Do your banking and accounting together

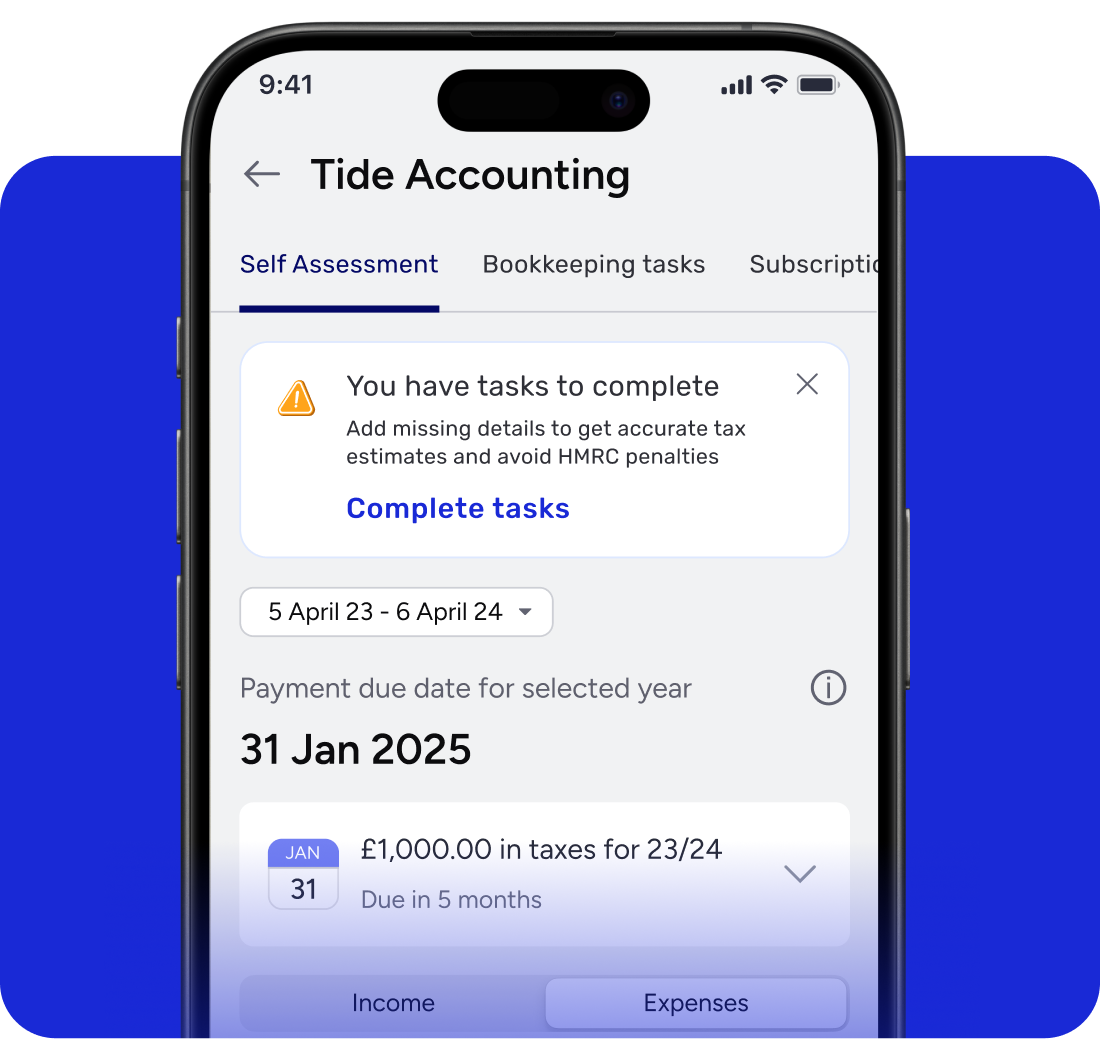

Take the stress out of tax season

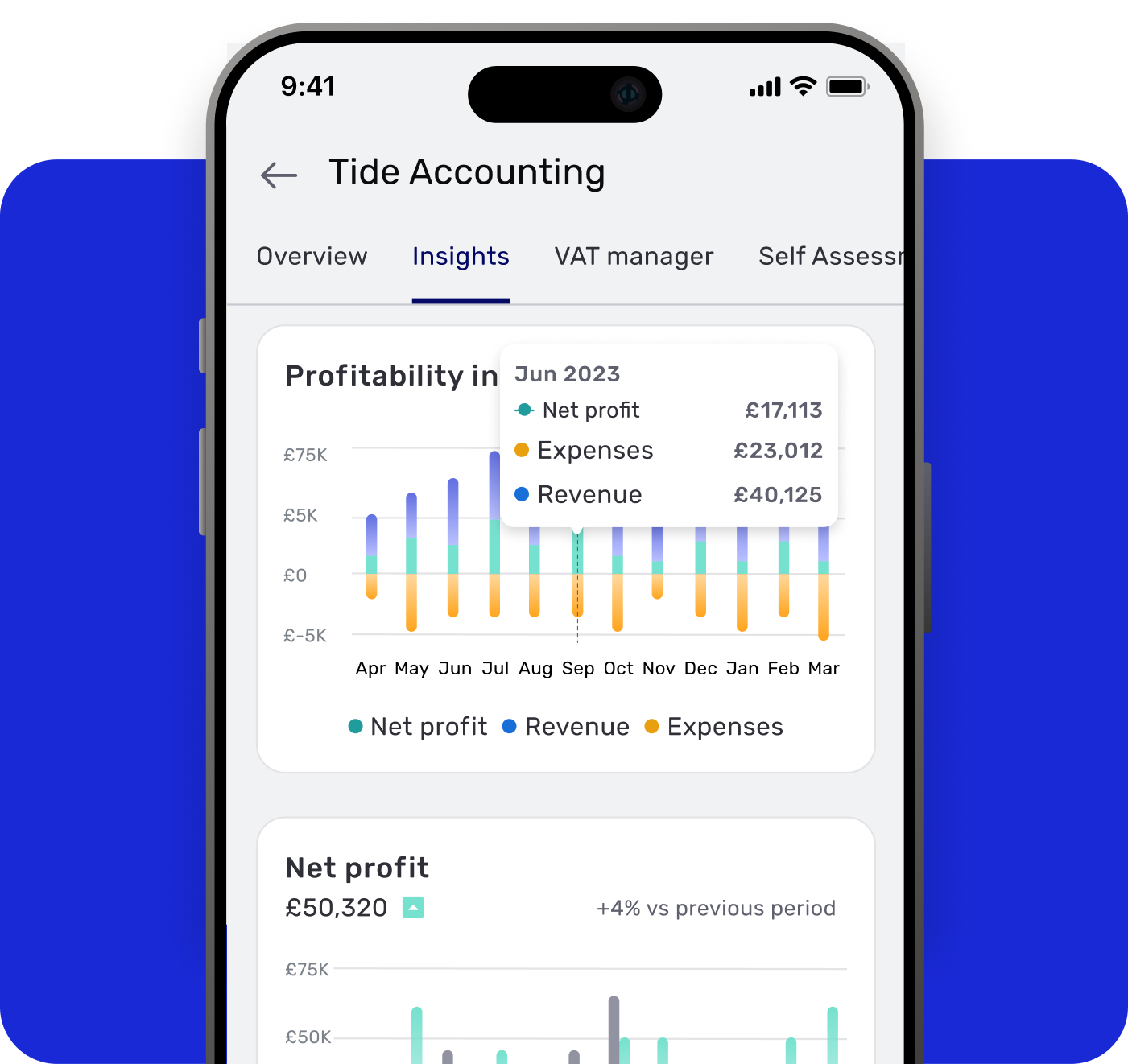

Grow your business using insights and reports

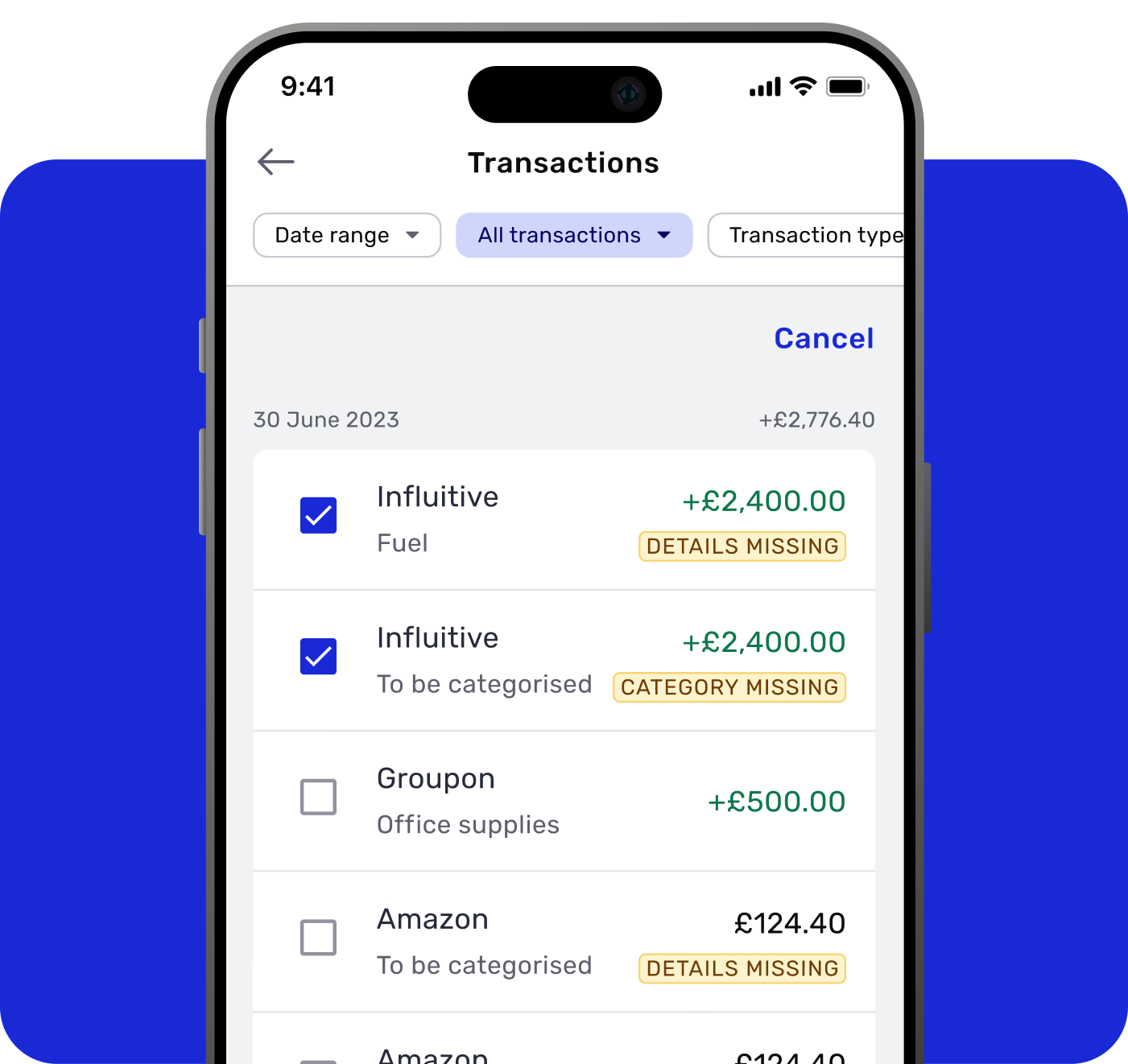

Automate bookkeeping and daily admin

Smarter banking starts now. Try Admin Extra free for 3 months.

Drive better business decisions with clear cash flow and profit insights

Understand what’s driving your costs and the source of your revenue – leverage the data to identify your next steps Download financial reports in one click to inform your decisions, stay compliant and secure funding Track overdue invoices and upcoming supplier bills to avoid cash flow disruptions

Estimate your tax bill and prepare ahead of tax deadlines

Get Self Assessment (Sole Trader only) and Corporation Tax estimates in real-time to know what you owe and avoid fines Open a dedicated tax account to save smarter and set aside money as you earn, avoiding any last-minute stress File VAT returns to HMRC using our Making Tax Digital tool and stay compliant – all done via the Tide app

Automate bookkeeping and daily admin

Auto-categorise income and expenses, including VAT, so you can focus on running your business Speed through bookkeeping fixes – use bulk edit or tagging to make instant adjustments Eliminate manual admin and time wasted on data transfers with a platform that brings everything under one roof

Choose a tailored toolkit that suits the unique needs of your business

£17.99 Sole Traders £24.99 for Limited Companies |  £13.99 Sole Traders £19.99 for Limited Companies |  £5.99 + VAT | |

|---|---|---|---|

File VAT to HMRC | |||

Prepare for Self Assessment (sole trader only) | |||

View tax deadlines | |||

Put money aside with a Tide Tax Account | |||

Profitability, expenses and cash flow insights | |||

Financial reports | |||

Real-time reconciliation to Tide BCA | |||

Live Bookkeeping Score and outstanding task list | |||

Categorise transactions in bulk | |||

Auto-categorisation of income and expenses | |||

Give user-access to your accountant | |||

Connect up external bank accounts | |||

Send customised invoices | Unlimited | 3/month | Unlimited |

Automations: auto-chasing and auto-matching | |||

Premium templates and cloning | |||

Send payment receipts |

Get the most out of your Tide Account with free invoicing and finance management tools

Get paid faster and boost your cash flow

Send 3 invoices or quotes per month using our professional templates Match incoming payments to invoices and add Payment Links to get paid instantly Prioritise and plan future payments to maintain a healthy cash flow

Charlotte Davitt-MillsShotley Vineyard

Tide Accounting is very, very useful for helping us run the business — we can see our day-to-day cash flow as well, meaning we don't have to worry about it, because it’s taken care of.

Learn more about small business accounting

Tide Accounting FAQs

Tide Accounting , which comes with all of our standard accounting features, costs £13.99 + VAT per month for sole traders, and £19.99+VAT for limited companies Admin Extra is a bundle that combines Tide Accounting and Invoice Assistant, costs £17.99 for sole traders and £24.99 + VAT per month * Invoice Assistant is available separately, too, and costs just £5.99 + VAT per month.