Understand, track, and take action to help you improve your business credit score

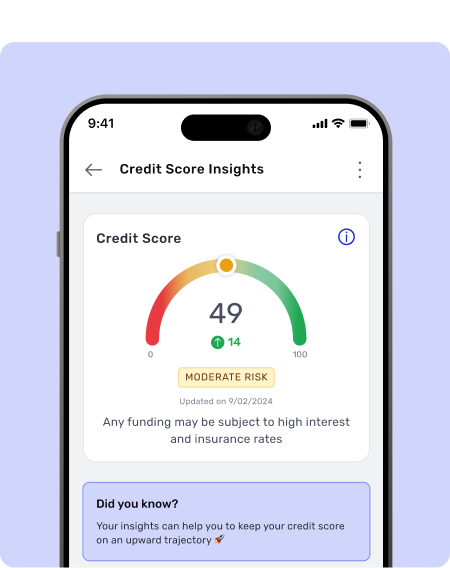

Access and track your business credit score from the Tide app

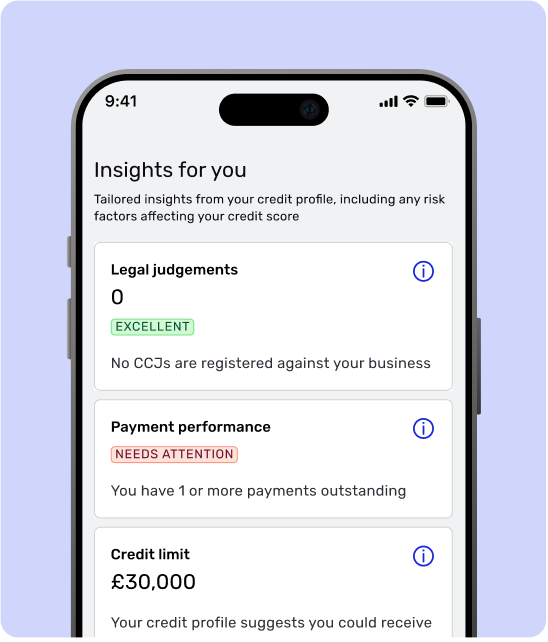

Get insights into your business credit profile and factors affecting the score

Improve your chances of securing favourable funding terms from lenders with a good score

Simple, affordable and easy to use

£4.99 + VAT

Monitor

Cancel and reactivate

Get insights into what’s affecting your credit health

Increase your chances of securing funding

A high business credit score means lenders are more likely to give you access to a wider range of loans and other credit products with lower interest rates, saving you money A low business credit score has the opposite effect; any funding available may cost you more due to higher interest rates, making it difficult to get funding

Join Tide in 3 easy steps

Download the Tide app Tell us more about your self-employment or your business We confirm your identity This is done via a quick verification call, and you get a response in minutes Your Tide account is ready to go! Activate Credit Score Insights at any time via the Tide app

How Credit Score Insights works

The all-in-one platform for managing your business seamlessly

Explore our additional tools designed to take your business to new heights.

Tide Accounting

Business Savings

Tide Card Reader

Business Loans

Am I eligible for a Tide business bank account?

You must be over 18

Have a UK-based business

Show valid photo ID

Upload a selfie photo

Credit Score Insights FAQs

A high business credit score means lenders are more likely to approve loans and other credit products, and with lower interest rates. This could save your business money in the long run. A low business credit score will have the opposite effect. From the funding that is available, it may cost your business more, because of higher interest rates.