Everything you need from your free business bank account

£0 /month

FSCS-protected

24/7 support

Deposit cash

Auto-categorisation

Switch hassle-free

Our business bank account is packed with features to save you time and money

International payments

Accounting and tax tools

Easily receive payments

Manage expenses

Team access

Earn interest

Matt HerdBeaucroft Watches

Everything became digital, and Tide just made it so easy. Everything was easy to set up. We didn't need tremendous amounts of paperwork or history to set up an account.

Benefits and perks

Open a free business bank account online in minutes

Download the app Tell us about your business and verify your identity Your account is approved and ready to go in minutes - your card will arrive in a couple of days

Security built in

Two-factor security

Easily freeze lost or stolen cards

Check recipient details with Confirmation of Payee

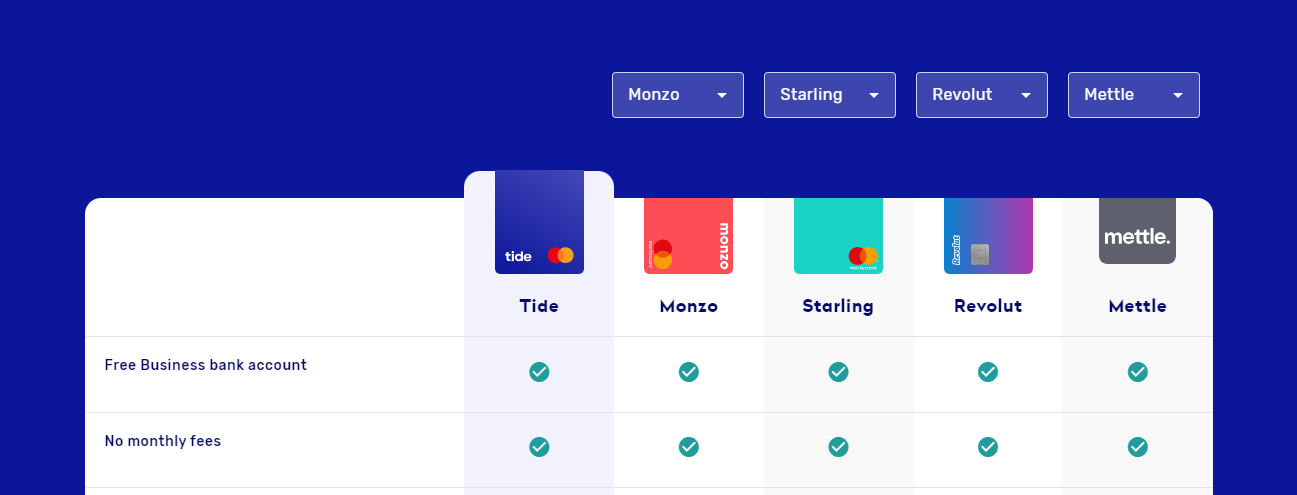

Compare our business bank account to other banks

Am I eligible for a Tide business bank account?

You must be over 18

Have a UK-based business

Show valid photo ID

Upload a selfie photo

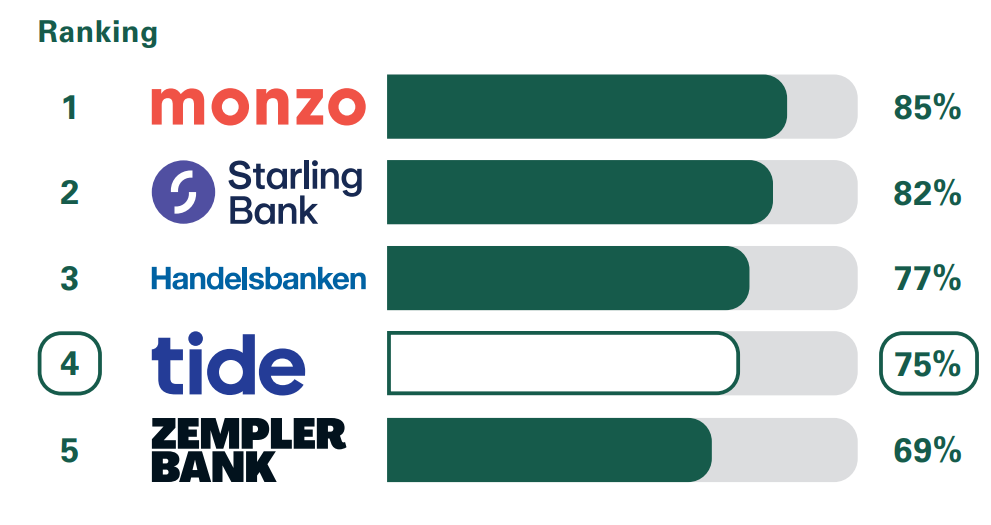

Independent service quality survey results

Overall service quality

Free business bank account FAQs