmacists and other health professionals are VAT exempt. That said, they still may require taxable services to conduct their business, such as paying an accountant or bookkeeper for financial assistance. In that case, the health service business cannot reclaim the VAT they pay to their accountancy firm.

Partially exempt businesses

If you sell reduced rate and exempt items, you must still register for VAT if you meet the threshold, and you will be a partially exempt business.

If you do not sell any exempt items but sell many reduced rate or zero-rated items, you are not a partially exempt business. You can recover all of your input tax (or the tax you paid to suppliers) for goods or services.

What about VAT rates for discounts and free gifts?

The VAT rate for discounts and free gifts varies depending on the discount or gift type.

For example, if you are giving away an item for free alongside a purchase, no VAT is due on the free item. If you are discounting an item, standard VAT is due on the discounted price. Further, you do not have to pay VAT on free samples as long as they follow certain conditions.

For full details on the rules that apply to discounts and gifts, visit GOV.UK’s discounts and free gifts page.

Top Tip: If your business sells many different types of items, working out the VAT you need to charge and report may be extremely complicated. It could be worth seeking an accountant’s advice to save you precious time. Learn more in our guide on how to choose an accountant for your small business ⚖️

Businesses that mainly sell zero-rated items

If you primarily sell zero-rated items and are over the threshold, even temporarily, you can apply for a VAT exemption to avoid VAT paperwork.

You have to weigh up whether or not the time spent on VAT paperwork is better or worse than the ability to reclaim VAT spent on taxable supplies or services.For more details on how to apply for a VAT exemption, explore GOV.UK’s section on “Working out whether you need to register”.

VAT for charities

If you are a VAT-registered business, you can sell goods or services to charities at a zero or reduced rate.

If you are a charity, you must register for VAT once your taxable sales exceed the £85,000 threshold—making you a partially exempt business. There are detailed guidelines for charities on GOV.UK’s website that outline what items and activities are considered VAT exempt, out of scope, zero-rated or reduced rate.

For example, admission charges for events that you may hold are exempt from VAT, but advertising services are 0%.

If you are not a charity, you alone are responsible for double-checking that the charity is eligible for reduced rates, as some may not be. For example, community amateur sports clubs (CASCs) don’t qualify for VAT reliefs.

In order to do everything by the book and guarantee eligibility, the charity must give you their Charity Commission registration number and a letter of recognition from HMRC if they are not registered with the Charity Commission for England and Wales.

You alone also must figure out what the VAT rates are when working with charities so that you apply the correct rate when sending your VAT invoice. The charity is also legally required to give you an eligibility certificate if you are charging a 0% VAT rate.

To learn more, visit GOV.UK’s when not to charge VAT page. For a full and up-to-date list of exempt, out of scope, reduced rate and zero-rated items, visit GOV.UK’s VAT rates on different goods and services directory.

How to apply VAT relief for people with disabilities and older people

If your business supplies goods and services to people with disabilities and people aged 60 or over, then, under certain conditions, you should apply zero or reduced rate VAT.

When to zero rate goods and services for people with disabilities

You can zero rate some goods and services for people with disabilities when the:

- Person is ‘chronically sick or disabled’

- Goods or services are eligible for VAT relief (see below)

- Goods and services are purchased for their personal or domestic use (ie, not hospitals and nursing homes)

GOV.UK states a person is “chronically sick or disabled” if they have a:

- Physical or mental impairment that has a long-term and substantial adverse effect on their ability to carry out everyday activities

- Condition that the medical profession treats as a chronic sickness, such as diabetes

Note: This does not include someone temporarily disabled or incapacitated, for example, with a broken limb.

Examples of goods and services that you can zero rate include:

- Adaptation of goods

- Adapted motor vehicles

- Boats

- Building works, such as ramps, lifts, widening doorways and passages, bathrooms, washrooms and lavatories

- Emergency alarm call systems

- Hydrotherapy pools

- Low vision aids

- Medical and surgical appliances, such as invalid wheelchairs, artificial limbs and heart pacemakers

- Mobility scooters

- Repair and maintenance of goods

- Specialist adjustable beds, chair lifts, hoists and sanitary devices

- Specialist computer devices

You can check the complete list of eligible items on GOV.UK.

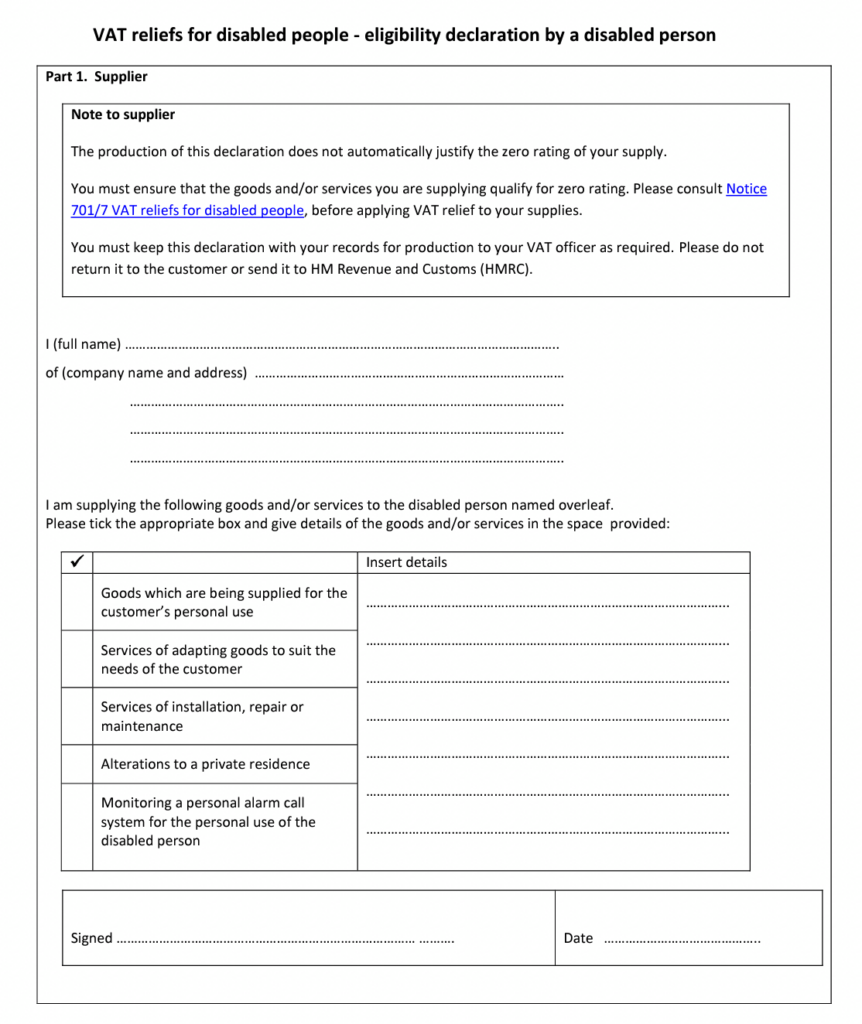

Qualifying customers don’t hold an ‘exemption certificate’. Instead, you should get a written or electronic declaration confirming that they are entitled to VAT relief. GOV.UK suggests using this template:

When to charge reduced rate on mobility aids for older people

Some mobility aids for people over 60 are subject to reduced rate VAT.

You can apply this rate when you supply and install (not simply supply) a qualifying mobility aid in their home or a private home shared with relatives and friends. The reduced rate does not apply to work carried out in a residential care home.

The reduced rate of VAT covers the supply and installation of:

- Grab rails

- Ramps

- Stairlifts

- Bath lifts

- Built-in shower seats or showers containing built-in shower seats

- Walk-in baths with sealable doors

Repair and maintenance of these items are not eligible for reduced rate VAT relief.

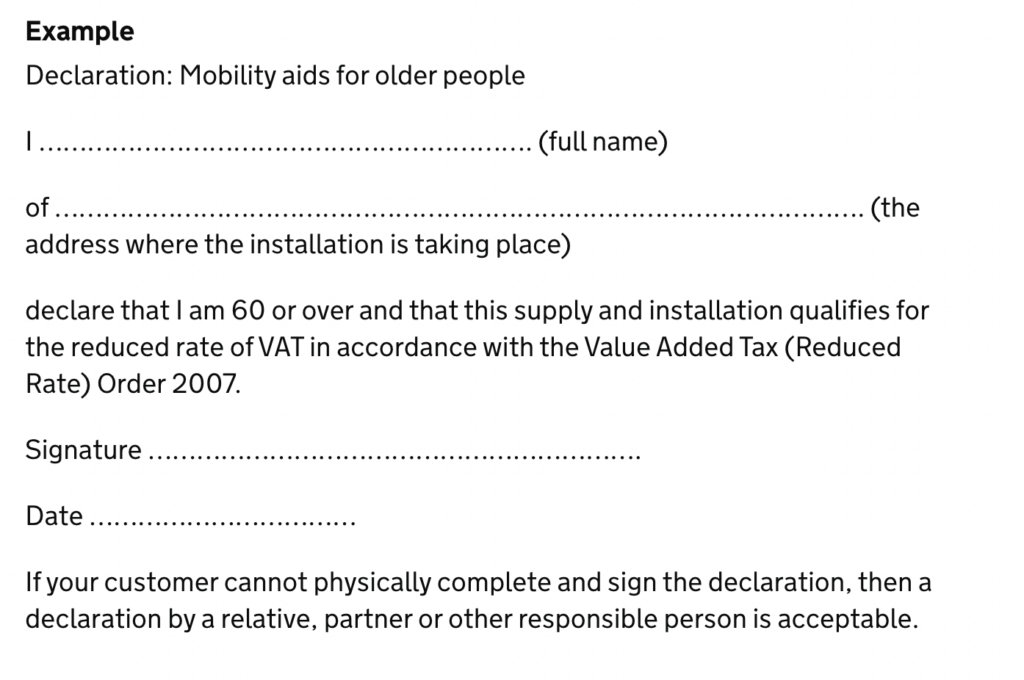

Your customer (or a relative, partner or another responsible person) must provide a written declaration to prove they are eligible.

For example, GOV.UK suggests using this template:

The benefits and drawbacks of VAT exemption

Most businesses don’t have a choice in whether or not the items they buy or sell are VAT exempt. The nature of your business often determines the decision.

VAT-exempt businesses

If you do fall into the VAT-exempt category and cannot become VAT registered, you will experience several benefits:

- Save money on the items that you purchase for your business if your supplier is also a VAT-exempt business

- Do not need to charge your customers VAT, thus can offer lower prices

- Do not need to keep VAT records

- Do not need to submit VAT returns

- No impact on cash flow

However, VAT-exempt businesses also experience some drawbacks:

- You cannot reclaim any VAT that you paid to a VAT-registered business for goods or services.

- Having a VAT registration number can add credibility to your business, but once you make it clear that you are VAT exempt, this doesn’t matter.

Partially exempt businesses

If you are partially exempt because you sell both taxable and nontaxable goods or services, things get a bit more complicated. The only items that do not count as taxable are exempt or out of scope, so you still need to account for your zero-rated, reduced rate and standard-rate items in your VAT records.

Here are some benefits that partially exempt businesses enjoy:

- You can reclaim the VAT you pay to VAT-registered businesses for goods or services

- VAT can make your business appear more credible and established, thus expanding your options when considering what businesses to buy from and sell to

- Displaying a VAT number on your website can make your business more appealing, especially to larger businesses

Here are some of the drawbacks that partially exempt businesses face:

- You must keep VAT records, and more specifically, keep separate records for your VAT-exempt vs non-exempt sales and purchases

- You must file VAT returns, which may affect your cash flow

- Adding VAT to your sales will increase your prices and potentially deter your customers

- If you end up charging more VAT to customers than you pay to businesses, you will need to pay HMRC the difference, which could negatively impact your finances

Top Tip: Calculating VAT is no easy task for partially exempt businesses. Accounting for both taxable and exempt items calls for far more complicated accounting than standard VAT calculations. To learn more about partially exempt businesses and specifically how to calculate VAT as one, read our detailed guide on VAT partial exemption 🧮

VAT exemption doesn’t have to be complicated

VAT exemption is straightforward if you are a VAT-exempt business that does not sell any taxable goods or services.

If you are a partially exempt business, VAT exemption is more complicated and requires strict record-keeping and more complex methods when it comes to filing your VAT return.

If you are a VAT-registered business but sell mostly reduced rate or zero-rated items, you can apply for VAT exemption. You may be granted an exemption if your circumstances are deemed justified.

VAT exemption has many benefits and drawbacks, and the right choice for your business depends entirely on your unique circumstances. After reviewing the rules and regulations yourself, consider hiring an accountant to help ensure you are following the correct procedures and avoid any penalties.

Photo by Anastasia Shuraeva, published on Pexels