Accounting features to suit all your business needs

Smarter invoicing

Create and send personalised invoices in-app Match payments to invoices in seconds Add payment links to invoices and get paid on the spot

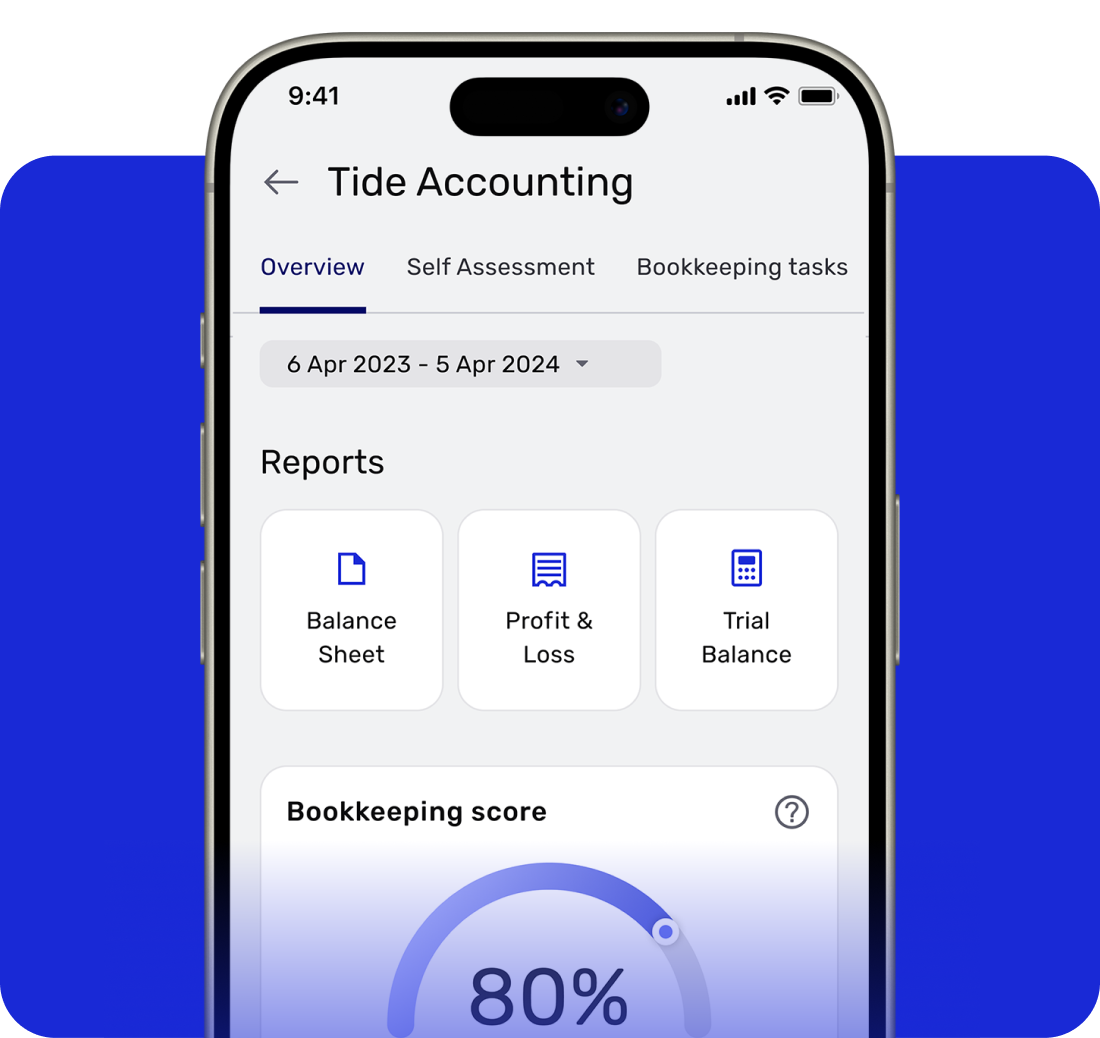

Automated bookkeeping

Organise your transactions, upload receipts and add VAT rates Track your performance with automated profit and loss reports Secure funding for growth with accurate and up-to-date financial records

Keep on top of your taxes

Auto-categorise your transactions and claim your allowable expenses Use our simple expense categories to manage your income and spend Prepare your Self-Assessment form and submit to HMRC with ease

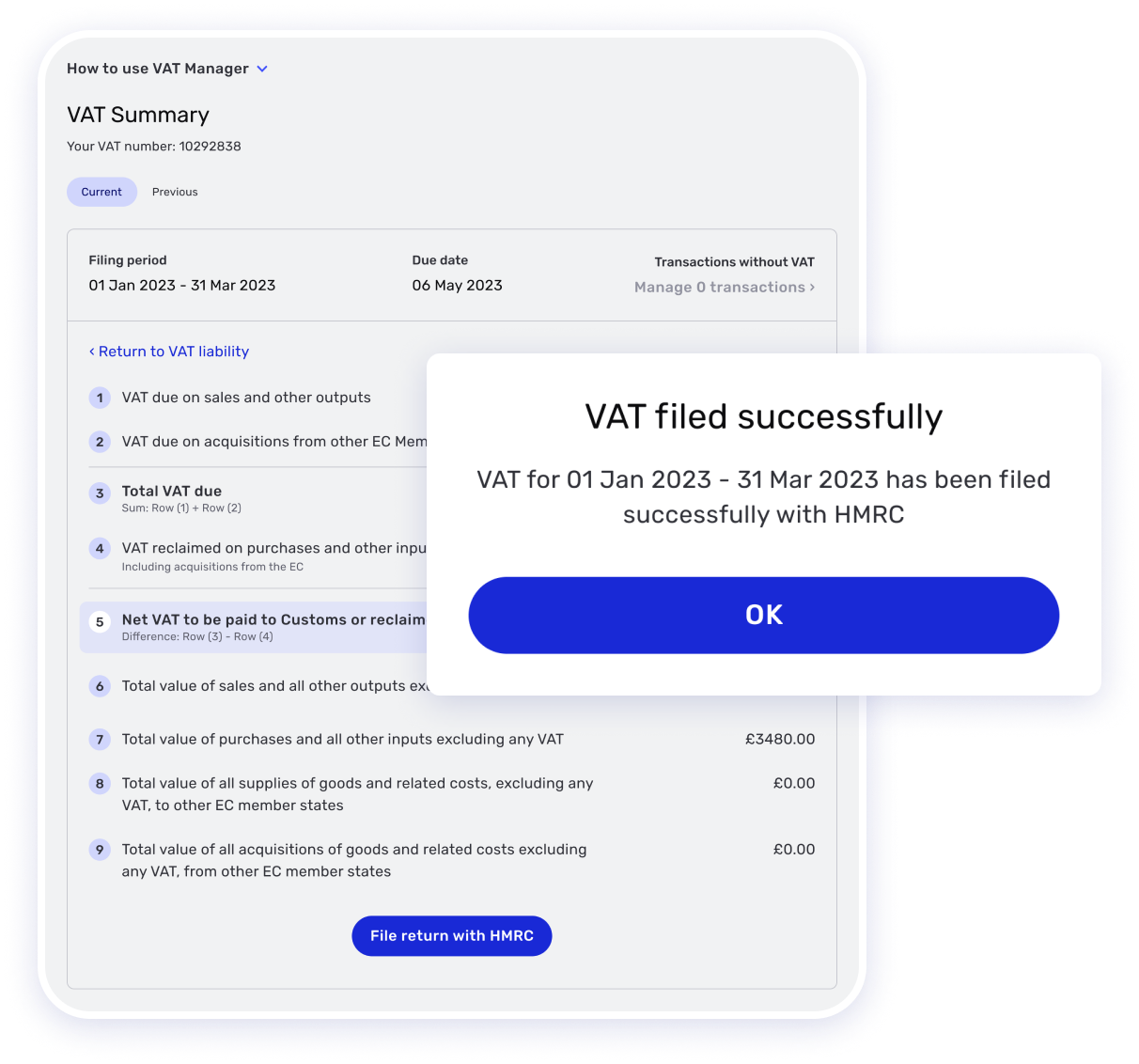

Prepare VAT with confidence

Get automated calculations of your VAT liabilities Manage VAT returns and bookkeeping Connect your Tide account to HMRC and submit your returns via the Tide platform

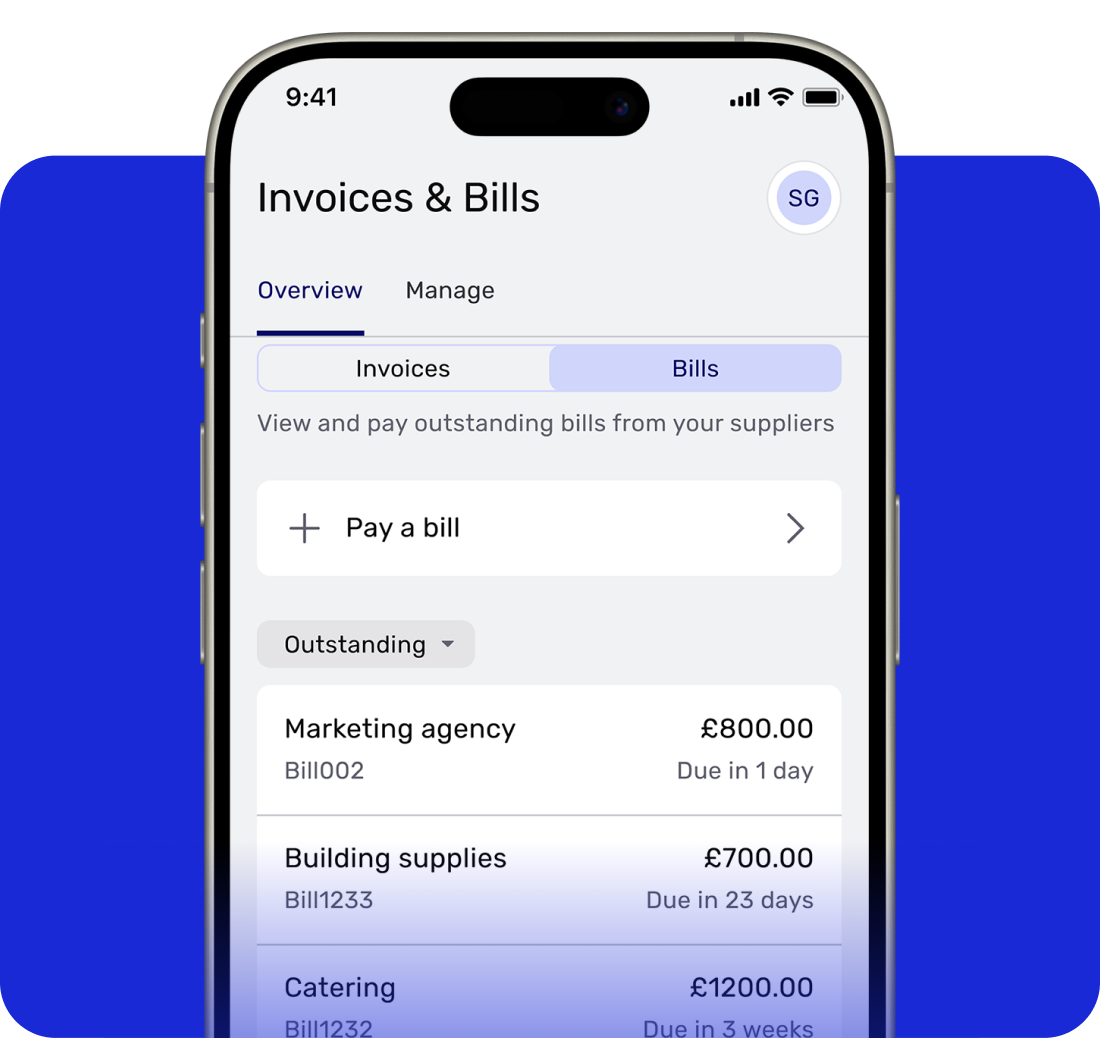

Organise your bills

Keep on top of your incomings and outgoings throughout the year Prioritise payments by seeing what, when and who you owe at a glance Plan for future payments to maintain a healthy cash flow

Why choose Tide Accounting?

Businesses of all shapes and sizes

Everything you need, all in one place

Built-in financial statements

Get your tax estimates done for you

Claire PedleyThe Poured Project

I needed something that was user friendly, quick and smooth. Easy is definitely the word for Tide Accounting.

Trusted by over 1 million businesses worldwide

Learn more about small business accounting

Tide Accounting FAQs

Tide Accounting , which comes with all of our standard accounting features, costs £13.99 + VAT per month for sole traders, and £19.99+VAT for limited companies Admin Extra is a bundle that combines Tide Accounting and Invoice Assistant, costs £17.99 for sole traders and £24.99 + VAT per month * Invoice Assistant is available separately, too, and costs just £5.99 + VAT per month.

A business bank account that's free and easy to open