How do our savings interest rates work?

Earn up to 4.48% AER for 6 months, then pick the plan that works for you

Your results

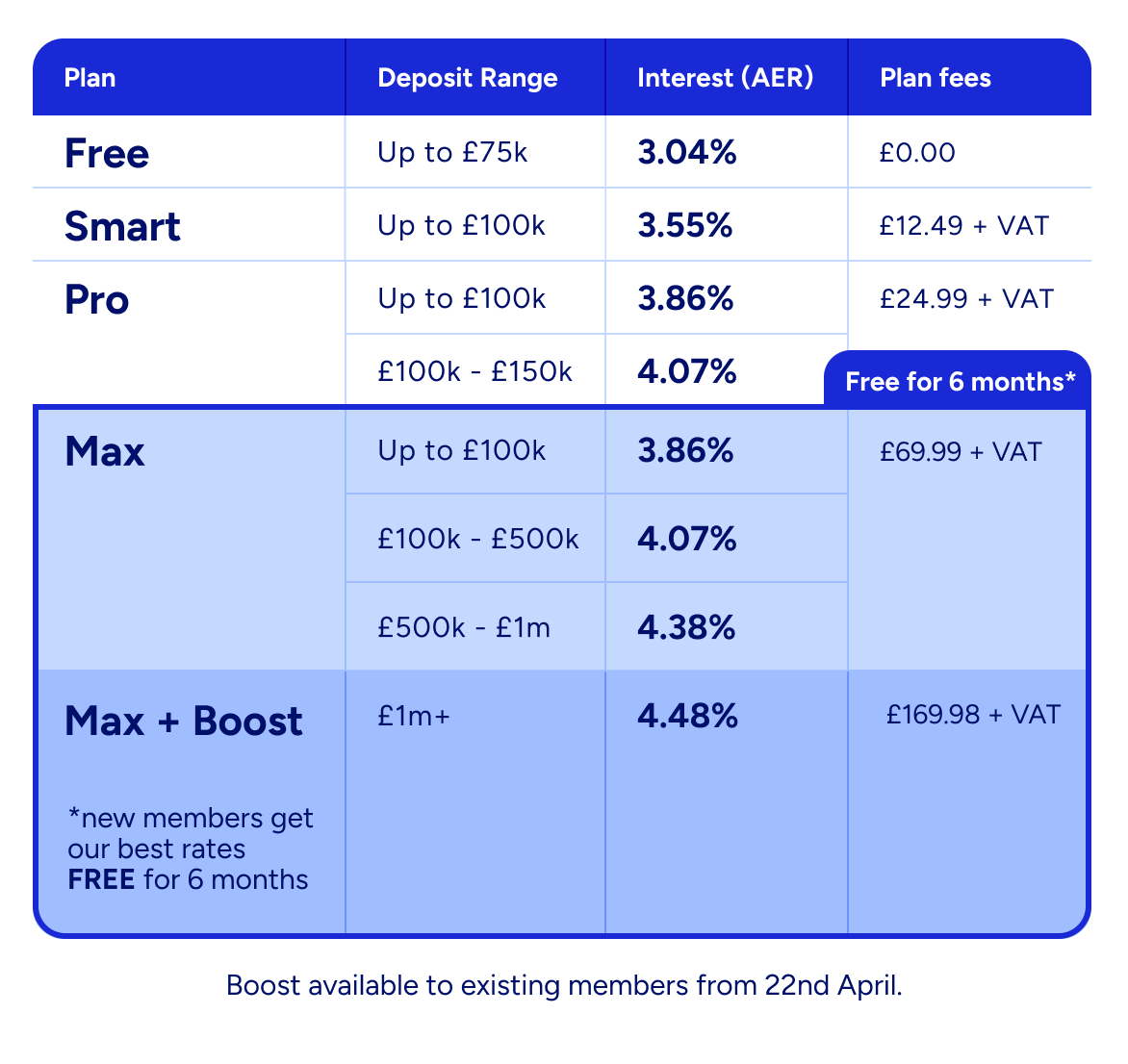

| Highest return  |  |  |  | |

|---|---|---|---|---|---|

Free | Smart | Pro | Max | Max + Boost | |

| Free | £12.49 + VAT | £24.99 + VAT | £69.99 + VAT | £169.99 + VAT | |

| 3.04 % | 3.55 % | 3.86 % | 3.86 % | 3.86 % | |

| 3.04 % | 3.05 % | 2.86 % | 1.06 % | -2.94 % |

Unlock higher interest rates

Why open an instant access business savings account with Tide?

Earn up to 4.48%* AER variable interest

Instant access to your funds

No need to change bank accounts

Open a business savings account in 3 easy steps

Download the Tide app Open a free business bank account or connect an external business account Complete the application and start saving

Compare business savings accounts

Tide |  Barclays |  Natwest |  Monzo |  Virgin Money |  Cynergy Bank |  Allica Bank |  Shawbrook |  Hampshire Trust Bank | |

|---|---|---|---|---|---|---|---|---|---|

% interest on business savings account | Up to 4.48% AER | Up to 1.81% AER | Up to 1.71% AER | 1.50% AER | 3.55% AER | 4.00% AER | Up to 4.58% AER | 4.11% AER | 3.90% AER |

Interest | Monthly | Quarterly | Monthly | Monthly | Monthly | Monthly | Yearly | Monthly/Annually | Annually |

Minimum deposit | £1 | £0 | £0 | £0 | £1 | £1 | £50,000 | £1,000 | £1 |

Withdrawal limits | None | None | None | None | None | None | None | Minimum of £500 | None |

Business current account integration | Yes | No | No | Yes | No | Yes | Yes | No | No |

The rates compared are all the best variable rates offered in the instant access business savings accounts | Valid as of 15/04/2025

Benefits of having a business savings account

You funds are in safe hands with a Tide business savings account

Am I eligible for a business savings account?

You must be over 18

Have a UK-based business

Show valid photo ID

Upload a selfie photo

Learn more about business savings

Tide Instant Saver Account Summary Box (Intro offer)

Interest Rate p.a. during the first six (6) months promotional period | ||

|---|---|---|

Balance | Interest Rate p.a. | Tide Margin |

Up to £100,000.00 | 3.86% AER / 3.80% gross | 0.70% gross |

Between £100,000.01 and £500,000.00 | 4.07% AER / 4.00% gross | 0.50% gross |

Between £500,000.01 and £1,000,000.00 | 4.38% AER / 4.30% gross | 0.20% gross |

Over £1,000,000.00 | 4.48% AER / 4.40% gross | 0.10% gross |

Standard interest rate applicable to the Tide Free Membership Plan:

Interest rate after the 6-months promotional period | ||

|---|---|---|

Balance | Interest Rate p.a.* | Tide Margin |

Up to £75,000.00 | 3.04% AER / 3.00% gross | 1.50% gross |

Over £75,000.00 | 0.00% AER / 0.00% gross | not applicable |

Interest rate after the 6-months promotional period | ||

|---|---|---|

Balance | Interest Rate p.a.* | Tide Margin |

Up to £100,000.00 | 3.55% AER / 3.50% gross | 1.00% gross |

Over £100,000.00 | 0.00% AER / 0.00% gross | not applicable |

Interest rate after the 6-months promotional period | ||

|---|---|---|

Balance | Interest Rate p.a.* | Tide Margin |

Up to £100,000 | 3.86% AER / 3.80% gross | 0.70% gross |

Between £100,000.01 and £150,000.00 | 4.07% AER / 4.00% gross | 0.50% gross |

Over £150,000.00 | 0.00% AER / 0.00% gross | not applicable |

Interest rate after the 6-months promotional period | ||

|---|---|---|

Balance | Interest Rate p.a.* | Tide Margin |

Up to £100,000.00 | 3.86% AER / 3.80% gross | 0.70% gross |

Between £100,000.01 and £500,000.00 | 4.07% AER / 4.00% gross | 0.50% gross |

Between £500,000.01 and £1,000,000.00 | 4.38% AER / 4.30% gross | 0.20% gross |

Over to £1,000,000.00 | 0.00% AER / 0.00% gross | not applicable |

Interest rate | |

|---|---|

Balance | Interest Rate p.a.* |

Up to £75,000.00 | 3.04% AER / 3.00% gross |

Over £75,000.00 | 0.00% AER / 0.00% gross |

Tide can change the Tide Margin at any time and this will impact the interest rate you receive. Please also refer to the Tide Instant Saver Terms.

If we decide to increase the Tide Margin and your interest rate will decrease as a result, we will give you at least 14 days’ notice in writing before the change takes effect. We don’t have to give you prior notice if your interest rate increases because we decrease the Tide Margin. However, we will notify you about the change within 30 days of it taking effect.

The change will take effect from the day the Bank of England announces the change. We do not have to give you prior notice of the change, but we will notify you about the change within 30 days of it taking effect. The Bank of England Base Rate may be negative, which may result in a negative interest rate applying to your Tide Instant Saver Account.

Initial amount | Balance after 6 months | Balance after 18 months** |

|---|---|---|

£100,000.00 | £101,915.11 | £104,195.11 |

£500,000.00 | £509,982.07 | £512,262.07 |

£1,000,000.00 | £1,020,828.83 | £1,023,108.83 |

£2,000,000.00 | £2,043,031.49 | £2,045,311.49 |

Initial amount | Balance after 6 months | Balance after 18 months** |

|---|---|---|

£100,000.00 | £101,915.11 | £105,465.11 |

£500,000.00 | £509,982.07 | £513,532.07 |

£1,000,000.00 | £1,020,828.83 | £1,024,378.83 |

£2,000,000.00 | £2,043,031.49 | £2,046,581.49 |

Initial amount | Balance after 6 months | Balance after 18 months** |

|---|---|---|

£100,000.00 | £101,915.11 | £105,853.05 |

£500,000.00 | £509,982.07 | £515,877.07 |

£1,000,000.00 | £1,020,828.83 | £1,026,723.83 |

£2,000,000.00 | £2,043,031.49 | £2,048,926.49 |

Initial amount | Balance after 6 months | Balance after 18 months** |

|---|---|---|

£100,000.00 | £101,915.11 | £105,853.05 |

£500,000.00 | £509,982.07 | £530,559.28 |

£1,000,000.00 | £1,020,828.83 | £1,062,868.83 |

£2,000,000.00 | £2,043,031.49 | £2,085,071.49 |

the Bank of England base rate being 4.50% no further deposits or withdrawals being made and no changes to the interest rate taking place no further changes in Bank of England rates and the Tide Margin, beside the one resulting from the expiry of the promotional period

Initial amount | Interest Rate AER (variable) | Balance after 12 months |

|---|---|---|

£1,000 | 3.04% AER | £1,030.40 |

£75,000.00 | 3.04% AER | £77,280.00 |

£85,000.00 | 3.04% on the first £75,000, and 0% on the remaining £10,000 | £87,280.00 |

the initial amount being deposited at account opening the Bank of England base rate being 4.50% no further deposits or withdrawals being made and no changes to the interest rate taking place no further changes in Bank of England rates and the Tide Margin The projections are for illustrative purposes only and do not take into account your personal circumstances.

If you hold a Tide Business Account, your Nominated Account will be your Tide Business Account. In case you are a UK-registered limited company who does not hold a Tide Business Account, your Non-Tide Account will serve as your Nominated Account. You may only have one Nominated Account

Tide Instant Saver Account Summary Box (Free)

Account name - Tide Instant Saver Account

What is the interest rate?

Balance | Interest Rate p.a (variable) |

|---|---|

Up to £75,000 | 3.04% AER / 3.00% gross |

Over £75,000 | 0% AER / 0% gross |

Can Tide change the interest rate?

If we decide to increase the Tide Margin and your interest rate will decrease as a result, we will give you at least 14 days’ notice in writing before the change takes effect. We don’t have to give you prior notice if your interest rate increases because we decrease the Tide Margin. However, we will notify you about the change within 30 days of it taking effect.

The change will take effect from the day the Bank of England announces the change. We do not have to give you prior notice of the change, but we will notify you about the change within 30 days of it taking effect. The Bank of England Base Rate may be negative, which may result in a negative interest rate applying to your Tide Instant Saver Account.

Example 1: Where your current interest rate is 3.04% AER / 3.00% gross and Tide decides to increase the Tide Margin from 1.50% by 0.50% (gross), the Tide Margin will be 2.00% (gross) and your interest rate will decrease to 2.52% AER / 2.50% gross. We will give you 14 days prior notice before this change comes into effect. Example 2: Where your current interest rate is 3.04% AER / 3.00% gross and the Bank of England Base Rate decreases by 0.25% (gross) but your Tide Margin remains 1.50%, your interest rate will automatically decrease to 2.78% AER / 2.75% gross. We will not give you prior notice of this change taking effect but we will notify you about the change within 30 days. Example 3: Where your current interest rate is 3.04% AER / 3.00% gross and Tide decides to decrease the Tide Margin from 1.50% by 0.50% (gross), the Tide Margin will be 1.00% (gross) and your interest rate will increase to 3.55% AER / 3.50% gross. We will not give you prior notice of this change taking effect but we will notify you about the change within 30 days.

What would the estimated balance be after 12 months based on £1,000, £75,000 and £85,000 deposit?

Initial amount | Interest rate AER (variable) | Balance after 12 months |

|---|---|---|

£1,000 | 3.04% | £1,030.40 |

£75,000 | 3.04% | £77,280.00 |

£85,000 | 3.04% on the first £75,000, and 0% on the remaining £10,000 | £87,280.00 |

the initial amount being deposited at account opening the Bank of England base rate being 4.50% no further deposits or withdrawals being made and no changes to the interest rate taking place no further changes in Bank of England rates and the Tide Margin

How do I open and manage my account?

If you hold a Tide Business Account, your Nominated Account will be your Tide Business Account. In case you are a UK-registered limited company who does not hold a Tide Business Account, you would need to connect a business current account provided by another bank or financial institution and held solely in the name of your business ( “Non-Tide Account” ) to the Tide Platform and it will serve as your Nominated Account.

Can I withdraw my money?

Additional information