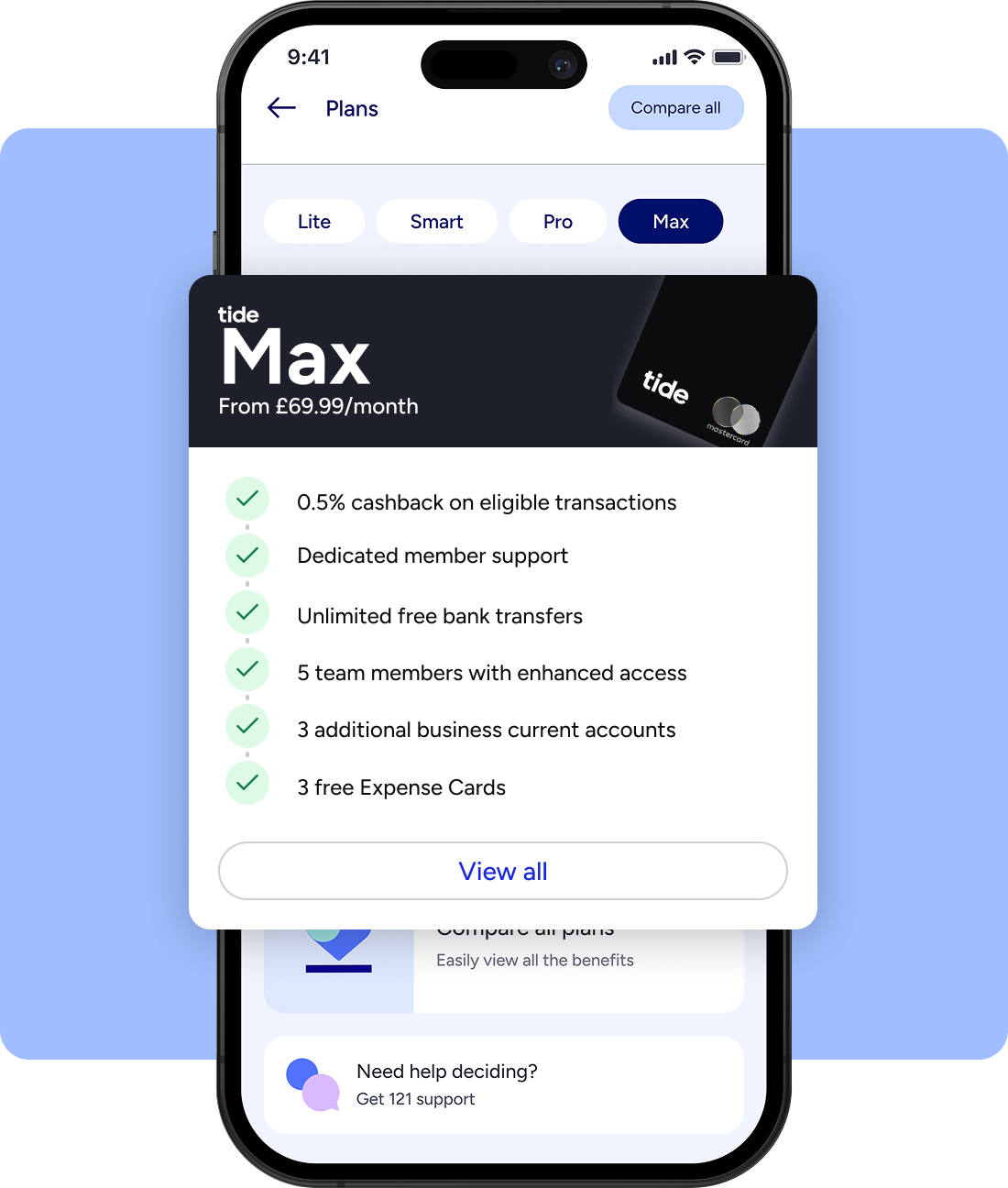

A plan that celebrates your business growth

Get 0.5% cashback

Earn up to 4.22% AER

Premium accounting

Team access x5

+3 free business accounts

0% FX fees on card transactions

Enhanced member rewards

Business Credit Score Insights

Choose a plan that fits your business needs

Max |  Free |  Smart |  Pro | |

|---|---|---|---|---|

Monthly fee | £69.99 + VAT | £0 | £12.49 + VAT | £24.99 + VAT |

Savings interest rate | up to 4.12% AER | up to 2.78% AER | up to 3.29% AER | up to 3.81% AER |

Tide Instant Saver Boost | Up to 4.22% AER | |||

0.5% cashback | ||||

Accounting Software | Admin Extra | Tide Accounting | ||

Transfers in & out | Unlimited | 20p per transfer | 25 free/month | Unlimited |

Expense Cards | 3 free | £5/month | 1 free | 2 free |

FX fees on card transactions | 0% FX fees | 1.75% on FX fees | 0% FX fees | 0% FX fees |

Additional Business Current Account | 3 included | 1 included | 2 included | |

Team Access | 5 team members with enhanced access | View only | 1 team member with enhanced access | 2 team members with enhanced access |

ATM withdrawals | £1 | £1 | £1 | £1 |

Priority in-app support | ||||

Phone Support | 9am - 6pm weekdays | 9am - 6pm weekdays | 9am - 6pm weekdays | |

Weekend support | Priority callback on weekends | |||

Legal advice helpline | 24/7 access | 24/7 access | 24/7 access | |

Dedicated member support | ||||

Enhanced Rewards | ||||

Your Tide business card | Free matte black card | Free blue card | Free matte black card | Free matte black card |

With Max, your business gets the best of Tide's products

Enjoy 0.5% cashback

Earn cashback on transactions made with your Tide Max card Receive cashback payouts monthly, straight into your Tide account Transform everyday spending into effortless rewards

Premium savings

The more you save, the more you earn—each rate applies only to the portion within its range Grow your savings with daily interest, paid monthly—no penalties, withdraw funds at any time New members get our Max + Boost rate for 6 months, then switch to their plan’s standard rate. Max members can activate the Instant Saver Boost to earn up to 4.22% AER on deposits over £1m.

Admin Extra

Submit stress free tax returns and plan ahead for payments, with automated estimates for how much you’ll have to pay Send and track invoices easily, and get clear insights on cash flow, tax, and P&L Speed up bookkeeping and c ollaborate seamlessly with your accountant in one integrated platform

Credit Score Insights

Monitor your credit score in real-time, straight from the Tide app Protect your eligibility for better finance solutions, insurance premiums, and supplier terms Get personalised alerts and tips to maintain credit health and stability

Choose Max in three easy steps

Signup for a Tide Business Account Choose the Max plan and enjoy a 3-month free trial Get access to all features immediately

Go Max and bring the essentials with you

FSCS protected

24/7 support

Deposit cash

Auto-categorisation

Export transactions

Switch hassle-free

Matt HerdBeaucroft Watches

Everything became digital, and Tide just made it so easy. Everything was easy to set up. We didn't need tremendous amounts of paperwork or history to set up an account.

Tide Max Instant Saver Account Summary

Balance | Interest Rate p.a.* | Tide Margin |

|---|---|---|

Up to £100,000 | 3.60% AER / 3.55% gross | 0.70% gross |

Between £100,000.01 and £500,000.00 | 3.81% AER / 3.75% gross | 0.50% gross |

Between £500,000.01 and £1,000,000.00 | 4.12% AER / 4.05% gross | 0.20% gross |

Over £1,000,000.00 | 0.00% AER / 0.00% gross | not applicable |

Tide can change the Tide Margin at any time and this will impact the interest rate you receive. Please also refer to the Tide Instant Saver Terms.

If we decide to increase the Tide Margin and your interest rate will decrease as a result, we will give you at least 14 days’ notice in writing before the change takes effect. We don’t have to give you prior notice if your interest rate increases because we decrease the Tide Margin. However, we will notify you about the change within 30 days of it taking effect.

The change will take effect from the day the Bank of England announces the change. We do not have to give you prior notice of the change, but we will notify you about the change within 30 days of it taking effect. The Bank of England Base Rate may be negative, which may result in a negative interest rate applying to your Tide Instant Saver Account.

Initial amount | Balance after 12 months* |

|---|---|

£100,000.00 | £103,611.66 |

£500,000.00 | £518,898.25 |

£1,000,000.00 | £1,038,799.96 |

£2,000,000.00 | £2,038,799.96 |

the Bank of England base rate being 4.25% no further deposits or withdrawals being made and no changes to the interest rate taking place no further changes in Bank of England rates and the Tide Margin

Tide Instant Saver Boost Account Summary Box

Account name: Tide Instant Saver Account

What is the interest rate?

Balance | Interest rate p.a.* | Tide margin |

|---|---|---|

Up to £100,000 | 3.60% AER / 3.55% gross | 0.70% gross |

Between £100,000.01 and £500,000.00 | 3.81% AER / 3.75% gross | 0.50% gross |

Between £500,000.01 and £1,000,000.00 | 4.12% AER / 4.05% gross | 0.20% gross |

Over £1,000,000.00 | 4.22% AER / 4.15% gross | 0.10% gross |

Can Tide change the interest rate?

If we decide to increase the Tide Margin and your interest rate will decrease as a result, we will give you at least 14 days’ notice in writing before the change takes effect. We don’t have to give you prior notice if your interest rate increases because we decrease the Tide Margin. However, we will notify you about the change within 30 days of it taking effect.

The change will take effect from the day the Bank of England announces the change. We do not have to give you prior notice of the change, but we will notify you about the change within 30 days of it taking effect. The Bank of England Base Rate may be negative, which may result in a negative interest rate applying to your Tide Instant Saver Account.

What would the estimated balance be after 12 months based on a £100,000, £500,000, £1,000,000 and £2,000,000 deposit?

Initial amount | Balance after 12 months* |

|---|---|

£100,000.00 | £103,611.66 |

£500,000.00 | £518,898.25 |

£1,000,000.00 | £1,039,546.58 |

£2,000,000.00 | £2,081,845.12 |

the Bank of England base rate being 4.25% no further deposits or withdrawals being made and no changes to the interest rate taking place no further changes in Bank of England rates and the Tide Margin

How do I open and manage my account?

Can I withdraw my money?

Additional information

Tide Max FAQs

0.5% cashback on all eligible card purchases Unlimited, free, inbound and outbound transfers within the UK (subject to Tide's fair use policy ) A stylish matte black card 3 free Expense Cards 0% fee on foreign currency card transactions or ATM withdrawals 24/7 priority in-app chat support 9am - 6pm phone support - weekdays (excluding bank holidays) Priority callbacks by our team on weekends Dedicated member support 24/7 access to a legal helpline ( Irwin Mitchell LLP ) 5 Team Members with enhanced Team Access A preferential savings rate – Earn between 3,86% AER and 4.38% AER (variable) on your business savings up to £1,000,000** in the Tide Instant Saver Account. Enjoy a tiered interest structure. Each portion of your balance earns its own rate. See Summary Box Enhanced rewards Free premium accounting with Admin Extra *** Free access to Credit Score Insights ****