What is the VAT threshold, and when should you register for VAT?

No matter whether you’re running a large or small business in the United Kingdom, you are required to register for Value-Added Tax (VAT) if your annual turnover exceeds a certain threshold.

If you don’t register for VAT once you’ve hit your threshold, you could face a penalty from HM Revenue and Customs (HMRC). So what is the threshold for VAT?

In this article, we’ll answer your questions regarding the minimum VAT thresholds, when to register for VAT and the various accounting schemes you can join to make the process easier.

Top Tip: To ensure your business remains in good standing, you’ll need to understand VAT. Learn more about what VAT is, how it works and how to charge it correctly in our detailed VAT guide 💡

Table of Contents

- What is the VAT threshold in the UK?

- When should I register for VAT?

- What if you’re temporarily over the VAT threshold?

- VAT accounting scheme thresholds

- VAT deregistration: How to cancel your VAT

- Expert insights

- Wrapping up

What is the VAT threshold in the UK?

As of 1 April 2024, the VAT registration threshold increased from £85,000 to £90,000.

This means that if your business makes £90,000 in revenue in a 12-month period (or is forecast to reach this amount), you must register for VAT. If your revenue is below this threshold, you are not required to register.

The threshold for VAT registration had been frozen at £85,000 since 2017. However, HMRC increased it in 2024 to support small businesses and reduce their administrative burdens.

Most businesses can register for VAT online through the GOV.UK website.

After your registration process is complete, you’ll receive a VAT registration certificate from HMRC that confirms your:

- VAT registration number

- VAT registration date

- First VAT payment details

Top Tip: You need a VAT registration number to legally charge VAT on your invoices. Learn more about the important details you need to include in your VAT invoices in our guide to VAT invoice requirements 💡

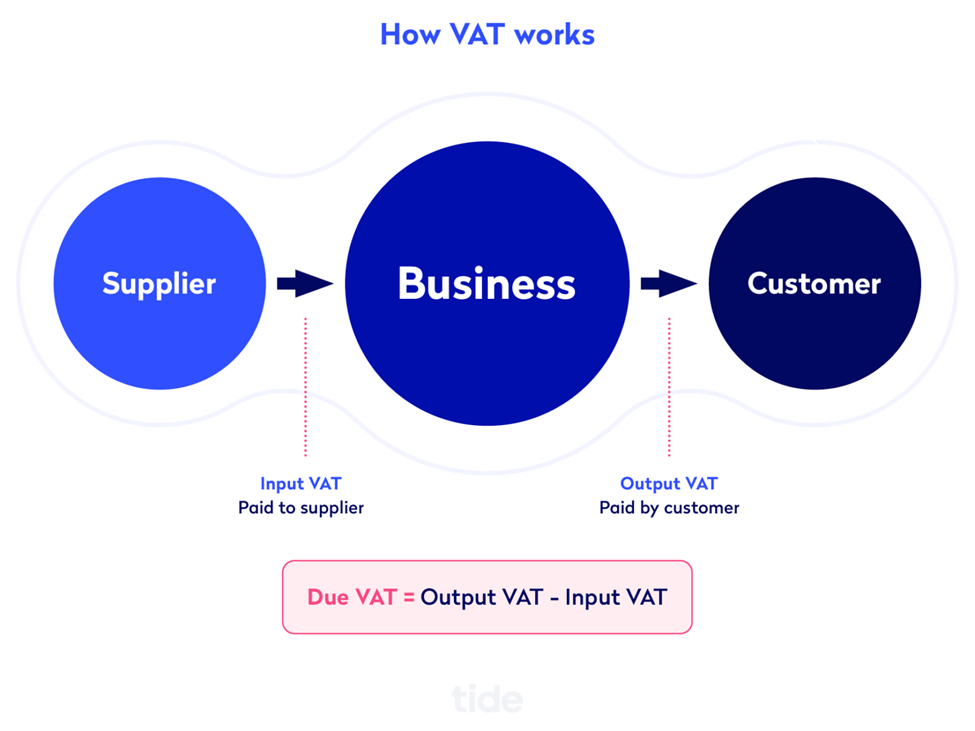

After your effective VAT registration date, you’ll be responsible for the following:

- Charging VAT on items you sell to customers

- Paying VAT on items you buy for your business

- Submitting VAT returns to HMRC

- Maintaining accurate VAT records

According to HMRC, you charge VAT depending on the type of product you’re selling. There are three different VAT rates that UK businesses can charge.

- Standard rate (20%): This rate applies to most goods and services.

- Reduced rate (5%): This rate applies to some items, such as children’s car seats and energy products.

- Zero rate (0%): This rate applies to some items, such as health products, books and newspapers.

Top Tip: VAT-registered businesses need to know the VAT codes that apply to each of the products or services they sell. This helps them pay the correct amount of VAT and avoid any penalties from HMRC. Learn more in our complete guide to VAT codes 💡

What’s the VAT threshold for sole traders?

The VAT registration threshold for sole traders is also £90,000.

If your annual turnover exceeds this amount, you are legally bound to register for VAT.

In case you currently haven’t exceeded the limit but know that your taxable turnover will go above £90,000 in the next 30 days, you must still register for VAT.

Note: VAT-registered sole traders also have to maintain digital records as per the rules laid out under Making Tax Digital for VAT. This needs to be done through software that’s compatible with HMRC’s systems.

When should I register for VAT?

According to HMRC, you must register for VAT if any of the following applies to you:

If you expect your taxable turnover to exceed £90,000

Once you discover your business’s annual turnover is going to pass the VAT threshold, you must register for VAT with HMRC within the next 30-day period.

Importantly, your date of registration is set at the day you realised your turnover was going to go over the threshold, not the date you notify HMRC.

For example, if you realise on the 1st of June that your taxable turnover is going to exceed £90,000, perhaps because of a large order coming up, you have until the 30th of June to inform HMRC. Your date of registration is the 1st of June when the order went through, no matter when you notify HMRC.

In another example, if you realise on the 3rd of October that you’re going to exceed the threshold, you have until the 3rd of November to notify HMRC. Your registration date is the 3rd of October.

If your business had a taxable turnover of more than £90,000 over the last 12 months

Equally, if your business turnover exceeded the VAT threshold in the past 12 months, you’ll need to notify HMRC within 30 days of the end of the month that you went over that threshold.

For example, if you are doing your business finances on the 15th of June and realise the £10,000 job you did on the 5th of June put your turnover at £90,000 for the past 12 consecutive months, you’ll need to notify HMRC by the 30th of July.

Note: Some goods and services are exempt from VAT, such as medical care provided by doctors. However, if you buy items from EU VAT-registered suppliers (such as those in Northern Ireland) for more than £90,000 to use in your business, you’ll still need to register.

Remember, you’re required to pay VAT from the moment you’re eligible, and neglecting to do so can incur penalties from HMRC. To avoid penalty charges and stay in good standing with HMRC, it’s best to get your head around VAT early on.

Even if you don’t fall under the two categories above, you might still want to register for VAT for a few other reasons.

Here are some benefits of registering for VAT even if you’re not required to.

1. Get ahead of the curve

Registering for VAT with HMRC may take some time, which is why some businesses that are expecting to meet or exceed the VAT threshold in the near future register in advance.

This is especially important for busy businesses that are planning to exceed the threshold in the future, even if you don’t have the clients and purchases just yet.

If you’ve been teetering on the edge of the threshold for some time now and you don’t want to run the risk of HMRC penalties, it might make sense to opt for voluntary registration.

2. Save costs

VAT-registered businesses can reclaim VAT on most items they purchase from other businesses for manufacturing their own products.

So, registering ahead of time can help keep your prices competitive, along with the ability to recover the VAT on your costs.

In some cases, voluntarily registering your business for VAT can help you earn more profit by enabling you to reclaim some of the VAT you paid from HMRC.

For example, let’s say that your total revenue for the year is £60,000 (under the threshold), and your total costs are £25,000.

If you haven’t registered for VAT, your profit would be:

£60,000 – £25,000 = £35,000

Now, if you register for VAT, your revenue would increase to £72,000 (assuming that a standard rate of 20% applies to the goods and services you sell).

Since you are now VAT-registered, you are also eligible to claim any VAT you’ve paid for while manufacturing your own goods and services.

Let’s say that out of your total costs, £3,000 is now claimable because you’re VAT-registered. In that case, your total costs will now be:

£25,000 – £3,000 = £22,000

Consequently, your total profit will now be:

£60,000 – £22,000 = £38,000

3. If you’re forecasting growth

If you’re forecasting business growth in the year, it makes sense for you to register for VAT in advance to accommodate the growth in revenue if and when it happens.

For example, if you expect to sign a lucrative deal with a client in the next few weeks, you might want to register for VAT as soon as possible to avoid any delays in the process and save on supply costs.

Or, say you run a landscaping business, which can be seasonal. Perhaps you had a big project in the spring that puts your turnover at £75,000 (under the threshold), and you’re looking ahead to a busy summer. Your financial forecasts tell you that you’ll probably hit the threshold in July, your busiest month. It’s probably worth registering early, so you don’t end up with headaches.

What if you’re temporarily over the VAT threshold?

It’s possible that your business may meet or exceed the VAT threshold for a certain period of time, compelling you to register for VAT.

But if you have enough evidence to prove that this influx was a one-off event, you can request a registration exception, meaning that you don’t need to register for VAT.

To request a registration exception, you must write to HMRC and explicitly explain your case. In your application, you must provide HMRC with evidence showing that you have a good reason to apply for this exception.

If HMRC accepts your request, they will write back to you with a confirmation of the exception.

In case they reject your request, they’ll do so in writing, and you’ll have to register your business for VAT.

Applying for an exception as soon as possible is crucial. There’s a chance that your application will be rejected, and if you’re months behind the moment you crossed the threshold, HMRC may still require you to submit VAT returns for past months.

If your exception is accepted, it applies to this event only. If you breach the threshold again in future, you’ll have to apply for it all over again (or register for VAT if your circumstances change).

VAT accounting scheme thresholds

Alternatively, HMRC offers several VAT schemes that make it easier for businesses to charge and pay VAT. These schemes are especially helpful for businesses that are negatively impacted by the standard VAT process.

Here are three VAT accounting schemes and their respective thresholds:

1. Flat rate scheme

Under the flat rate scheme, you are required to pay a fixed rate to the HMRC.

Additionally, you can keep the difference between what you charge your customers and what you pay to HMRC. However, you cannot reclaim VAT on your business purchases (except for a few capital assets amounting to more than £2,000).

To join the flat rate scheme, your taxable turnover must be £150,000 or less. If your turnover exceeds the threshold of £230,000, you are required to deregister and leave the scheme.

2. Cash accounting scheme

Under the cash accounting scheme, you must pay VAT on your sales when your customers pay you.

In some ways, this scheme follows the same principle as cash accounting, which states that revenues and expenses are recorded when cash is received and paid.

You can also reclaim any VAT you’ve contributed to while making your purchases from the supplier under the cash accounting scheme.

To join the cash accounting VAT scheme, your taxable turnover must be £1.35 million or less. You must leave the scheme if your turnover exceeds the compulsory deregistration threshold of £1.6 million.

3. Annual accounting scheme

Under the annual accounting scheme, you must submit one VAT return per year to HMRC and make advance VAT payments towards your VAT bill.

Most businesses keep digital VAT records and use software to submit their VAT returns.

While submitting your VAT return under this scheme, you can either pay the difference between your advance payments and actual VAT bill or apply for a refund if you’ve overpaid your VAT bill.

HMRC recommends that you steer clear of this scheme if you regularly reclaim VAT for your business, as you’ll only be able to get one refund per year (while submitting the VAT return).

You can join the annual accounting scheme if your estimated VAT taxable turnover is £1.35 million or less. If your turnover exceeds the compulsory deregistration threshold of £1.6 million, you must leave the scheme.

VAT deregistration: How to cancel your VAT

The VAT registration threshold compels businesses to register for VAT, but there isn’t a compulsory VAT deregistration threshold in place that compels businesses to opt out of it.

You can, however, ask HMRC to cancel your registration if your VAT-taxable turnover falls below the deregistration threshold of £88,000.

HMRC stipulates two situations where you must cancel your registration:

- You’ve stopped trading or making VAT taxable supplies

- You’ve joined a VAT group (a group of companies joining together to simplify the VAT process)

The cancellation must be made within 30 days of ineligibility. If you fail to do so, you may be subject to a fine.

It usually takes HMRC up to three weeks to confirm your cancellation (and your date of cancellation). They will do so through your online VAT account or through the post if you didn’t apply online.

HMRC states that you must stop charging VAT from the date of your cancellation.

However, you are required to keep your VAT records for six years, as well as submit a final VAT return for the period up to and including the cancellation date.

In the final return, you must account for any stock and assets you have on this date if your total VAT due exceeds £1,000.

💡 Expert insights

Insights author: Dan Hogan, Co-Founder and COO at Ember, who make it simple for everyone to launch, operate and grow a business by automating the tax and accounting, allowing business owners to do just business. Ember takes a tax-first approach to finances, meaning business owners can easily see how much tax they’re paying, automatically optimise it and send it off to HMRC in a few simple steps, without needing to hire an expensive accountant.

What should business owners do if they have earned over the VAT threshold without realising to minimise penalties?

If business owners haven’t registered for VAT before surpassing the VAT threshold, we recommend doing so as soon as possible. There is a 30-day period where you can register without any problems; however, waiting longer than this period risks incurring additional penalties.

What are the pros and cons of being VAT registered? Are there cases where staying below the threshold is advantageous?

The main advantage that comes with being VAT registered is the ability for registered businesses to reclaim VAT on their expenses, which is especially beneficial for those with a lot of expenditure. There are also a lot of reputational benefits that come with being VAT registered, as third parties and end clients are more likely to perceive VAT registered businesses as more ‘official.’ It also ensures that business owners are in good habits when it comes to keeping on top of receipts and records.

However, being VAT registered means having to be vigilant with expenses, making sure that all outgoings are recorded with receipts to back it up in order to claim VAT returns. For companies that have recently made the switch from unregistered to registered, there’s a chance that there’ll be a price hike — making for potentially unhappy customers, especially those who have been buying from the company before the switch.

Wrapping up

Knowing the exact VAT threshold and when to register for VAT can help you plan for growth, pay the right amount of tax and avoid getting into any legal trouble with HMRC.

If you’re already registered for VAT, you can use our Tide Accounting software to get paid faster, manage your bills, track business performance and submit your VAT returns. Open a Tide business bank account today to get started.

Photo by Andrea Piacquadio, published on Pexels