Help your customers make online payments on the go

Your smart online payment method

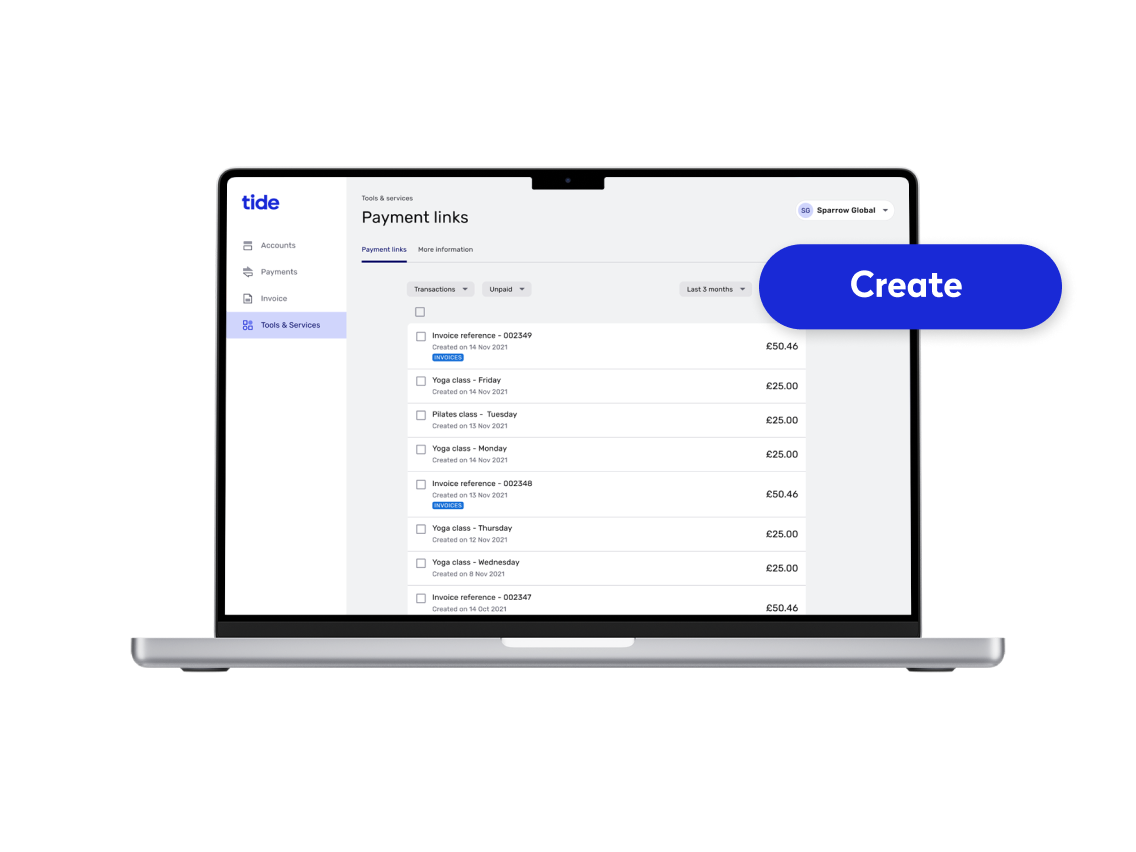

Create payment links in seconds

Keep track of online payments

Take fast online customer card payments

Your all-in-one online payment solution for small businesses

Streamline your online card payment options

Use with or without our Invoicing feature Access your Payment Links dashboard in the app View your customer payment history at a glance

Create your secure link in seconds

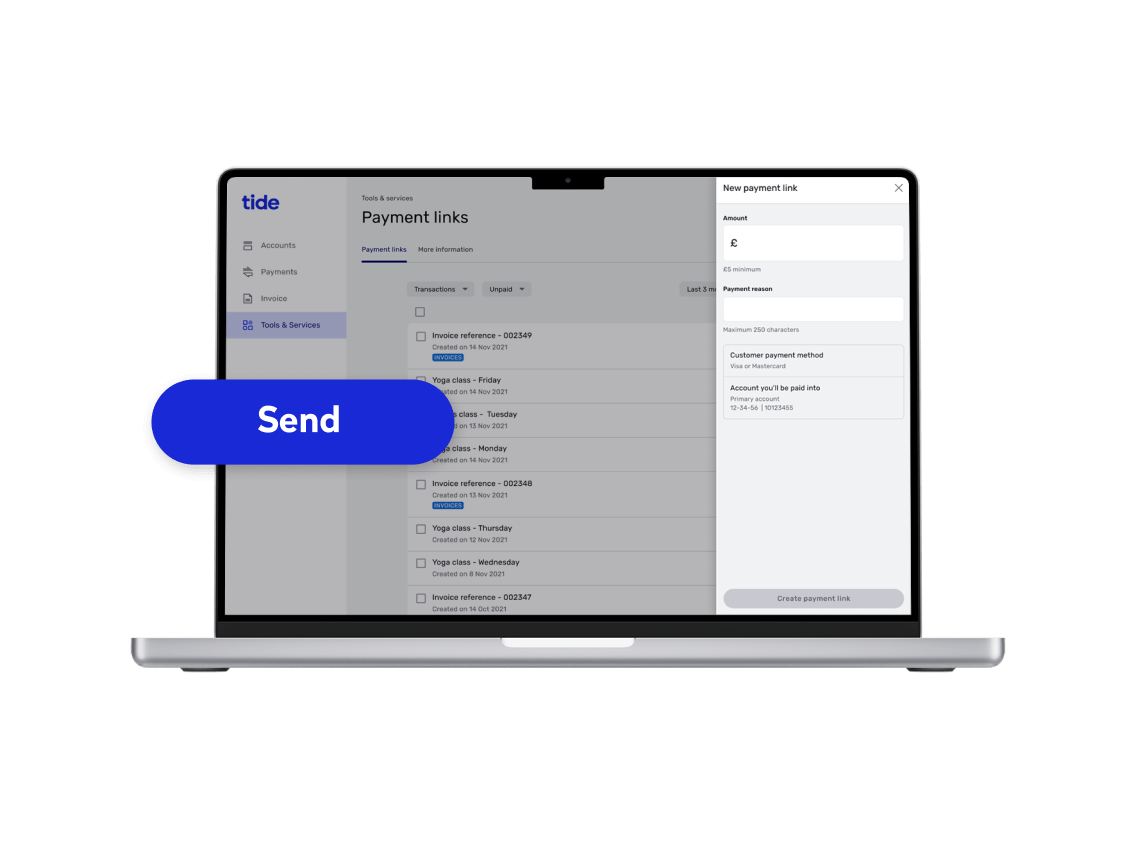

Enter the online payment total required and reason Select Visa or Mastercard as the preferred online card payment method Confirm your account details for receipt of payment

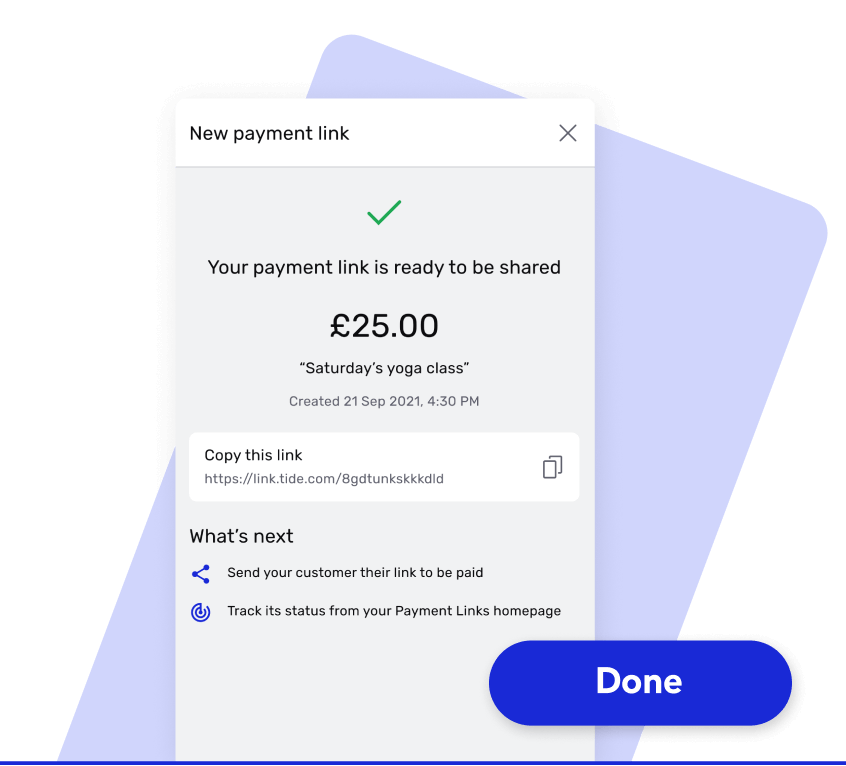

Share and send secure links to your customers

Create a secure individual payment link Share with your customer by SMS or email Manage payments on the go

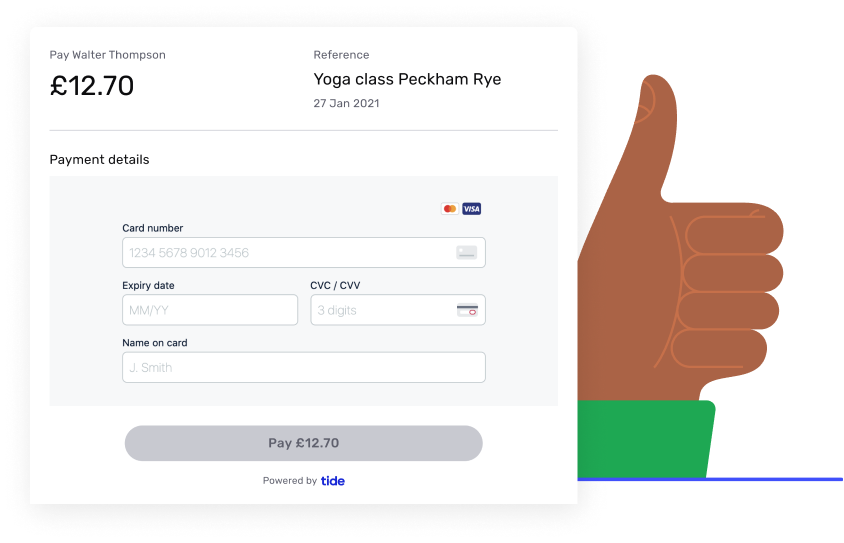

Process online payments with ease

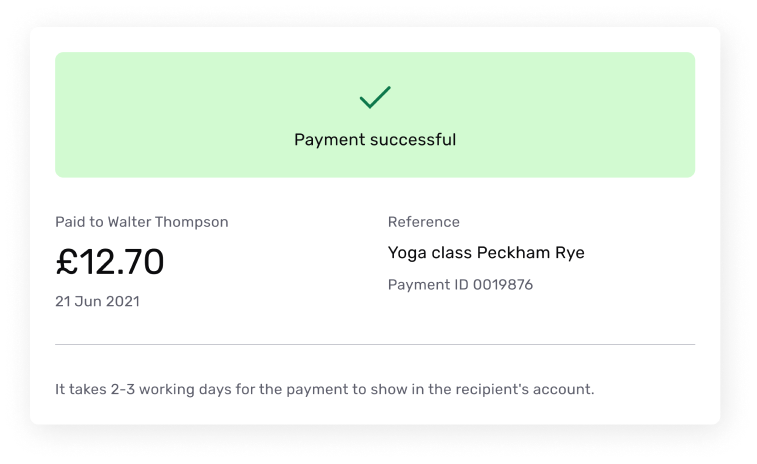

Check payment totals at a glance Enter their Mastercard, Visa or Apple Pay details Make payment in a single click

Get paid faster and track online payments

*Pay just a 1.5% transaction charge for UK domestic consumer card payments (2.5% for all other card payments ) Receive payment usually within two business days, less the transaction fee*** Get notification when payments are made

The smart way to receive online payments in seconds

Business tips from our expert community

Still have questions about online payments for customer cards? We’ve got you covered

American Express Visa Mastercard Diners Club Discover

A signed copy of the invoice A signed copy of the contract with your customer Proof of delivery of goods or services

you are new to Tide and we do not have a lot of processing history on your Tide Account there are sudden changes in the volume or size of transactions you’re processing

The age of your business: at least 90 days must have passed from the day you opened your Tide account The nature of your business and its size How long you have held a Tide account The number and frequency of transactions you make with your Tide account

Fetish products Content: Books, magazines, audio, videos, websites, streaming services and other content formats deemed offensive or of a sexual nature Escort services and other services in the adult industry Financial service or money service business. E-wallet or e-money that can be monetized, re-sold or converted to physical and digital goods and services or otherwise exit the virtual world Credit repair and credit protection business Buy now pay later / Instalment payment methods Bearer share entities and binary options Independent or unlicensed financial advisors Insurance sales and services (life) Money transfer & remittance businesses Payroll, invoice & business services Provider or seller prepaid access/stored value Marketing related services Airlines and Cruise Lines Cloud storage, VPN, file sharing, (high-risk) cyber lockers Animals and wildlife products classified as endangered or protected Bail bonds and bankruptcy lawyers Bidding fee and penny auctions Certain social media business (e.g. click farms) Casual dating services Direct Marketing – Inbound teleservices, outbound telemarketing and travel-related arrangement services, Insurance services, catalogue merchants, door-to-door sales, multi-level marketing Governmental services, such as embassies or consulates Hazardous materials (B2B and B2C) Intravenous therapy or Medical benefit packages Key-entry telecom merchant Live-streaming Services with in-app currency and donations Mail order spouse or international match-making services Pawn shops Political, religious or Social Campaigning Drugs, and tools specifically intended for the production of drugs, drug paraphernalia, illegal drugs, substances designed to mimic illegal drugs and / or other psychoactive products Gambling services Products or services specifically offered or intended to be used to create, produce or grow drugs or drug ingredients Pharmaceuticals, prescription medicine and medical devices (including animal pharmaceuticals) Tobacco, smoking supplies, e-cigarettes, e-liquids, vaping liquid, vaping accessories Trade of fireworks, flammable or radioactive materials Trade of weapons, ammunitions, military arms, explosive devices and firearm parts Cryptocurrency exchange High-risk securities, such as contract for difference (CFD), financial spread betting, initial coin offering (ICO), forex currency options, cryptocurrency options, trading and purchases Security brokers /investments of any kind including the purchase of securities, currencies, derivatives, commodities, shares, options, precious metals, other financial instruments Third-party Payment Processing such as aggregators, aggregators, including but not limited to marketplaces, platforms Staged Digital Wallet Operators Payment Facilitators or other internet payment or member service providers (IPSP or MPS) Payment service companies, including but not limited to peer-to-peer, bill payments, commissary accounts Decryption and descrambler products and services, devices designed to block, jam or interfere with cellular and personal communications

Available - You will see this status if you have not yet been onboarded to use Payment Links Pending - This means your onboarding process to use Payment Links is underway between Tide and our payment provider Active - You’ll see this status when you have been successfully onboarded and Payment Links is available to use Unavailable - If you see this status, it means that your member access has been deactivated, usually as a result of regulatory obligations that we have to comply with. Should this occur, then our Member Support team will work with you to resolve the issue.

Afghanistan Barbados Belarus Bosnia & Herzegovina Bulgaria Burkina Faso Burundi Cambodia Cameroon Central African Republic Congo Democratic Republic Croatia Democratic People’s Republic of Korea (North Korea) Democratic Republic of the Congo Gibraltar Guinea Guinea-Bissau Haiti Iran Iraq Jamaica Lebanon Libya Mali Morocco Mozambique Myanmar Nicaragua Nigeria Philippines Russia Senegal Somalia South Africa South Sudan Sudan Syria Tanzania Turkey Uganda Ukraine Sanctioned Regions (Donetsk, Crimea, Kherson, Luhansk, Zaporizhzhia) United Arab Emirates Venezuela Vietnam Yemen Zimbabwe

A notification to let you know that your customer has successfully made their payment. A second notification to advise when the payment has been initiated to your Tide Account.

If you have sent an payment link, then all transactions relating to this will appear in the account statement from Tide Payout If you have made payments using an invoice payment link, then all transactions relating to these will appear in the account statement from Tide Platform Ltd *Tide Member’s Name*