What is a good business credit score (and how to find yours)

A good business credit score opens the door to generous business lines of credit, affordable loans and other financial resources for growing your business. Monitoring your score is the key to keeping all of these options open, but only if you know what your score means.

So, what is a good business credit score? How do you know if your finances are in good shape, and how do you compare to your competitors?

In this article, we’ll explain how business credit reports work and what a good score looks like. We’ll also show you how to check your score and what steps you can take to improve it.

Top Tip: Building great business credit is an ongoing process. Learn how to keep your credit strong in our guide on everything you need to know about your business credit score (and how to improve it) 📈

Table of contents

- What is a good business credit score?

- How do business credit scores work?

- Does my personal credit score impact my business score?

- What’s included in a business credit score?

- How to check your score to protect your business’s financial health

- How to improve (and maintain) your business credit score

- Wrapping up

What is a good business credit score?

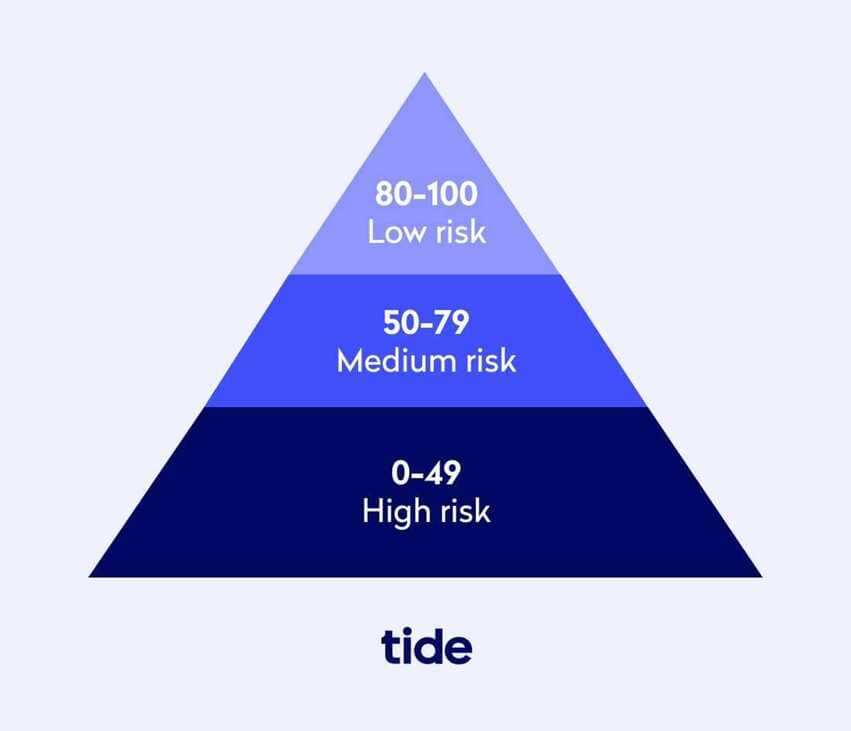

Business credit is typically scored on a scale of 0 to 100. The higher your score, the better your financial health. A high score tells lenders you pose less risk as a loan candidate. Thus, the further your score is from the bottom end of the scale, the more likely you are to secure credit.

Lenders typically describe business credit score brackets by risk. Here’s a breakdown of the ranges that can move you from high risk to medium risk to the ideal low-risk score:

What score do I need to get a small business loan?

You need your score to be in good shape if you want to take out a business loan. Even if you have a healthy cash flow now, you may need extra financing in the future.

Loans can help with things like large one-time expenses (like purchasing equipment or real estate) or taking advantage of new business opportunities. So, what score do you need to qualify for a loan?

Ideally, you want to be in the top 20% of the scoring range (80–100) to get the best finance options. However, there’s no predefined magic number that guarantees a loan, and you can still secure one with a less-than-perfect score. It may just mean a higher interest rate and more costly loan overall.

Your score doesn’t just help lenders decide whether to loan you money. It also determines the terms of the loan. A high credit score gets you better options on things like:

- Loan types. A lower score might preclude you from taking out a loan with a traditional provider (like a bank). You may have to seek nontraditional routes like borrowing from an online bank or alternative lender (non-bank lenders who offer loans or lines of credit). Often these options are easier to qualify for and have shorter terms but come with higher interest rates or stricter loan limits.

- Payment terms. A higher risk score may mean bigger fees on any financing you secure. It can also mean stricter terms on when and how you must repay a loan.

- Interest rates. When lenders feel confident in your ability to repay a loan, you’ll have access to lower interest rates.

Keeping your business’s credit score strong means financing will cost you less as you grow your business.

Top Tip: Loans and lines of credit aren’t the only ways small business owners can fund their growing companies. Learn about other viable options in our guide to 10 ways to fund your small business 🔍

How do business credit scores work?

Business credit scores are calculated by credit bureaus, or credit reporting agencies (CRAs). Each agency uses different criteria to calculate scores, but they all base scores on common factors in your financial history.

Potential lenders can do a credit check with any of these agencies as they figure out whether to work with you, so it’s helpful to be familiar with the top CRAs and what information they share.

Top business credit reporting agencies in the UK

Three main credit bureaus carry the most weight for businesses in the UK. Each generates reports with unique takes on your credit score.

- Experian. Experian business credit scores fall on a scale of 0 to 100, with 80 and up indicating a healthy credit score. Experian assesses credit risk by looking at repayment history and public records. Its report is typically used by banks and lenders to decide whether your business qualifies for a loan.

- Dun & Bradstreet PAYDEX. D&B also rates your business credit on a scale of 1 to 100, with a score of 80 and above considered low risk. Their report analyses credit history as reported by vendors and suppliers. Lenders, suppliers and vendors typically use this score to determine credit terms.

- Equifax. Equifax offers a range of scores, including a standard business credit score ranging from 0 to 100. Besides the standard business credit score, a Business Credit risk score indicates how likely a business is to be delinquent on payments going forward. Likewise, their Business Failure score projects the likelihood of a business ceasing operations in the next 12 months.

As with Experian, banks and lenders typically use the Equifax business credit score to decide whether a business qualifies for a loan. They may opt for this option if they’re looking for more specific information.

Does my personal credit score impact my business score?

Business credit is separate from your personal credit score, but that doesn’t mean they’re completely unconnected. The major differences between your personal credit score and your business credit score include:

- Access. You have free access to your personal credit score, but in many cases, you’ll need to pay a reporting or processing fee to see your business credit score.

- Privacy. Business partners, vendors and investors can’t review your personal credit score. However, they can access your business score to check up on you before deciding whether to work together.

- Rating scales. There’s no standardised system for calculating personal or business credit scores, so your scores may differ between reporting agencies. However, personal scores tend to range between 0 and up to 1,000, while business scores are typically up to 100.

Top Tip: Bad personal credit can hurt your chances of getting business financing when you don’t have a separate business credit profile. Learn what you can do about it in our guide on how to get a business loan with bad credit 💰

These distinctions make your scores independent of one another in many ways. But there are some cases where your personal credit comes into play. For instance, you need to have a strong personal credit score if you’re a small business owner starting out with no business credit history.

The type of company you run can also affect whether lenders look at your personal score. If you’re registered as a sole trader or partnership, lenders take your personal history (or that of your business partners) into consideration. They’re less likely to look at personal finances when working with limited companies, which have separate business credit scores.

Top Tip: How you register your business can affect your financing options as you grow. Learn which direction is best for you by reading our guide on what to consider before you choose between a limited company or a sole trader 💡

What’s included in a business credit score?

A business credit score results from all the data a CRA takes into account. All reports look at the staples of good financial health, but each reporting agency looks at different driving factors to reach its final score.

Here’s an overview of the basics that go into calculating your score and generating your report as well as what you (and potential lenders) will see in a report.

What credit rating agencies look at

Credit reporting agencies look at anything they think will affect your creditworthiness when putting together a credit report. Here are some of the things they may take into account:

- How long you’ve been in business

- How big your business is

- Your annual revenue

- Your industry and location

- Repayment history and outstanding debts

- Business-owned assets

- Personal and business loan history and credit history

- Public records like outstanding County Court Judgments

- Number (and success rate) of past finance applications

- Existing company accounts

What’s inside a business credit report

Once they have all the information they need, CRAs generate reports along with your business credit score. Here is some of the information credit providers see in a typical credit report:

- Background information on your business

- Company financial information

- Your business credit score

- Potential risk factors

- A summary of your banking, repayment and collection history

- Notice of any liens, judgments or bankruptcies against you

How to check your score to protect your business’s financial health

Looking at your score regularly can help you prevent fraud and monitor your company’s financial standing. The financing process will run more smoothly when you ensure everything is in order before you apply. Here’s what you need to know.

How to check your business credit score online

You can check some reports for free, though some CRAs charge a fee for one-time or ongoing access. The list below covers how to check your score with the top UK business credit reporting agencies.

- Experian offers a My Business Profile subscription that’s great for small businesses who want to actively manage their credit scores. The reports dive deep into what impacts their credit score. You can sign up for a My Business Profile account on Experian’s site. Start with a free three-month trial, with regular monthly payments after that.

- Equifax offers a variety of scores to inform lenders on different types of risk. You can apply to check your business credit score by filling out and sending this form. Or, you can request any of the additional scores in a Commercial Credit Report.

- Dun & Bradstreet offers one free credit report through their website. They also offer paid subscription models that help you regularly see what’s being reported about your company.

What if I find a mistake on my credit report?

One reason to check your report regularly is to find any errors before a business or lender does and correct them.

Occasionally, false information will show up in your report. This can be things like vendors misreporting payment info, the credit bureau connecting your report with the wrong business or genuine identity theft, where someone else is using your details.

If you detect an error in your report, correct it as quickly as possible to keep it from affecting your score.

- Make a list of any incorrect information you find

- Submit a dispute with the agency that produced the report

- Keep watching your account to ensure corrections go through and no new errors show up

How to improve (and maintain) your business credit score

Knowing how your business score works doesn’t just help you understand your position with potential lenders, business partners and vendors. It also lets you see where you could actively make improvements to strengthen your position.

Here are seven ways to build (or repair) your business credit and keep it strong:

- Separate business finances from personal. Keep company finances independent from your personal records. Start a separate business bank account and establish lines of credit for your company.

- Create a strong payment history. Late payments can hurt your score, so consistently pay your bills on time (or even early). A pattern of timely repayment will improve your credit score and show potential creditors that you have a healthy cash flow.

- Make sure vendors report payment history. Not all vendors report on-time payments to credit agencies. Do your research and find out if those you work with do. You can request that they report if it’s not standard practice for them. Or you may consider switching vendors to make sure you get credit for your on-time payments.

- Establish business credit. You can also build up your repayment history by establishing lines of credit with a bank or lender and using them for smaller expenses. Or consider getting a business credit card for smaller business expenses and paying it off each month.

- Limit credit applications. Having too many applications for loans or lines of credit can be a red flag. This is especially true if you have a poor success rate in securing them. Only apply for credit you know you need and you are sure you can pay off.

- Review your score often. Protect your score by keeping tabs on where you stand with your credit score. If possible, sign up for alerts of any changes to your score so you can review it and correct any errors or detect fraud immediately.

- Review the scores of any business partners. The vendors, suppliers and other business partners you work with can also impact your score. Check up on their credit histories before you sign on to partner with them to make sure their actions won’t hurt your score.

Top Tip: Looking for more information on how to boost your business credit score? Take a deeper dive into steps you can take in our complete guide on how to increase your business credit score 📈

Wrapping up

It’s easy to check the numbers and see how your business is judged. But if you want to leverage your credit score to help your business grow, you need to know what it means and how your financial transactions affect it.

A good business credit score is a composite of healthy financial practices over time. You can’t change it overnight, but you can use the tips in this article to help you turn around a less-than-perfect score, or to build up a strong score if you’re just starting out.

Whatever the case, start working now to create a score that will help fund your small business and keep it growing in the future.

If you want to establish a reliable business credit score, open a free business bank account with Tide and explore all of our credit options today.

Photo by olia danilevich, published on Pexels